Well, we're making no progress.

Well, we're making no progress.

On Friday we looked at our bounce levels and we were encouraged that we'd improved enough to be a bit more confident into the weekend but the ongoing Government shutdown by the President is making us more and more concerned every day – especially with the mounting evidence that President Trump may be a Russian Agent who's actual intent is to weaken this country. Still, the entire GOP is going along with this insanity and they can't all be in Putin's pocket – can they?

Even if Trump isn't destroying America on behalf of Vladimir Putin, he's still destroying America so we added some hedges to our Short-Term Portfolio yesterday in our Live Member Chat Room in order to lock in our recent profits as well as to protect ourselves from the next Twitter rampage coming out of the oval office.

Trump is meeting with Congress this morning and, hopefully, it will go better than Friday's meeting, where he threw a tantrum and walked out because Nancy Pelosi said no to his wall – even after he offered her candy. Meanwhile, you can see the Brits debating Brexit all day and all night in their Parliament because, when something important is affecting your Government – a real Government tends to focus on the problem.

That's a live feed – how cool is that?

Don't even try to compare that to CSpan – it will make you cry. British Parliament is based on debate and consensus so any MP is a skilled orator – it's basically a job requirement. Most of our Congresspeople can't put two coherent sentences together without their entire staff working overtime to prep them and God forbid our Congresspeople get interrupted – that's game over for them but that's the entire game in the UK – a much better way to discuss the issues.

Don't even try to compare that to CSpan – it will make you cry. British Parliament is based on debate and consensus so any MP is a skilled orator – it's basically a job requirement. Most of our Congresspeople can't put two coherent sentences together without their entire staff working overtime to prep them and God forbid our Congresspeople get interrupted – that's game over for them but that's the entire game in the UK – a much better way to discuss the issues.

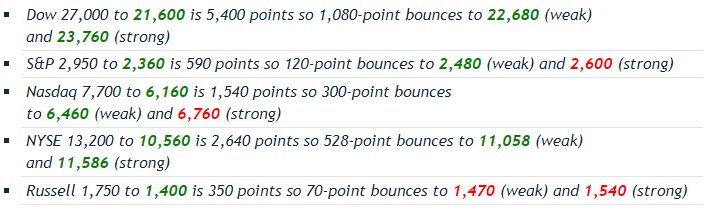

With about an hour to go before the markets open, the Futures are down a bit and that may not seem bad but the Dow (/YM) Futures were up 200 points around midnight and have since collapsed back to where we were at yesterday's close. The big boost came from an announcement out of China that they would implement more stimulus such as a cut in VAT rates as well as tax rebates and go-forward tax reductions to "Make China great again!"

We'll hear more doveish comments from Kashkari (11:30), Kaplan and George (1pm) as the Brexit vote is expected to fail and the Fed will look to offset our own market turmoil so it's going to bde a wild day. This morning we got very bad news as the Empire State Manufacturing Index dropped 66.6% to 3.9 vs 10.75 expected by leading Economorons. I always find it very disturbing when the "great" economic minds that are consulted by Bloomberg et. al are completely missing economic deterioration that is going on right under thier noses.

How many other things are they getting wrong and who is relying on these morons to make policy? Also a surprise is a 0.2% DROP in the December Producer Price Index, so now we have DEflation and even the core PPI (ex-food & energy) is down 0.1% – for the Fed, that's much, much worse than inflation so it is starting to look like their December rate increse may have been a mistake after all.

It is estimated now that we are losing 0.1% of our GDP for each week the Government remains shut down and, as noted yesterday, estimates are now 2.2% vs 3.1% pre-shutdown so we're looking at dipping below 2% by next week if this thing isn't resolved and keep in mind we'll be hearing warnings from many of the corporations that will be reporting over the next few weeks – not a recipe for a bull market by any means!

It is estimated now that we are losing 0.1% of our GDP for each week the Government remains shut down and, as noted yesterday, estimates are now 2.2% vs 3.1% pre-shutdown so we're looking at dipping below 2% by next week if this thing isn't resolved and keep in mind we'll be hearing warnings from many of the corporations that will be reporting over the next few weeks – not a recipe for a bull market by any means!

As with many things, the Republicans think if they can't see the effect at their local Mercedes dealership, then it isn't real – no matter how much data you present them with and it makes you wonder how many of those "Leading Economorons" are Republicans but the answer is MOST of them, since it's exactly those kinds of clueless fact-ignoring idiots that the GOP likes to employ in order to make their completely unrealistic economic policies sound better to the American people.

Unfortunately that means, when you really need good economic forecasting – there's little of it to be found and certainly none of it in those that advise our President most closely (Kudlow, Laffer….. say no more!). Of course, if I were a Russian Agent looking to destroy the US economy, I would want to surround myself with the dumbest economists I could find so – mission accomplished – I guess…

- If I were a Russian Agent, I might have collected $109M in cash from Russians – Trump did. In 2010, the private-wealth division of Deutsche Bank also loaned him hundreds of millions of dollars during the same period it was laundering billions in Russian money. ‘Russians make up a pretty disproportionate cross-section of a lot of our assets,’ said Donald Jr. in 2008. ‘We don’t rely on American banks. We have all the funding we need out of Russia,’ boasted Eric Trump in 2014.”

- If I were a Russian Agent, Russia might interfere in an election to put me into office – Russia did.

- If I were a Russian Agent, I might direct Russian spies to hack the computers of my opponents – Trump did and Russia did.

- If I were a Russian Agent, I'd have a lot of contacts with Russian operatives along with my team – Trump and his team have 101 documented contacts with Russia, so far.

- If I were a Russian Agent, I'd hire a campaign manager who was also an agent who would feed data to the Russian hackers in order to better coordinate election-rigging – Trump did.

- If I were a Russian Agent, I'd fire the head of the FBI who was looking into the "Russia thing" if I could – Trump did. He also bragged about it to the Russian Ambassador and Foreign Minister while sharing top-secret information with them – hardly the worst of his crimes…

- If I were a Russian Agent, I'd seek to undermine the credibility of US Intelligence and even my own Justice Department – Trump did.

- If I were a Russian Agent, I'd take Vladimir Putin's word over my own experts on Russia's role in election hacking – Trump did.

- If I were a Russian Agent, I'd try to get the US out of NATO and encourage other Members to quit the alliance – Trump did.

- If I were a Russian Agent, I'd support pro-Russian leaders in Europe like Viktor Orban in Hungary and Marine Le Pen in France – Trump did and does.

- If I were a Russian Agent, I would praise Putin as “a strong leader” while trashing just about everyone else from grade-B Hollywood celebrities to leaders of Allied Nations. I would even praise Putin for expelling U.S. diplomats and, notwithstanding written nstructions from my own aides saying “DO NOT CONGRATULATE”, I would congratulate Putin on winning his own rigged reelection – Trump did.

- If I were a Russian Agent, I'd burn the notes about my meeting with Putin – Trump did.

- If I were a Russian Agent, I'd defend Russia's invasion of Afghanistan – along with anything else Putin cares to do – Trump did and does.

- If I were a Russian Agent, I'd pull our troops out of Syria, handing control of the country over to Russia – Trump did.

- If I were a Russian Agent, I would not respont to Russian attacks on Ukranian ships in International Waters nor would I look into Russia's poisoning of various strategic agents around the World – Trump did not.

These are just some of the FACTS that just happen to be very consistent with the thesis that Donald Trump is a Russian Agent that was placed in power to undermine the United States of America and irreparably divide our country along with a massive disinformation campaign aimed to destablize our entire Democracy. You may, of course, form your own opinion from these facts – it's a free country – for now…