500 points!

That's how far the Dow (/YM) Futures have climbed since yesterday morning on rumors that trade negotiations with China are progressing but China but we've seen this fade before so we reserve judgment for the moment and we're not going to get all bullish into a Holiday Weekend (Martin Luthor King Day on Monday), not with all this uncertainty still in the air.

We have been, however, very bullish since the bottom on 12/26, only the second time all year we've been very bullish and it's paid off nicely in our Member Portfolios so now is the time to protect our gains – not to add to the risks. We added hedges to our Short-Term Portfolio and our Options Opportunity Portfolio this week to lock in the month's gains and now we can happily enjoy the long weekend ahead.

While the headlines on China SOUND good, let's consider it from China's perspective. Apparently Treasury Secretary, Steve Mnuchin, has floated the idea of pulling back some tariffs in exchange for China doing the same as long as China makes some long-term concessions on policy. US Trade Rep, Robert Lighthizer is against this but, then again, he has spent his whole career telling people how evil China is (and he's the guy Trump put in charge of the negotiations), so what else would you expect from him?

So ignoring Lighthizer and focusing on what Mnuchin proposes, he's essentially saying to China that we began tariffs to make them change their policy and then China said "no, we're not changing our policy" and placed retaliatory tariffs on US and now Mnuchin says, "how about we drop the tariffs and you change your policy?" My kids were better negotiators when they were toddlers! Certainly they were not so transparent about their motives.

If we were serious about Trade, we'd also be making concessions, not simply saying we'd stop doing something we only started doing so we could use it as a negotiating tool down the road – which is now. Even if China were that stupid (and they are not), Lighthizer didn't come all this way just to make a deal. His goal is the economic destruction of China and he doesn't care if he accidentally destroys the US as well in order to achieve his personal goals. Imagine spending your whole life as an anti-China activist (he was Deputy Trade Secretary under Reagan after which he practiced law for 20 years) and then to get another chance to take China down by a President who doesn't consider the consequences of his actions. Lighthizer isn't in this to settle…

If we were serious about Trade, we'd also be making concessions, not simply saying we'd stop doing something we only started doing so we could use it as a negotiating tool down the road – which is now. Even if China were that stupid (and they are not), Lighthizer didn't come all this way just to make a deal. His goal is the economic destruction of China and he doesn't care if he accidentally destroys the US as well in order to achieve his personal goals. Imagine spending your whole life as an anti-China activist (he was Deputy Trade Secretary under Reagan after which he practiced law for 20 years) and then to get another chance to take China down by a President who doesn't consider the consequences of his actions. Lighthizer isn't in this to settle…

Meanwhile, the markets are settling ABOVE their 50-day moving averages just in time for Tuesday's World Economic Forum in Davos or, I should say, The Rest of the World Economic Forum because Trump has just pulled the US delagation "due to the Government shutdown" insuring the US will be an even greater laughing stock when the rest of the World's Government and private leaders gather next week. If we were actually trying to make progress on Trade, wouldn't meeting with Chinese leaders in Davos be a good idea?

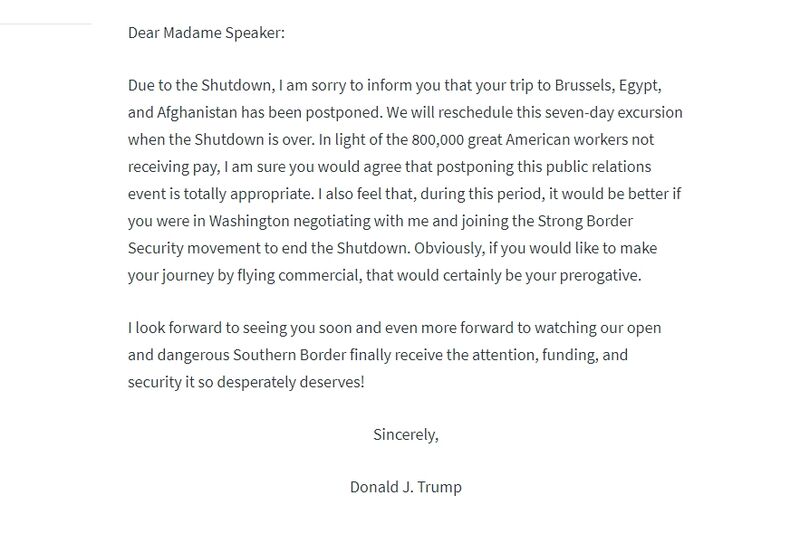

Trump also told Nancy Pelosi she couldn't travel to Afghanistan via Military Plane, suggesting she fly commercial instead – even though the plane itself is still going to Afghanistan – Trump just wanted to make a petty dig at the Speaker of the House because she still won't give him $5.7Bn to start building a $30Bn wall.

Seriously, this is what we have now come to. Pelosi spokesman Drew Hammill pointed out that Trump had visited troops in Iraq since the shutdown began, as did a congressional delegation led by Republican Representative Lee Zeldin of New York. “We believe this is completely inappropriate by the President,” said House Intelligence Chairman Adam Schiff of California, who had intended to accompany Pelosi. “As far as we can tell this hasn’t happened in the annals of Congressional history.”

Seriously, this is what we have now come to. Pelosi spokesman Drew Hammill pointed out that Trump had visited troops in Iraq since the shutdown began, as did a congressional delegation led by Republican Representative Lee Zeldin of New York. “We believe this is completely inappropriate by the President,” said House Intelligence Chairman Adam Schiff of California, who had intended to accompany Pelosi. “As far as we can tell this hasn’t happened in the annals of Congressional history.”

I don't know about you but I'm happy we have more hedges – this will prolong the shutdown at least a week and then we have President's Day Weekend on Feb 18th, which is another big Congressional break so there's maybe one week in the next month in which a deal can be made to re-open the Government and another month of damage is going to be another 0.4% shaved off our GDP. MADNESS!!!

Have a great weekend,

– Phil