.png) Hold that line!

Hold that line!

It's a football term but approprate for the indexes as the moving averages indicate the line at which the bulls and bears are both struggling to gain ground. As in a football game, sometimes the bulls cross into bear territory and sometimes the bears cross into bull territory but even a game that seems certainly won by one side or the other can suddenly reverse in a last-minute rally.

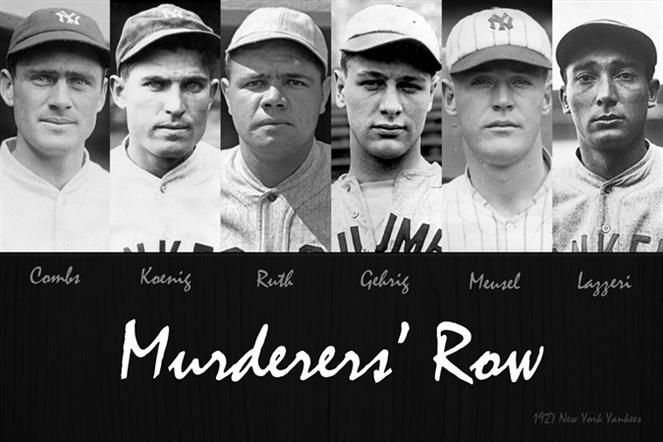

While anyone can win a single game, the real measure of a team's strenght is how they persevere over a whole season or even seasons – as that is the way dynasties are born. The 1927 Yankees were considered the greatest baseball team in history, not just because of that one season but because, between 1921 and 1928 they were in 6 of 8 World Series and won 3 of them (3 of the last 4 as they got better and better).

No matter how good a baseball team may look during the season, once they enter the playoffs and the World Series, they come up against the best of the best from other divisions and other leagues and that's where they are truly tested. The moving averages are like that – on one side you have bulls and on the other side you have bears and it's very easy for the bulls to approach the moving averages from below and it's very easy for the bears to approach the moving averages from above but, once they hit those lines – they face only the most determined bulls and bears and that's where the championships are won or lost.

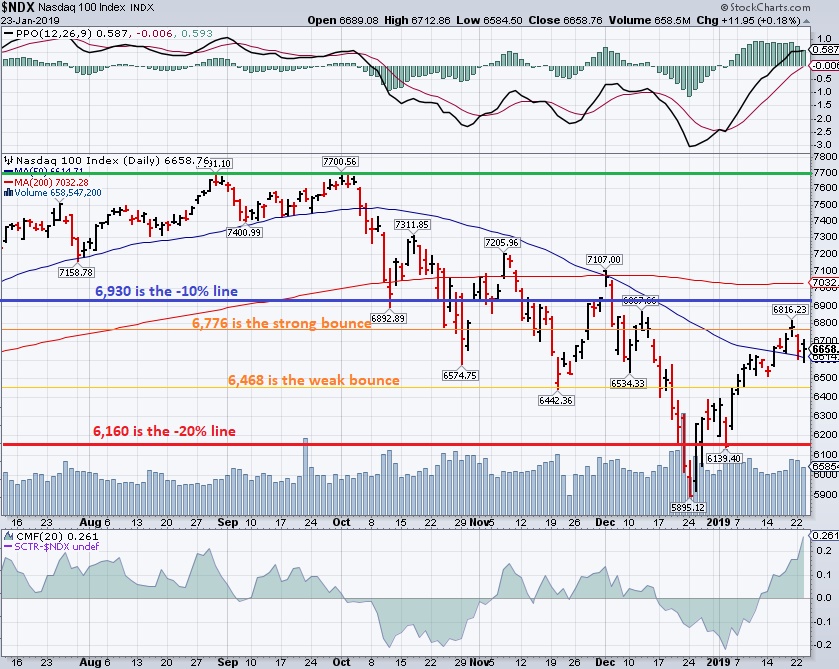

The 50-day moving average is like the playoffs and the 200-day moving average is like the World Series – played for all the marbles. But, before your team can get to the World Series they have to win the playoffs and, at the moment, that's where the bulls are – struggling to get over the 50-day moving averages before they can even think about taking on the 200-day bears, who took the market down 20% in a single quarter and, though the bulls have rallied back – don't count those bears out just yet.

When we see our 5% Rule™ being adhered to this closely, we KNOW the bots are in charge if this market. Last week, we failed exactly at the strong bounce line but that's OK – as long as we don't fail the weak bounce line – that would be very, very bad. Hopefully, we're consolidating for a move back up but, even if we make that, there's the -10% line to contend with just to make a 50% recovery so let's not get too excited just yet…

There was A LOT of selling interest over that strong bounce line, two solid months worth of it and we've spent just 1 low-volume month attempting to rally back so far and we haven't even made it over the line yet. The bears still have the ball and they are well-rested as no one has really challenged them since October. The bulls are going to need a strong catalyst to get them over the line and fortunately, the bears are looking a little tired with their Murderer's Row of Brexit, Trumpdown, Wally, Tradewar, Obstruct & Fedhike all looking tired after beating down the bulls for 3 months but don't count the bears out because Trump is still pitching and, so far, he hasn't met an economic positive he hasn't been able to strike out!

There was A LOT of selling interest over that strong bounce line, two solid months worth of it and we've spent just 1 low-volume month attempting to rally back so far and we haven't even made it over the line yet. The bears still have the ball and they are well-rested as no one has really challenged them since October. The bulls are going to need a strong catalyst to get them over the line and fortunately, the bears are looking a little tired with their Murderer's Row of Brexit, Trumpdown, Wally, Tradewar, Obstruct & Fedhike all looking tired after beating down the bulls for 3 months but don't count the bears out because Trump is still pitching and, so far, he hasn't met an economic positive he hasn't been able to strike out!

Even this morning, Treasury Secretary and Third Base Coach, Wilbur Ross, said we are nowhere near a deal with China and that means Tradewar is ready to play and that sent the the morning line (the Futures) down quickly as bets on the bearsh piled in since Tradewar's health had been questionable into today's game. No such luck for the bulls so now they'll have to figure out how to hit Trump's twitball, which is technically in illegal pitch but he's been getting away with it all season.

Over in the European League, where they say "Football" but mean "soccer" and they don't say baseball at all but spend 3 days watching a single cricket match in what can only be explained as some ancient way to grind their colonies to a halt, League Commissioner, Mario Draghi, will retire with his steak intact of NEVER raising rates once during his entire career.

Over in the European League, where they say "Football" but mean "soccer" and they don't say baseball at all but spend 3 days watching a single cricket match in what can only be explained as some ancient way to grind their colonies to a halt, League Commissioner, Mario Draghi, will retire with his steak intact of NEVER raising rates once during his entire career.

Rates in the ECB have always been week as they have tried everything over the past 20 years in an attempt to keep their made-up currency from going the way of BitCoin but, since the Financial crisis 10 years ago, the Euro has dropped from $1.60 to $1.10, giving up 31% of its value, which has pushed energy and commodity prices, which are priced in Dollars, through the roof and dropping interest rates 95%, from 4% to 0.2% did not help at all!

Fans will remember Draghi came to the ECB straight out of Goldman Sachs so it's no real surprise that he drove rates lower and lower and lower, which made his former teammates tens of Billions of Dollars while driving the ECB $4Tn addional Euros in debt – that's a legacy those fans are never going to forget!

As the Government Shutdown goes into extra innings this week and trade talks with China "miles and miles" apart, according to Ross, we certainly have low expectations going forward, we're going to need to put on our rally caps and hope that earnings will save us.