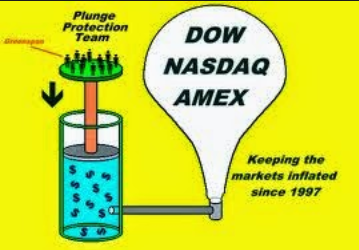

If there's anything the last 8 years of stimulus have taught us it's that you HAVE to be bullish. We have tried one short list since 2008 and we quickly gave it up as we could not catch a break and it's been very rare in the past 10 years that we've found anything we were comfortable shorting (Oil, Netflix, Tesla) for more than a brief period of time and you can see from the action this morning why that's still the case. Yesterday, Commerce Secretary Wilbur Ross had his "Let them eat cake" moment but he was quickly bailed out with more talk of progress with China Trade Talks as well as the Fed jumping in to now say they won't be selling so many bonds after all.

While the Fed was spending Billions making sure that wealthy people's portfolios didn't suffer during the Government shutdown, Trump vowed to keep the shutdown going as long as it takes to get his wall while insisting the 800,000 Federal Workers who aren't getting paid for a second week were behind him: “I love them,” Trump said to reporters on Thursday, “Many of those people that are not getting paid are totally in favor of what we’re doing because they know the future of this country is dependent on having a strong border.”

Ross, on the other hand, who walks around Washington in $600 slippers (with a custom Commerce Department logo, no less!) and is often found in the most expensive restaurants in town, went on CNBC in a $5,000 suit yesterday to complain about Speaker Nancy Pelosi volunteering in a Food Bank, helping the furloughed workers when, instead, she should be capitulating to Trump and giving him his wall:

“I don’t really quite understand why” the food bank visits were happening, Mr. Ross, 81, said on CNBC. Some banks were offering interest-free loans, he said, and because the workers would eventually get their back pay, “there’s no real reason why they shouldn’t be able to get a loan against it.”

Asked by reporters to respond to Mr. Ross’s comments, Mr. Trump said that he had not heard them, “but I do understand, perhaps, he should have said it differently.” He went on to suggest that “local people” who operate banks and grocery stores would be understanding of people who have missed pay. By that time, Senator Schumer had already called Mr. Ross’s comments “appalling” and further evidence of the administration’s “callous indifference” toward federal workers. But it was Speaker Nancy Pelosi of California, Mr. Trump’s most visible shutdown adversary, who invoked the French Revolution. “Is this the ‘let them eat cake’ kind of attitude,” Pelosi said, “or call your father for money?” — a reference to an earlier taunt of the president after a shutdown meeting.

Asked by reporters to respond to Mr. Ross’s comments, Mr. Trump said that he had not heard them, “but I do understand, perhaps, he should have said it differently.” He went on to suggest that “local people” who operate banks and grocery stores would be understanding of people who have missed pay. By that time, Senator Schumer had already called Mr. Ross’s comments “appalling” and further evidence of the administration’s “callous indifference” toward federal workers. But it was Speaker Nancy Pelosi of California, Mr. Trump’s most visible shutdown adversary, who invoked the French Revolution. “Is this the ‘let them eat cake’ kind of attitude,” Pelosi said, “or call your father for money?” — a reference to an earlier taunt of the president after a shutdown meeting.

Trump's daughter Lara also got some backlash for saying the shutdown amounted to “a little bit of pain, but it’s going to be for the future of our country” while idiot-at-large, Larry Kudlow told reporters the shutdown was "just a glitch" and, when pushed back on that and remined of the very real suffering the shutdown is causing, Kudlow replied: "Am I out of touch? I don’t think I’m out of touch. I’m addressing the problem.” Mr. Kudlow also seemed to disagree with a reporter who told him that coming to work during a shutdown was not, in fact, volunteer work because workers “believe in” the President but potentially illegal forced labor by the Administration, which could lead to a torrent of lawsuits.

If Mr. Kudlow, Mr. Ross, or literally anyone in this Administration would actually meet with federal workers and listen to their stories, they’d know how insulting these kinds of comments are.

Nancy just said she “just doesn’t understand why?” Very simply, without a Wall it all doesn’t work. Our Country has a chance to greatly reduce Crime, Human Trafficking, Gangs and Drugs. Should have been done for decades. We will not Cave!

Yes, this is how our Government works now, the President has brought everyone down, brought the entire country down – to his level!

What was “highly unusual,” Berkeley's Ken Jacobs said, was that so many members of Mr. Trump’s cabinet and administration have appeared to share those views. “When you have a cabinet filled with so many people who are as wealthy as this cabinet is, it just seems like they just do not understand or can’t comprehend how your average person lives.”

Keep that in mind next week as this nightmare drags on. 2% of all working Americans are civil servants and, so far 1/3 of them are being affected by the shutdown but that number will increase each week this thing drags on. Unless you walk in Wilbur Ross' $600 slippers, these people are your neighbors, your friends and YOUR CUSTOMERS. What happens to your business when 1% of your customers are no longer getting paid?

Have a good weekend,

– Phil