55 Miles, $1.4Bn.

55 Miles, $1.4Bn.

If that's what it costs to keep the Toddler-in-Chief from throwing another tantrum, Nancy Pelosi says she's willing to pay it as a bi-partisan group of Senators and Congresspeople have finally hashed out the details of a funding bill that will keep our Government open for 6 CONSECUTIVE MONTHS! Imagine being able to go all the way until September before our next shutdown crisis – what an accomplishment!

Well, the markets seem to think so as the Dow popped 200 points in pre-market trading, mostly last night, when news of the deal spread. Unfortunately, Trump will likely "prove" that the 55 miles of new wall is effective – simply because there are still 1,500 miles with no wall people can go through, so they simply won't try where the wall is. Will Trump ever get a greenlight to fund the rest of the 1,500 miles at $25.5M per mile ($38Bn)? That does seem like madness but we've now taken the first tiny step towards it.

Despite all the progress we're making in keeping out the tired, the poor and the huddled masses yearning to breathe free, Small Business Optimism contines to decline, especially in Future Expectations, which are down 10% since the last reading. That seems to be the general trend at the moment – people are content with the current conditions but they are worried that the country is going to Hell in a handbasket…

Despite all the progress we're making in keeping out the tired, the poor and the huddled masses yearning to breathe free, Small Business Optimism contines to decline, especially in Future Expectations, which are down 10% since the last reading. That seems to be the general trend at the moment – people are content with the current conditions but they are worried that the country is going to Hell in a handbasket…

Europe is literally going to Hell in a handbasket and, when they get there, they'll meet China, who have already slowed down significantly in Q4 and Q1 is shaping up to be worse and it isn't all about trade, though that's a factor. GM sold 25% less cars in Q4 in China than a year ago but they are not alone as the entire auto industry, including Chinese Auto Makers, sold 20% less cars in Q4 as the Government pulled back on incentives.

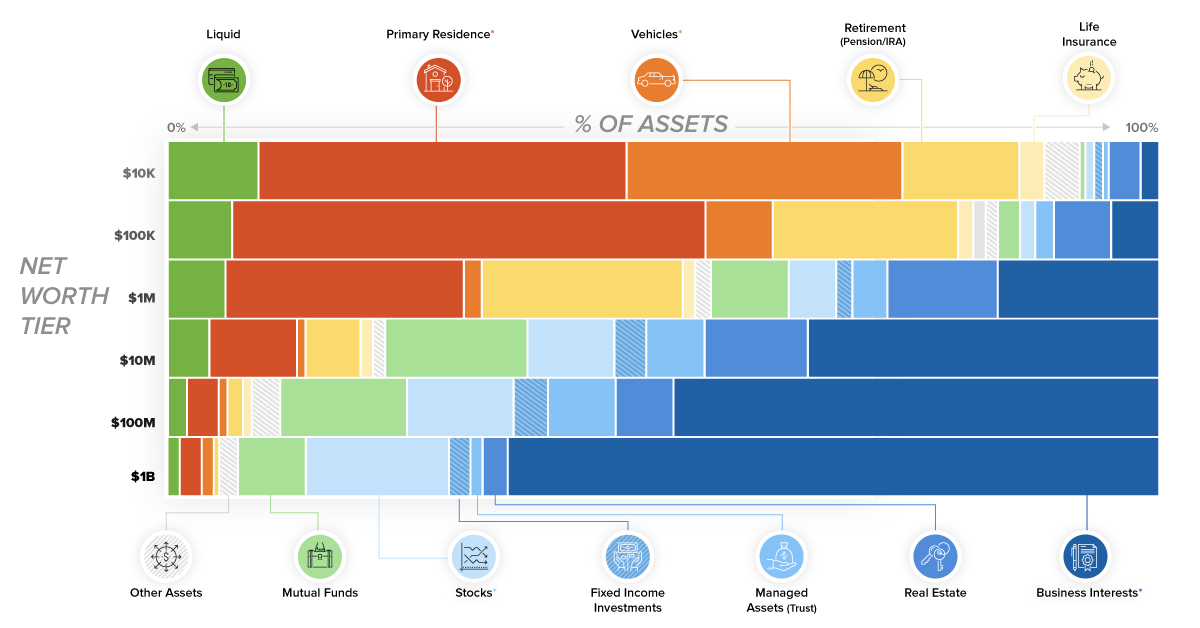

Nonetheless, Chinese customers still bought $52Bn worth of iPhones in Q4, about 15% of Apple's total sales. China is also very important to SBUX, UTX (60% of their Otis Elevator sales) and TIF, who saw a 9% increase in sales in China in Q4. That's because, no matter what is happening on the ground, the rich are getting much, much richer! As noted in Bloomberg, just 8 Asian Billionaires who are all over 90 control $125Bn in wealth but that's no big deal as just 400 Americans have more wealth than the Bottom 60% (192M of us) combined and the Top 1% of the United States have crossed over the 50% mark in their share of the wealth.

So Communism can't stop the Top 1% from accumulating all the wealth and Capitalism, of course, encourages it and that's why Trump and the GOP are working so hard to villify Socialism and to stamp out any hint from the democrats of some kind of Wealth Tax – even though it would only affect those of us with more than $500M in assets, leaving them with just $450M in assets enabling the Government to redistribute that 5% (of the total wealth) to the bottom 99%, who only have 50% so it's like boosting everyone else's wealth by 10% while taxing 32,000 people (the top 0.0001%) 10%.

Is that really so unreasonable? 10% does seem like a lot but we're addressing many years of abuse in a system where over 90% of the income growth goes to the Top 10% and most of that falls into the hands of the Top 0.001%. This has already been going on since Reagan and one little tax is not going to fix it – but at least it's a start!

Unless you are completely blind, however, you have seen how the Top 0.01% have been buying their way into positions of power, even passing laws that allow their money to outweigh your votes in what used to be a pure Democracy. The Top 0.01% have been waging a decades-long campaign to villify the Government and make you think that the Government is the problem and not the very people the Government is supposed to reign in on behalf of the people – "for the greater good" and all that other Founding Father claptrap we pretend to respect while we spit on the intent.

The Constitution of this country was not drafted in 1776 nor in 1781 – that was the Articles of Conferderation, which did not allow Congress to impose taxes (or tariffs) and did not address the economic concerns of ordinary citizens, nor did it protect citizens from debts incurred during the Revolution, a problem Madison said "contributed more to that uneasiness which produced the Constitution (in 1789) and prepared the mind for a general reform” than any other problem. As a result, the Constitution included protections for citizens facing bankruptcy, explicitly allowed Congress to collect taxes, and in general focused on fixing the problems that had become apparent in the Articles of Confederation.

The Constitution of this country was not drafted in 1776 nor in 1781 – that was the Articles of Conferderation, which did not allow Congress to impose taxes (or tariffs) and did not address the economic concerns of ordinary citizens, nor did it protect citizens from debts incurred during the Revolution, a problem Madison said "contributed more to that uneasiness which produced the Constitution (in 1789) and prepared the mind for a general reform” than any other problem. As a result, the Constitution included protections for citizens facing bankruptcy, explicitly allowed Congress to collect taxes, and in general focused on fixing the problems that had become apparent in the Articles of Confederation.

So 8 years after the Articles of the Confederation were drawn up, our founding fathers, through much debate, decided the country needed to be MORE SOCIALIST – not less! It was Washington himself who created the post office in 1792, creating thousands of Government jobs right off the bat.

Jefferson had fought since the beginning of his political career for homesteading policies that would give away free land in the Western territories – which, in an era when land ownership often mattered as much or more than financial worth, could have easily been considered “political gifts” by his opponents. Yet Jefferson did this not only because he hoped to encourage Western settlement, but because he sincerely saw no contradiction between maintaining a “small government” and using the state to economically assist ordinary people.

Jefferson had fought since the beginning of his political career for homesteading policies that would give away free land in the Western territories – which, in an era when land ownership often mattered as much or more than financial worth, could have easily been considered “political gifts” by his opponents. Yet Jefferson did this not only because he hoped to encourage Western settlement, but because he sincerely saw no contradiction between maintaining a “small government” and using the state to economically assist ordinary people.

When Jefferson succeeded in creating a budget surplus, he quickly proposed that the funds be used to create a top-notch public education system, subsidize scientific and technological innovation, and build transportation and other forms of infrastructure that would strengthen America as a world economic power even as it provided jobs for members of the working class. He even hoped that America would one day embrace taxing the wealthy in order to finance programs that helped the general public:

“We are all the more reconciled to the tax on importations, because it falls exclusively on the rich, and with the equal partitions of interstate estates, constitutes the best agrarian law… Our revenues once liberated by the discharge of the public debt, and its surplus applied to canals, roads, schools, etc., the farmer will see his government supported, his children educated, and the face of his country made a paradise by the contributions of the rich alone, without his being called on to spare a cent from his earnings.”

Even Lincoln, the "founder of the Republican Party" said in his 1861 State of the Union message:

Even Lincoln, the "founder of the Republican Party" said in his 1861 State of the Union message:

“Labor is prior to and independent of capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed. Labor is the superior of capital, and deserves much the higher consideration.”

Our great thinkers were SOCIALISTS and the believed in redistributing the wealth because they had left the lands where wealth was concentrated in the hands of the few and they decided they would rather die fighting than allow that to happen in America.

WTF happened to us?

When did we let these idiots take over and corrupt everything we believed in?