There is no trade deal.

There is no trade deal.

That's why the Asian markets fell 1.5% this morning although, this morning, a lot of people are acting like we're making progress so the Futures are creeping up again – and that's fine with us as we'd LOVE to have an opportunity to short them for the 3rd day in a row. We made $600 per contract from Wednesday Morning's Trade Idea and $1,200 per contract on Thursday Morning's Trade Idea (it only costs $3/day for you to get these ideas) and this morning we're HOPING to re-test 25,600 on the Dow (/YM) Futures but I think we're more likely to fail or, at best, drift into the holiday weekend.

If you cut through all the "he said, Xi said" noise of the trade rumors, the FACT of the matter is Lighthizer and Mnuchin just spent a week in China and accomplished nothing and now they are talking about extenting the March 1st deadline by at least 60 days, which is a major embarrasment for Trump, who set the arbitrary deadline and forced the problem in the first place. We haven't even BEGUN to have trade talks with Europe or Japan and Trump has threatened more tariffs on each of them – even though we're not even sending a negotiating team.

This is very much in-line with my premise, which we discussed last week – that Trump DOESN'T want a trade deal – he just wants the tariff money and as long as his base remains too dumb to understand that THEY are the ones paying these tariffs – not China, not Mexico, not Europe or Japan – then Trump can use the tariffs to help "balance" his budget. I put "balance" in quotes because, when you are running a $1.2Tn annual deficit (yes, it's up 20% since last time I looked) – giving up a projected $200Bn in tariffs would raise your deficit another 20% and you would, officially, be the WORST PRESIDENT EVER!

As noted by Bloomberg: "Trump appears to have over-estimated his own power in these talks. There is a reason the original package of U.S. demands to China was dubbed the “surrender-or-die” list by experts. Trump’s trade hawks believe nothing short of a Chinese capitulation and a fundamental reworking of its economic model will deliver the altered relationship they are after. They seemed to think that if the U.S. just used a tool that no one in recent history had dared to use as aggressively — tariffs — it could force that capitulation."

As noted by Bloomberg: "Trump appears to have over-estimated his own power in these talks. There is a reason the original package of U.S. demands to China was dubbed the “surrender-or-die” list by experts. Trump’s trade hawks believe nothing short of a Chinese capitulation and a fundamental reworking of its economic model will deliver the altered relationship they are after. They seemed to think that if the U.S. just used a tool that no one in recent history had dared to use as aggressively — tariffs — it could force that capitulation."

Trump and the GOP are being undone by the same underlying racism that fuels their rallies. They don't believe the Chinese are as smart or as willing as they are to endure a protracted conflict but it's Trump's base who are suffering the most in this war as US soybean farmers are drowing in crops, trading well below their break-even point at $10/bushel as China is no longer buying US beans. Long-term, China is finding other suppliers and developing long-term relationships and, if that business doesn't come back – these farmers will need to find different lines of work and then the banks who lend them money will also come crashing down – and we know how that story goes…

It's always a mistake to believe your oppenents are somehow "inferior" to you and, unfortunately, the GOP thinks anyone who isn't a White, Christian Male is inferior in many, many ways to the point where they underestimate their strengths and that leads them to crushing defeats at the hands of people like Nancy Pelosi, Elizabeth "Pochahantis" Warren and the notorious AOC.

It's always a mistake to believe your oppenents are somehow "inferior" to you and, unfortunately, the GOP thinks anyone who isn't a White, Christian Male is inferior in many, many ways to the point where they underestimate their strengths and that leads them to crushing defeats at the hands of people like Nancy Pelosi, Elizabeth "Pochahantis" Warren and the notorious AOC.

Mitch McConnell is so dismissive of AOC's New Green Deal that he's going to hold a vote on it (as opposed to blocking any proposed Democratic legislation like he usually does), thinking it will split the Democrats but I think he'll be surprised to see that not every GOP Senator is on board with Planetary Anihilation and, of course, those that vote against it will be held accountable every time we have severe weather for the next 2-6 years.

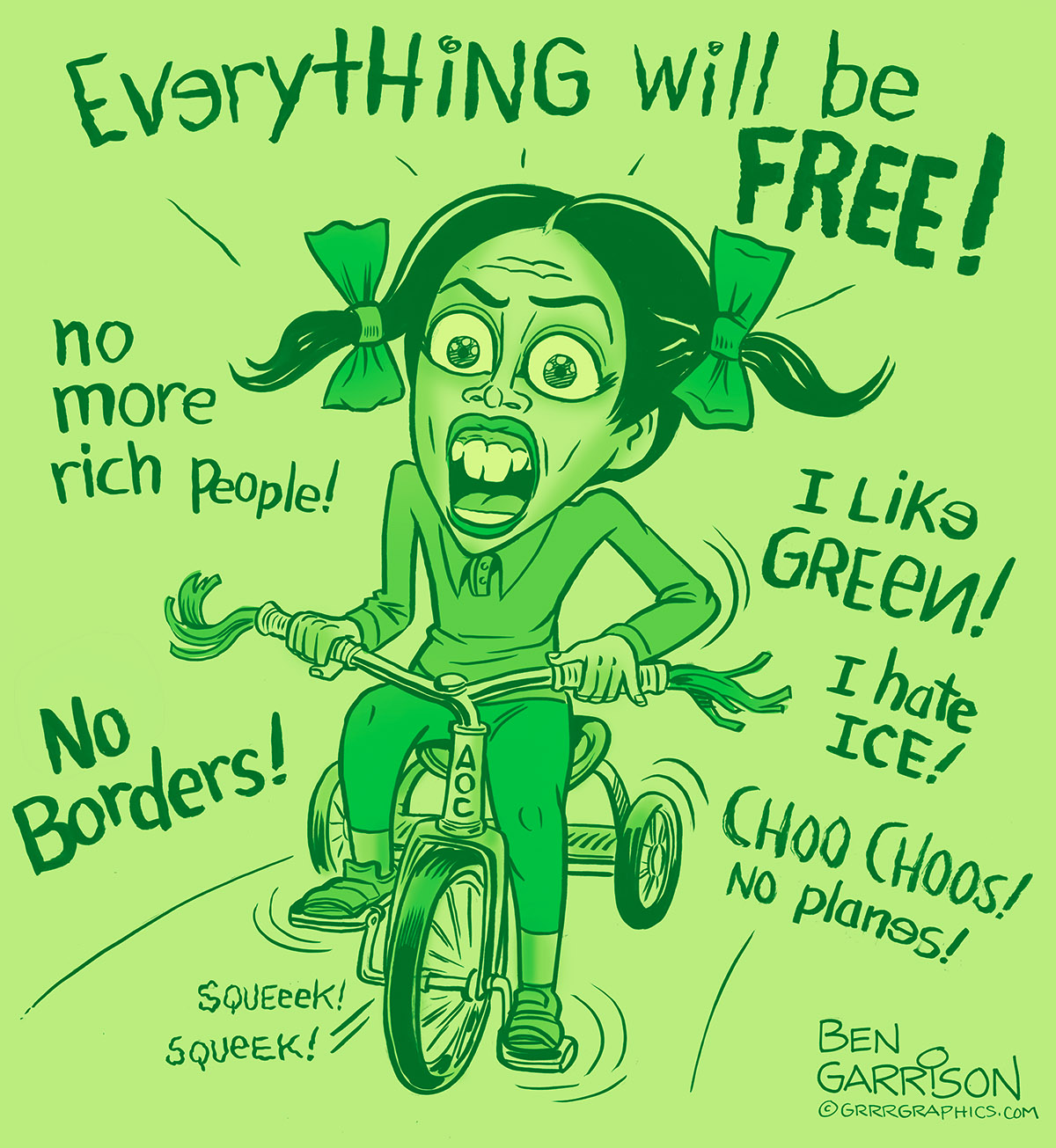

Even Ben Garrison doesn't get it. All those "negatives" in his cartoon are essentially the typical wish-list for young voters. The Conservative Brain generally only deals in absolutes but the Progressives understand that we set goals and then we find compromises to move things in a different direction. Taxing incomes over $50M at a 70% marginal rate isn't "no more rich people" – in fact, it's "MUCH more rich people" as those who stop earning money in "protest" (the Randian fantasy) leave room for others to start making some money. Preferring high-speed rail to air travel where practical is a proven success in all of the World, as is Universal Health Care and Open Borders (the whole point of the EU was to open borders and allow free trade).

This cartoon is nothing more than a glimpse into the casual, dismissive racism practiced by Conservatives, who have no respect for other people or other countries while young people today, who grow up chatting with people from around the World and make songs like Gangnam Style and Despacito the most watched videos of all-time aren't being sucked in by the GOP's myopic World-view the way they used to.

Like the song says: "SLOWLY" – these revolutions take time and every day the GOP and their Conservative Media seem to find a way to piss more and more Americans off and the marches get stronger and the protests go on longer and we're all just waiting for that "let them eat cake" moment that sparks the Revolution. We're not there yet and it may take a few more years – but it's coming.

It was the emergence of the Bourgeoisie and their takeover of Government that formented revolt in France. In the 1770s, the oligarchs took control and they ran very expensive wars (the 7 Years' War and helping the US Revelutionary War just to piss England off) and that ran up their deficit (sound familiar) and their solution was to tax the poor but not the rich (sound familiar). Meanwhile, the "Enlighenment" began to spread, which was essentially the same philosophical ideas that sparked the American Revolution (and those guys would have torn down this Government in a second!) and the success of the American Revolutionaries emboldened the French Citizens to begin organizing themselves.

It was, in fact, an experiment (or the invention of) Laissez Faire Capitalism in the 1780s that completely destablizied the economy which, ultimately, let to Louis losing his head in 1792 – along with most of the noble class. Sadly though, Trump, McConnel and Company have learned nothing from history other than "Laissez Faire? – Where can I get some of that?" but soon (historically) they will learn the lesson Kennedy preached:

It was, in fact, an experiment (or the invention of) Laissez Faire Capitalism in the 1780s that completely destablizied the economy which, ultimately, let to Louis losing his head in 1792 – along with most of the noble class. Sadly though, Trump, McConnel and Company have learned nothing from history other than "Laissez Faire? – Where can I get some of that?" but soon (historically) they will learn the lesson Kennedy preached:

"Those who make peaceful revolution impossible will make violent revolution inevitable."

Have a great weekend,

– Phil