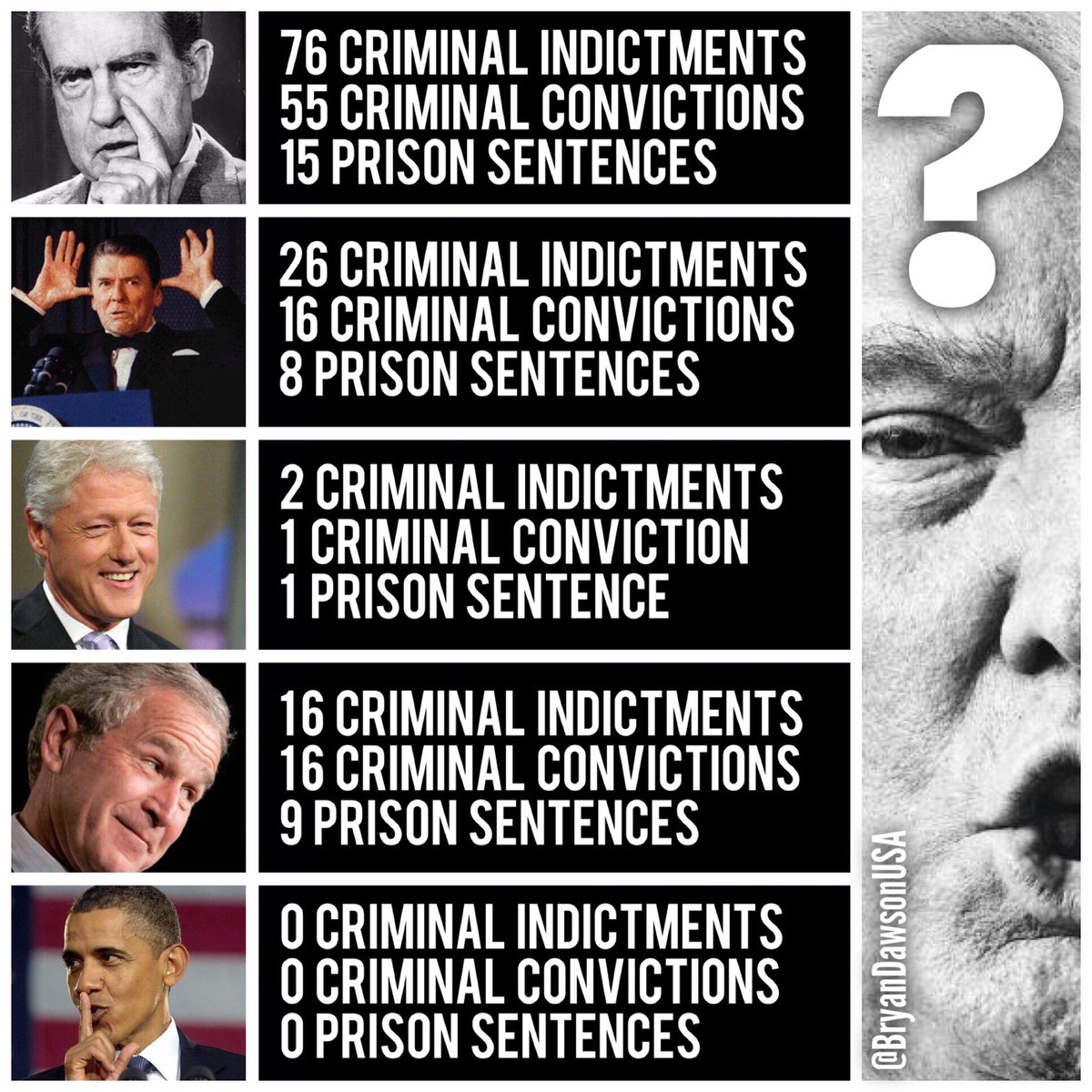

Criminal conduct!

Criminal conduct!

Trump's former lawyer, Michael Cohen will for the first time publicly accuse the President of criminal conduct while in office related to a hush-money payment to a porn star. According to the Wall Street Journal: "The President’s ex-lawyer will tell House Committee he witnessed Trump’s ‘lies, racism and cheating,’ role in hush payments." This is contrary to Trump and the GOPs position that his payments to the porn star he was cheating on his wife with were perfectly legal and just a normal part of any campaign process and, of course, he's already been given a pass by the Evangelicals who support Trump 100% in all of his exrtra-marital affairs.

Criminal charges are new and that opens up a whole new avenue of investigations for Trump – even if there isn't enough evidence to prove that he's a Russian Agent, placed in power through a coordinated effort that clearly came from Russia and Putin, with money that clearly came from Russia and Putin following through on an agenda that is clearly benefitting Russia and Putin BUT – we can't PROVE that he's purposely doing all this to pay back Putin or if it's just a cooincidence that his staff has already been found guilty of conspiring with Russia and none of that has anything to do with Trump himself.

Sure, that's the ticket, right? Well, the market has been willing to move along, even as Russian State TV on Sunday listed potential US cities that they could strike first with their new Hyppersonic Missiles. The report came days after Russian President Vladimir Putin warned the U.S. against deploying intermediate-range missiles in Europe. You would think the President (any other President) would be outraged but there was not a single tweet as Trump was busy calling for "retaliation" against Saturday Night Live for making fun of him and touting his trade progress with China, which boosted the markets yesterday.

Sure, that's the ticket, right? Well, the market has been willing to move along, even as Russian State TV on Sunday listed potential US cities that they could strike first with their new Hyppersonic Missiles. The report came days after Russian President Vladimir Putin warned the U.S. against deploying intermediate-range missiles in Europe. You would think the President (any other President) would be outraged but there was not a single tweet as Trump was busy calling for "retaliation" against Saturday Night Live for making fun of him and touting his trade progress with China, which boosted the markets yesterday.

While I know most of you reading this think this is all some sort of Liberal attack against the President (and yes, I am a Liberal), I don't really see how that disqualifies me from being concerned when the Russian Propaganda Network has a whole special about how easily they can now wipe out America with their new missiles and how close they can park their subs to US waters – and our President says NOTHING! Are you really OK with that?

The problem with having a President who's a Russian Puppet isn't just the wanton economic destruction he causes at home or the decline in respect the rest of the World has for us or the loss of American leadership on the World stage… The very real consequence of a Putin Puppet leading the US is that – if Russia were to strike first with their terrible new weapons – the Putin Puppet could simply surrender and that's that – the US is part of the Soviet Union. THAT is why we should be concerned enough to at least investigate whether or not the President of the United States is colluding with the Russians – he's also the Commander in Chief of our Armed Forces and that means you can wake up tomorrow in a different country.

Markets don't like uncertainty and not knowing whether they US will remain independent is a pretty big uncertainty. It's very worrying to see Putin making these chess moves just when the Russian Investigation is about to release its findings but, no matter how guilty Trump is – you know the drill – he will be defended for being a Putin Puppet by the same people who defend his affairs and his racism and his fraudulent Universities and his vulgar attitude towards women and the Constitution. It doesn't matter what Trump does – as long as he's doing it for them…

The markets are taking some notice today, reversing yesterday's gains (Monday's never matter anyway) but make sure you are well-hedged ahead of Powell's Fed Testimony on Capital Hill – especially as he speaks to the House tomorrow – who may have a few questions about his $4.5 TRILLION Balance Sheet than the GOP has been giving him since he took office.

Speaking of Fed Chairmen, the former head of the Federal Reserve thinks President Donald Trump doesn’t understand basic economics, the central banking system or international trade. But she said it in such a way that you might have missed it. In an interview with Marketplace that aired Monday, former Federal Reserve Chair Janet Yellen was asked if she thinks Trump “has a grasp of” macroeconomic policy, which encompasses everything from unemployment to the rates on bank loans. “No, I do not,” replied Yellen, who served under Trump during his first year in office.

Can you really believe that EVERY SINGLE PERSON who says something negative about the President has an "agenda"? Maybe some of them are right? Maybe we shoudl be concerned?