Back to 2,800!

Back to 2,800!

As you can see from the chart, S&P earnings are down about 1% since September but the S&P itself it up 1%, back to the critical 2,800 line (again) and we'll see if it sticks but the /ES Futures are a fantastic short below that line with very tight stops above. What I find most interesting on this chart, however, is the "value" of the S&P 500 stocks now bushing $67Tn and I'll tell you why that is important.

You can look and look and look but you can't find a good number on the total Profit of US Corporations because they, and the Government, work very hard to obscure that information from the public. Why? Because if the public understood just how much money Corporate America was makin and how little they are paying in taxes – there would be lynchings – and NOT the kind the GOP like!

$67 TRILLION is a good clue about corportate profits because you know that the S&P is trading at roughly 22x forward earnings so, if the valuation is $67Tn, we divide that by 22 and find that profits must be $3.05Tn. That makes sense becuase Apple alone makes $60Bn and they are about 2% of the S&P so 50 x $60Bn is $3Tn also. Well that's settled then, JUST the 500 companies in the S&P 500 make $3Tn and figure $3Tn for the other 5,500 public companies is $6Tn and than whatever all the private companies (Cargill, Koch, Deloitte, Pricewaterhouse, Mars, Publix, Bechtel…) make has got to be at least another $2Tn so that's about $8Tn in PROFITS for our Corporate Masters and let's see what they paid in taxes last year:

$297Bn??? WTF??? That's just 1.5% of our GDP and Corporate Profits are 40% of our total GDP – they are barely paying 10% of their profits in taxes! 165M wage-earners making $50,000 a year get paid $8.25Tn – about the same as the corporations make in profits, yet they paid $1.6Tn in Income Taxes (20%) and another $1.2Tn (15%) in Payroll Taxes.

THESE are the "people" we gave $1.5Tn in tax breaks to? It takes them 5 years to PAY $1.5Tn in taxes! The American people (that's you!) had to BORROW $1.5Tn to finance tax breaks for Corporations who pay 1/10th as much tax as we pay. Also, note on the chart that we, the people, paid $1.2Tn in Payroll taxes and Social Security only paid out $939Bn – yet the GOP tells you we have to cut that. Medicare is another $600Bn and Medicaid almost $400Bn but they are fighting tooth and nail not to have Universal Health Care and get those costs under control (aside from all the money you have to pay out of pocket because the companies you work for no longer pay for health insurance).

THESE are the "people" we gave $1.5Tn in tax breaks to? It takes them 5 years to PAY $1.5Tn in taxes! The American people (that's you!) had to BORROW $1.5Tn to finance tax breaks for Corporations who pay 1/10th as much tax as we pay. Also, note on the chart that we, the people, paid $1.2Tn in Payroll taxes and Social Security only paid out $939Bn – yet the GOP tells you we have to cut that. Medicare is another $600Bn and Medicaid almost $400Bn but they are fighting tooth and nail not to have Universal Health Care and get those costs under control (aside from all the money you have to pay out of pocket because the companies you work for no longer pay for health insurance).

This is MADNESS people – we need to stop screaming about Socialism and start screaming about the perversion of Capitalism that is what is really destroying this country. 165M workers make $8.25Tn and pay $2.8Tn in taxes, leaving them with $5.45Tn (less state taxes) so about $33,000 each to spend while 165,000 people who own the Corporations make $8Tn and pay $300M in taxes, leaving them with $7.7Tn (less state taxes or rebate incentives) so about $46.66M each to spend.

Since Trump took office, Corporate tax revenues have dropped 60% – about $666Bn a year less paid out by our Corporate Masters and what have they done with the money? NOTHING!!! Very little investment, very little job creation, LOTS of buying back their own stock and inflating market prices which helps who? The same 165,000 people who have $46.66M in disposable income – not the poor schmucks who have $33,000 and voted for this madness!

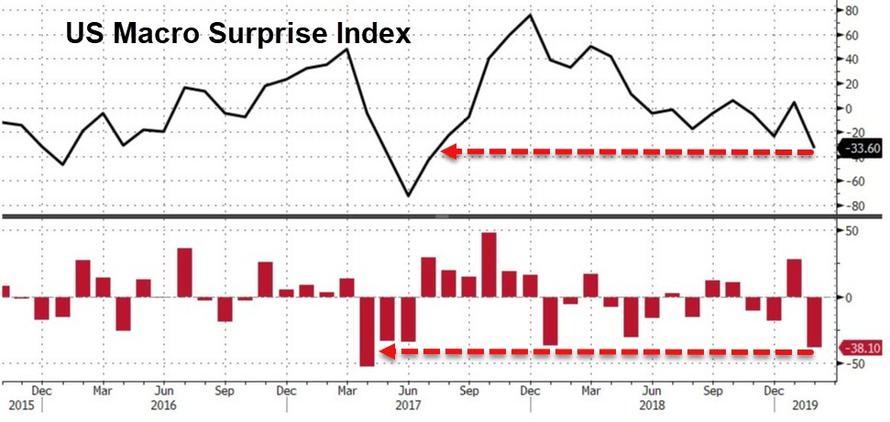

Meanwhile, despite all the buybacks and despite all the tax breaks – the economy has been in steep decline for the past 16 months as we saw from yesterday's GDP Report and as we can see from this Macro Surprise Index, which is as low as it was in January of last year, when we had a 10% market correction.

Meanwhile, despite all the buybacks and despite all the tax breaks – the economy has been in steep decline for the past 16 months as we saw from yesterday's GDP Report and as we can see from this Macro Surprise Index, which is as low as it was in January of last year, when we had a 10% market correction.

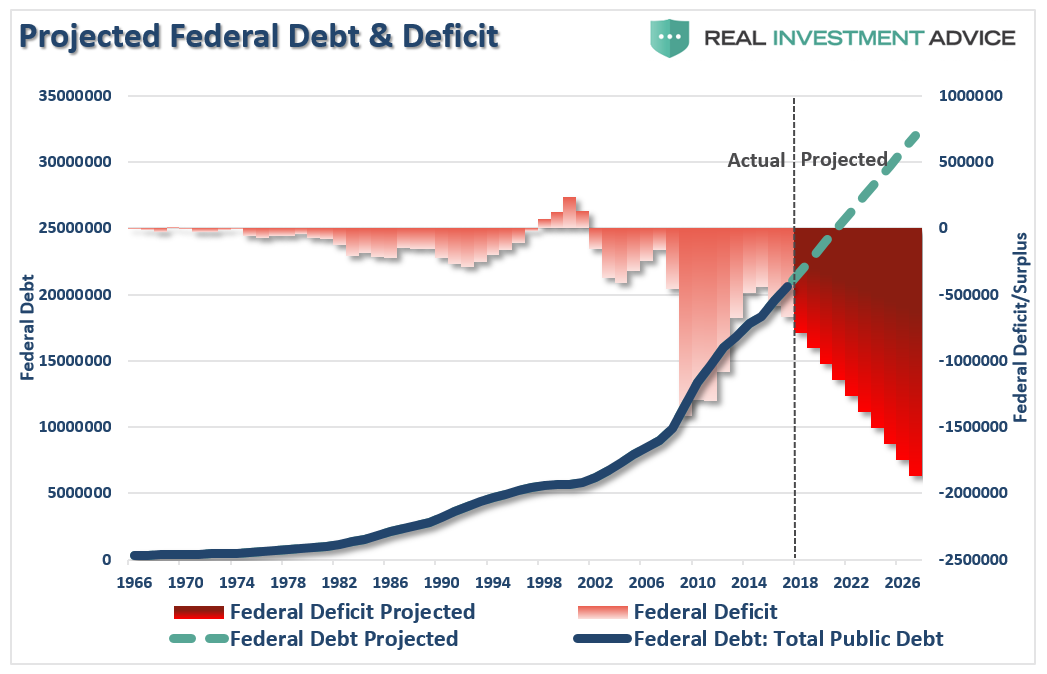

Trump's current budget has us on a path to rack up $35 TRILLION in debt by 2030. The $1.5Tn tax break we are giving Corportations multiplies through the years – as does the massive increases in Military Spending, etc. Even if the country does prosper – we're not going to reap the benefits of increased Corporate Profits and the Corporations are not obligated to pay our nation's debts – they can just leave if they want to – as they often threaten to do – leaving the poor citizens who can't afford to shift their assets overseas to foot the bill:

This is the non-Socialist future you are being promised – a Capitalist's Debtor's Prison from which you and your family won't be able to escape – except maybe on a boat since most of the country will be underwater by then… That's the bright side – other than the boat – there's nothing bright-looking about this future.

So instead of screaming "Socialism" evey time someone suggests a solution – maybe let's consider that people like Bernie Sanders, Elizabeth Warren and Alexandria Ocasio-Cortez may actually have a point and we do need to RADICALLY rethink the way we are running this country – before we run it right off a cliff!

“Unless you believe in fairies, that is not an economy that can function without inflationary instability.” – Alan Greenspan, yesterday!

“The long-term outlook is terrible. The short-term outlook is not too bad."

Not too bad!

Have a great weekend,

– Phil