More Fed data.

More Fed data.

That's what we're waiting for today as the Fed will release their Beige Book, which covers the end of the shutdown period and should give us a read on how damaging the shutdown has been to Q1 earnings. As you can see from the chart, the Atlanta Fed's estimate of growth in Q1 is pretty close to zero while the "consensus" estimate of leading economorons is just under 2% – that's a pretty wide gap and it's going to matter A LOT which way that line begins to bend.

For the moment, the markets are hanging onto hope that the US and China have finally worked out their differences and that the Governement won't shut down again this year and Brexit won't be a total disaster and, of course, that all those warning signs that have been flashing in the economy are temporary (from our self-inflicted wounds) and we will get back to growth very quickly. Despite my skepticism, that is how we've been playing the market as our Member Portfolios are generally bullish – with a few hedges – "just in case".

I would still be happier if the market made a nice 10-20% correction and stayed down long enough to consolidate for a proper move up but it doesn't look like the powers that be are willing to let that happen – and that includes China – who went to great lengths to prop up their own markets this week as well.

The OECD cut it's Global Outlook – again – and warns more cuts may be ahead, reducing the Global Groth Rate from 3.5% to 3.3% and Australia's GDP just missed their growth forecast by the same 0.2%, at 2.3% vs 2.5% expected. Italy has given up on the US and Europe for that matter and has joined China's "Belt and Road" trade initiative – making them the first G7 Nation to economically defect to greener pastures in China while China, however, has not trouble trading with the US – sending a record $419.2Bn worth of goods to America in 2019.

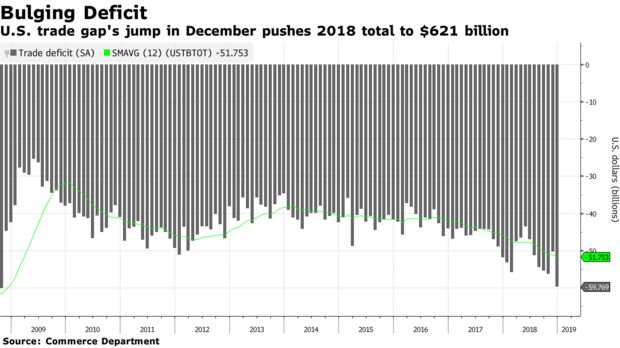

The annual deficit in goods and services that Trump seemed to care so much about has INCREASED 12.5% ($68.8Bn) to $621Bn DESPITE the tariffs so Trump has now INCREASED the Trade Deficit by $119Bn during his first two years in office. Isn't that GREAT??? Trump constantly cites the Trade Deficit as evidence of the failure of his predecessors’ trade policies – will his party now hold him accountable to the same measurments? LOL – of course not!

The annual deficit in goods and services that Trump seemed to care so much about has INCREASED 12.5% ($68.8Bn) to $621Bn DESPITE the tariffs so Trump has now INCREASED the Trade Deficit by $119Bn during his first two years in office. Isn't that GREAT??? Trump constantly cites the Trade Deficit as evidence of the failure of his predecessors’ trade policies – will his party now hold him accountable to the same measurments? LOL – of course not!

And we are "saved" by the export of our services as the Goods part of the trade deficit, which Trump usually cites, is now $891.3Bn, up $83.8Bn (10.4%) for the year. In Services, we have a $270.2Bn surplus – maybe we should stick to what we're good at and embrace the idea of being a service-based economy rather than trying to make America great by going back to a 1950s model economy?

We did export $2.5Tn worth of stuff, led by Oil and Airplanes and usually we export a lot of Soybeans, but Trump's tariffs but the brakes on that and shipments dropped $4Bn in 2018 (and the poor farmers are suffering for it). Now we're starting a Trade War with India as Trump is trying to please his sponsors from the Medical Equipment Industry, who wanted to jack up prices but India said "no thank you" as they have rules against greedy corporations ripping off consumers when they are in dire need.

This is likely to push yet another critical trading partner into China's arms and one struggles to understand Trump's long-term strategy here – unless, of course, it's to undermnine the United States' leadership role in Global Commerce and Diplomacy – in which case he's doing a fantastic job!

This is likely to push yet another critical trading partner into China's arms and one struggles to understand Trump's long-term strategy here – unless, of course, it's to undermnine the United States' leadership role in Global Commerce and Diplomacy – in which case he's doing a fantastic job!

And North Korea restarted their Nuclear Missile Progam.

Are we great yet?