Up and up we go!

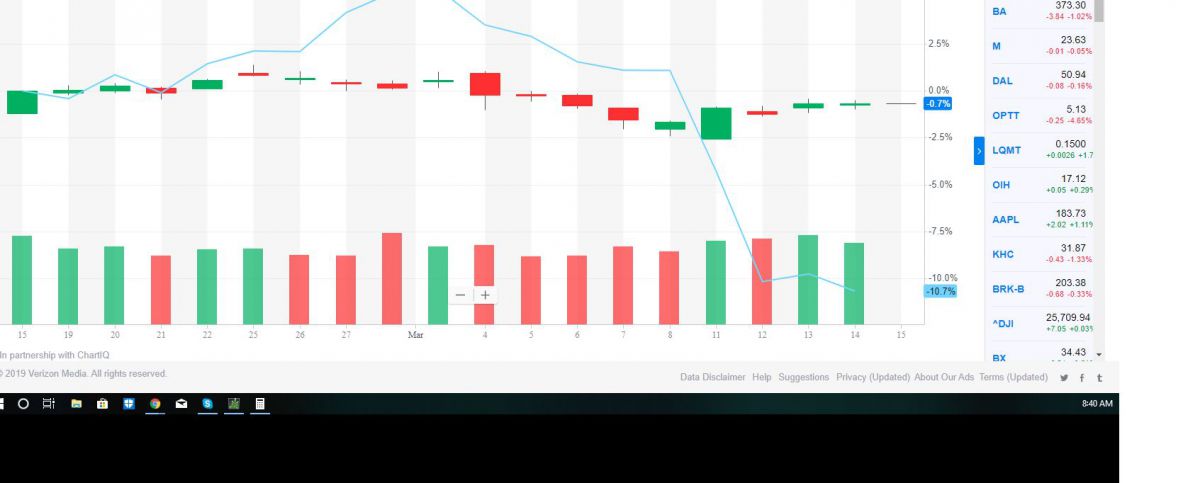

It's been an all bull week after Monday's weak start and we're up 600 points (2.4%) on the Dow (despite BA falling apart), to 25,900 though that's nothing compared to the S&P 500's 5.5% rise from 2,730 on Friday to 2,825 at yesterday's close.

Are things 5.5% better than they were last Friday? What can you think of that's changed for the better? If you can't think of 3 things – or at least one really good one – you have to question WTF the market is doing…

The Nasdaq was at 6,975 last Friday and this morning we're looking at 7,310, which is up 335 points and that's 4.8% while the Russell bottomed out at 1,520 and is now 1,560 – that's just 2.6% and we can't blame Boeing for that one, can we? And, let's not forget that a 2.5% gain in the Dow still doesn't get us back to where we were at February Expiration Day (15th):

Still, without BA dragging the Dow, we'd be up 5% on the majors and that's a pretty good week though today is Options Expiration Day so it's not over yet. We do have strong-looking Futures at the moment (8:30) and I don't see any news likely to derail things though there was a terrorist attack against 2 New Zealand Mosques where 49 people were killed and dozens more injured by explosions.

Not that the market cares about such things – especially when they happen far away to people we don't know but it should remind us that the World is still a bit unstable and we shouldn't be pricing stocks as if we don't have a care in the World about the future…

Despite our doubts, we can't fight the tape on this one as the indexes are all over their 200 dmas (except the Russell) and we'll probably come down to test them again but, if we pass that test and the Russell gets back over 1,585 and holds that – then we may be looking at a brand new rally.

Still, we haven't found a Top Trade Idea all week and that indicates that bargains are few and far between at the monent. Even in our Long-Term Portfolio Review, we did not find many positions that were still good for a new trade. When opportunities dry up, it's time to start questioning the things you are holding – no matter how good they seem.

Have a great weekend,

– Phil