"How long, how long will I slide?

Separate my side, I don't

I don't believe it's bad

Slit my throat it's all I ever"Turn me on, take me for a hard ride

Burn me out, leave me on the other side

I yell and tell it that it's not my friend

I tear it down, I tear it down

And then it's born again" – RHCP

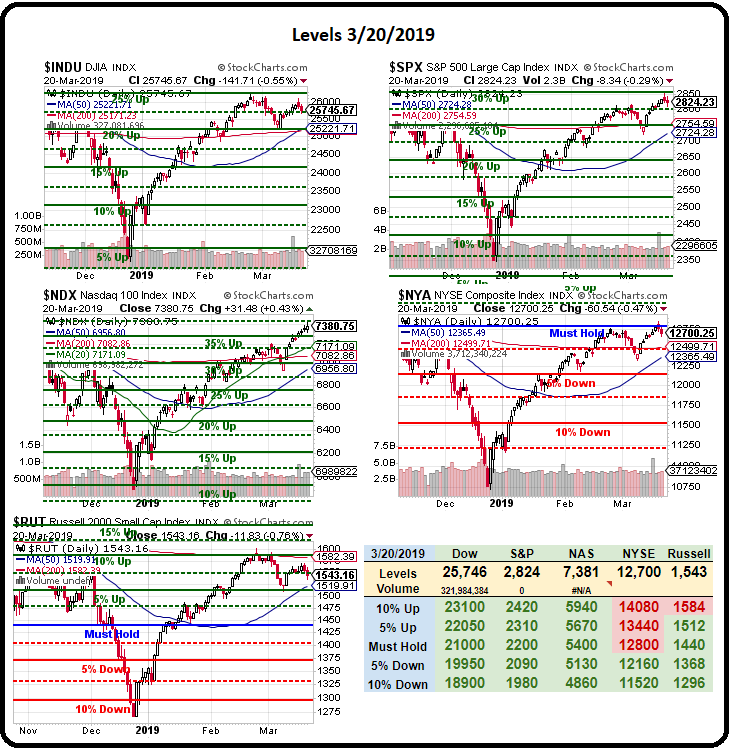

Well, you can see why we remain skeptical with these low-volume rallies as we've now given up 50 S&P points since Tuesday's hign along with a whopping 500 Dow points and now we are testing 2,800 from above on /ES Futures and 25,600 from above on the /YM Futures. During yesterday's Live Trading Webinar, we called for shorting the Russell (/RTY) at 1,560 and that's down 20 points, to 1,540 and that's good for gains of $1,000 per contract but we took a quick $750 and ran into yesterday's close.

We also shorted Gasoline Futures (/RB) at $1.915 and, of course, we always go long on July Coffee Contracts (/KCN19) at $97 and Natural Gas (/NG) is getting to be playable again as a long at $2.80 (with tight stops below) but, since it's close to expiration on April Contracts (6 days), I'd go with /NGK19, which are the May contracts at $2.815 though even a stop at $2.80 would cost $1,500 per contract – so be very careful with those!

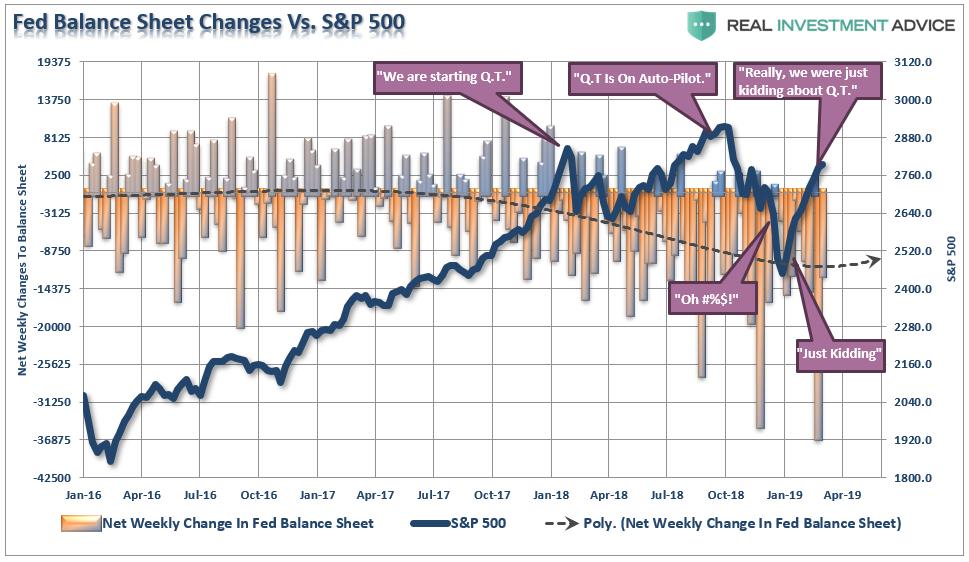

The Fed was very doveish, as expected but what spooked investors in the end was their overall downgrade of the economic picture as Trump's Tax Cuts simply are not boosting the economy and his Trade Wars are hurting it. The Fed keeps dropping subtle hints that such things are our of their hands to fix and their $4Tn balance sheet makes it very difficult for them to add any new programs to boost the economy – the best we can hope for is the status quo.

Even as the Fed winds down to $3.5Tn in bonds in September, where they say they will hold it, that's still 17% of our GDP that the Fed is holding, up from 6% in 2006. That kind of policy is anything but "normal" and monetary policy is extremely stimulative still with the 2.25% Fed Funds Rate just 0.25% ahead of expected (2%) inflation. That's not at all normal – 1.5-2% over inflation is "normal" (implying a 4% FFR).

Even as the Fed winds down to $3.5Tn in bonds in September, where they say they will hold it, that's still 17% of our GDP that the Fed is holding, up from 6% in 2006. That kind of policy is anything but "normal" and monetary policy is extremely stimulative still with the 2.25% Fed Funds Rate just 0.25% ahead of expected (2%) inflation. That's not at all normal – 1.5-2% over inflation is "normal" (implying a 4% FFR).

Underlying forces such as slow-growing populations and diminished investment opportunities continue to weigh on economic growth and inflation around the world. Should the economy stumble again, the Fed won’t have much ammunition with which to respond. By global standards, the U.S. is the lucky one. The European Central Bank never managed to raise its interest rate out of negative territory or shrink its balance sheet. Earlier this month, responding to a slowdown in the European economy, it said it would keep rates below zero through December, longer than originally planned, and offered special, cheap loans to banks for the first time in three years. The Bank of Japan has, similarly, given no sign of raising its target rate from negative territory any time soon.

While our economy is struggling with what are, for the most part, self-inflicted wounds, economies like Switzerland’s, whose Central Bank signaled no change in its negative-rate policies for years to come, are small compared with the U.S. and Eurozone. Still, they are home to major global banks and companies that are sensitive to exchange rates and financial conditions. With financial markets so interconnected, problems in small countries can quickly spread to larger ones. The Swiss National Bank said Thursday that it would keep its policy rate at minus 0.75%, where it has been since January 2015, and reduced its inflation forecast to 0.3% this year and 0.6% in 2020. The SNB cited weaker overseas growth and inflation and “the resulting reduction in expectations regarding policy rates in the major currency areas going forward.” As noted in the WSJ:

Here’s why Fed and ECB decisions matter for countries that don’t use the dollar or euro: Switzerland and countries near the eurozone but not part of it—like Sweden and Denmark—rely on the bloc for much of their exports and imports. That makes growth and inflation highly dependent on the exchange rate. Central-bank stimulus tends to weaken a country’s exchange rate, so when the ECB embraces easy-money policies as it did two weeks ago it tends to weaken the euro against other European currencies such as the Swiss franc. Because the ECB is so large, Switzerland and others can do little to offset it.

“The gravity pull is very strong” from the Fed and ECB, said Sebastien Galy, macro strategist at Nordea Asset Management. “The consequence is [non-euro central banks in Europe] mostly end up importing policy from the ECB, so you end up with housing bubbles and a misallocation of capital.”

So far, there have been few consequences to this dangerous game but capital is, indeed, being misallocated because the rates at which companies borrow money are artificially low and that means their profit outlook and balance sheet health is also questionable and it's very likely that companies would be hit very hard if external factors cause rates to actually reflect the risk of lending (like what happened to Greece very suddenly in 2010, when people finally realized they were cooking the books. Fortunately, we have a President whose much better at cooking the books than the Greeks – so hopefully we won't get caught. How's that for a bullish premise?

We'll see if the markets can bounce back today but failing our lines – especially those 200-day moving averages – would be very, very BAD – so let's hope we can end the week on a positive note but the Russell still hasn't held its 200 dma at 1,582 and that's so bad it's been dragged down 3 more points while we're waiting.

Be careful out there!