And now we are down again.

The Dow started the week at 25,900 and we hit 26,130 on Tuesday but now back to 25,830 this morning so, on the whole, we'll be lucky to finish the week out flat. It's a clearly manipulated, low-volume market and JP Morgan points out that, despite the S&P 500 surging 20% from its December low – almost every catagegory of investors tracked by JPM, from individuals to hedge funds and computer-driven trading, has shown little inclination to chase the rally.

Dwindling liquidity is often dragged into discussions of market meltdowns. In December, for instance, when the S&P 500 plunged toward the brink of a bear market, both President Donald Trump and strategists from Goldman Sachs flagged it as potentially escalating the sell-off. While very dangerous if the market turns negative, JPM says these low-volume conditions could also keep the rally going:

“Given liquidity, it is plausible that just short covering, buybacks, dealers’ gamma hedging, and some limited re-leveraging drove the entire recovery. This, in turn, opens the possibility that the current rally can continue during the spring.”

JPM cites the dramatic reversal in Central Bank policies as putting another floor under the market. While I agree with their premise, I believe it, like most bullish premises, is ignoring the risks of the overall Global slowdown driven by the Trade Wars, Rising Oil Prices and Brexit as well as the dramatic slowdown in Corporate Profits we'll see now that they don't have additional tax breaks and, of course, rising wages will eat into profits as well.

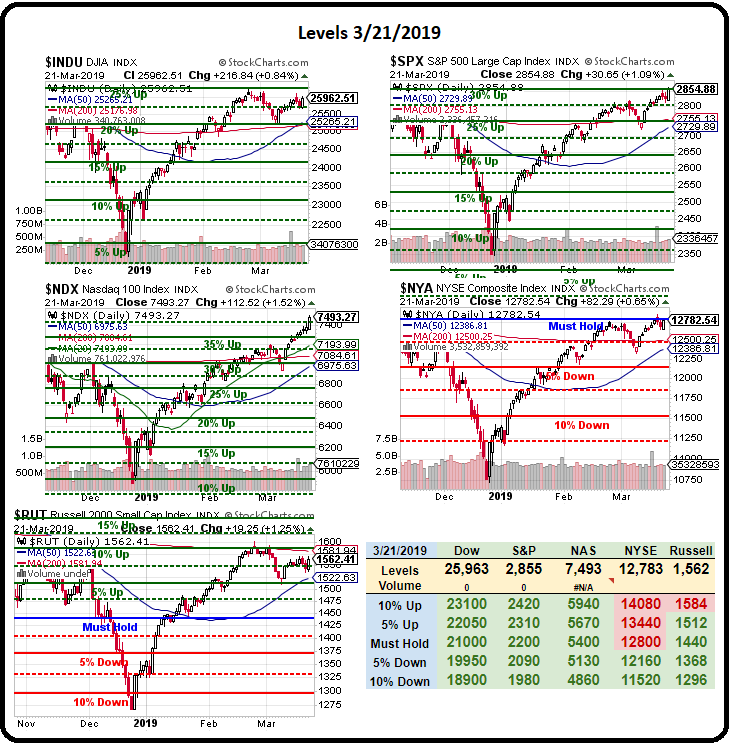

Bullish but cautious is the best description of our stance. As long as we hold those 200-day moving averages, things are fine but I'd sure feel better if the Russell could manage to take back their 200 dma at 1,592 (the bar is lowered every day) it doesn't seem too much to ask, does it?

Bullish but cautious is the best description of our stance. As long as we hold those 200-day moving averages, things are fine but I'd sure feel better if the Russell could manage to take back their 200 dma at 1,592 (the bar is lowered every day) it doesn't seem too much to ask, does it?

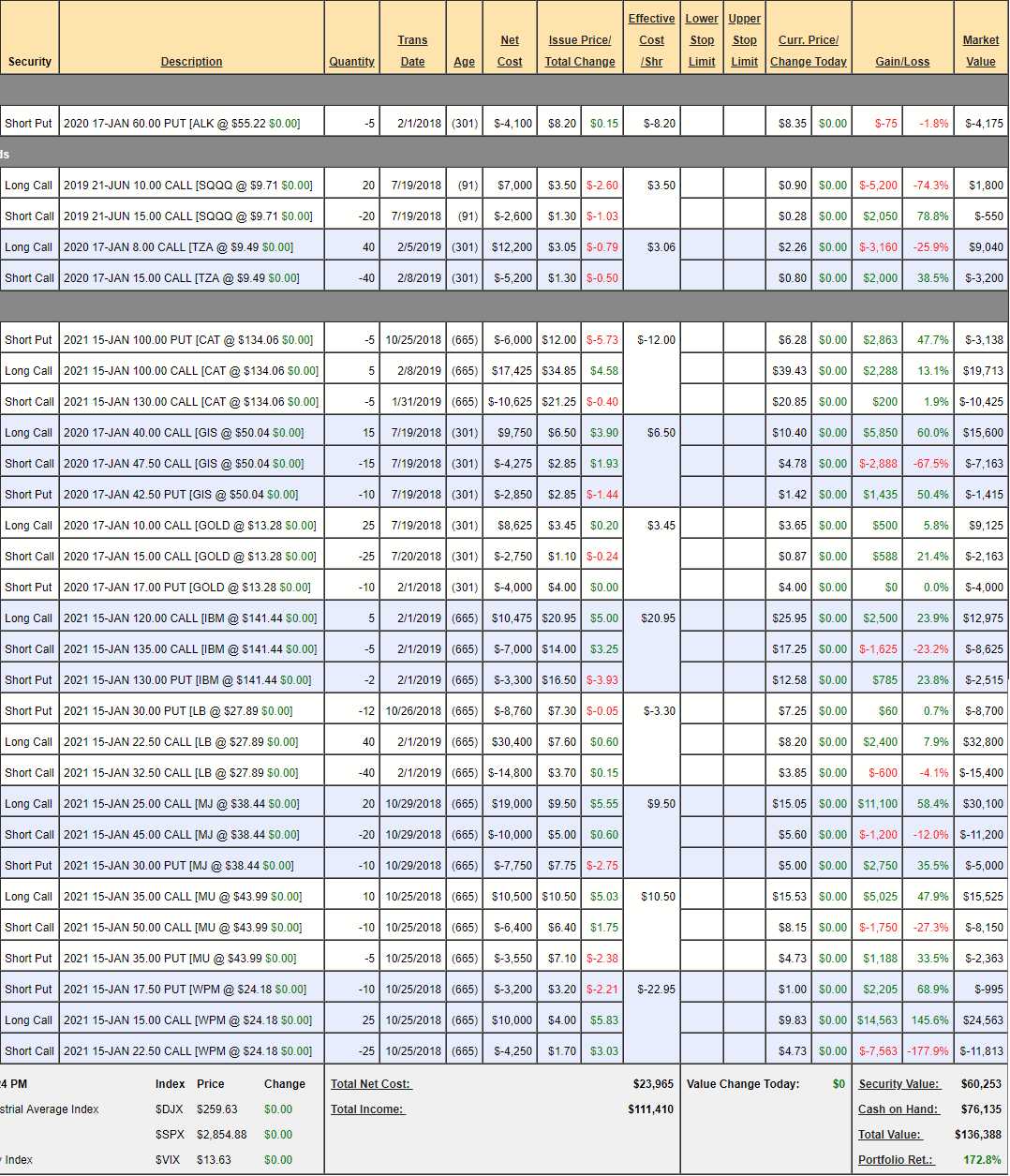

As I noted recently, as long as we're over the 50 dma, they keep on rising and, when they cross over the 200 dma, that will be a very bullish signal – just as the cross below in November was a bearish signal. Meanwhile, we are simply printing money in our Member Portfolios. The Money Talk Portfolio, which we don't touch unless we're doing the show, was just reviewed Tuesday at $130,260 and today, just 3 days later, those exact same positions are at $136,300, that's up 12.3% on our original $50,000 start (9/5/17) and up $6,040 (4.6%) from Tuesday's total.

The Money-Talk Portfolio is a self-contained, very low-touch (once per quarter) portfolio with just 11 positions – a very good starter portfolio that's easy to follow that uses our strategies of "Be the House – NOT the Gambler" and "How to Get Rich Slowly" – though up 172% in 18 months is not very slow! Of course, getting off to a great start in a portfolio means you SHOULD switch to being more cautious going forward as it's more important to lock in exceptional gains than to keep swinging for the fences.

We do have a couple of hedges in the MTP (SQQQ and TZA) but we'll need to expand on those next time we're on the show (probably April). In our more active Member Portfolios, we already made those adjustments last week and, if the market keeps going up, we will continue to spend about 25% of our additional gains on hedges as I'd rather lock in 75% and be sure of keeping it than gain 100% but possibly lose it on a December-like drop.

Meanwhile, we can't take the down moves any more seriously than we take the up moves so we're pretty patiently just waiting out the month of Mach and looking forward to April earnings where, if the Q1 numbers don't push us back under the 200 dmas – we're very likely to be off to the races in May.

Until then, still a bit cautious.

Have a great weekend,

– Phil