Wow, what a rally!

Up 40 points in 3 days on the S&P (/ES) is 1.42% so Everything is Awesome – just like it was before the last crash because it's very dangerous to pin the Awesome Indicator and then something bad comes along and everyone is SHOCKED that things may not be as awesome as they were led to believe.

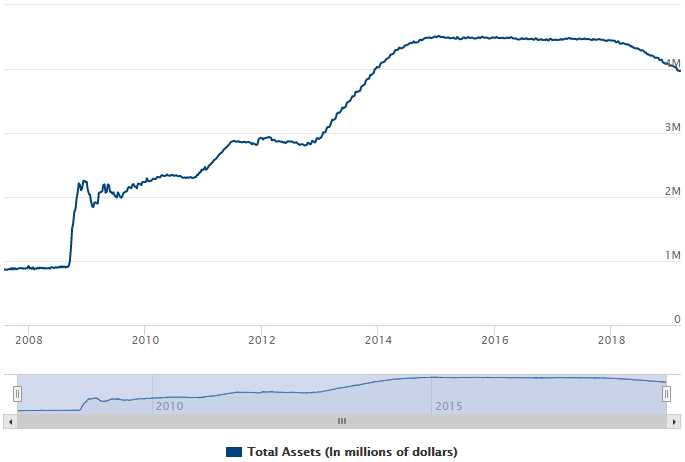

Today we are waiting on the ever-wise Federal Reserve to come up with yet another excuse not to raise rates (the last Jobs Report comes to mind) or unwind their still $4,000,000,000,000 Balance Sheet. Keep in mind that these Fed Fund Rates and this Balance Sheet are at emergency crisis levels and keeping the rates this low and the balance sheet this high means the Fed still thinks we are in an emergency of some sort – no matter what market traders may believe.

All the Fed has done so far is unwind $500Bn (11%) out of $4.5Tn that's on their books – and the market freaked out about that…

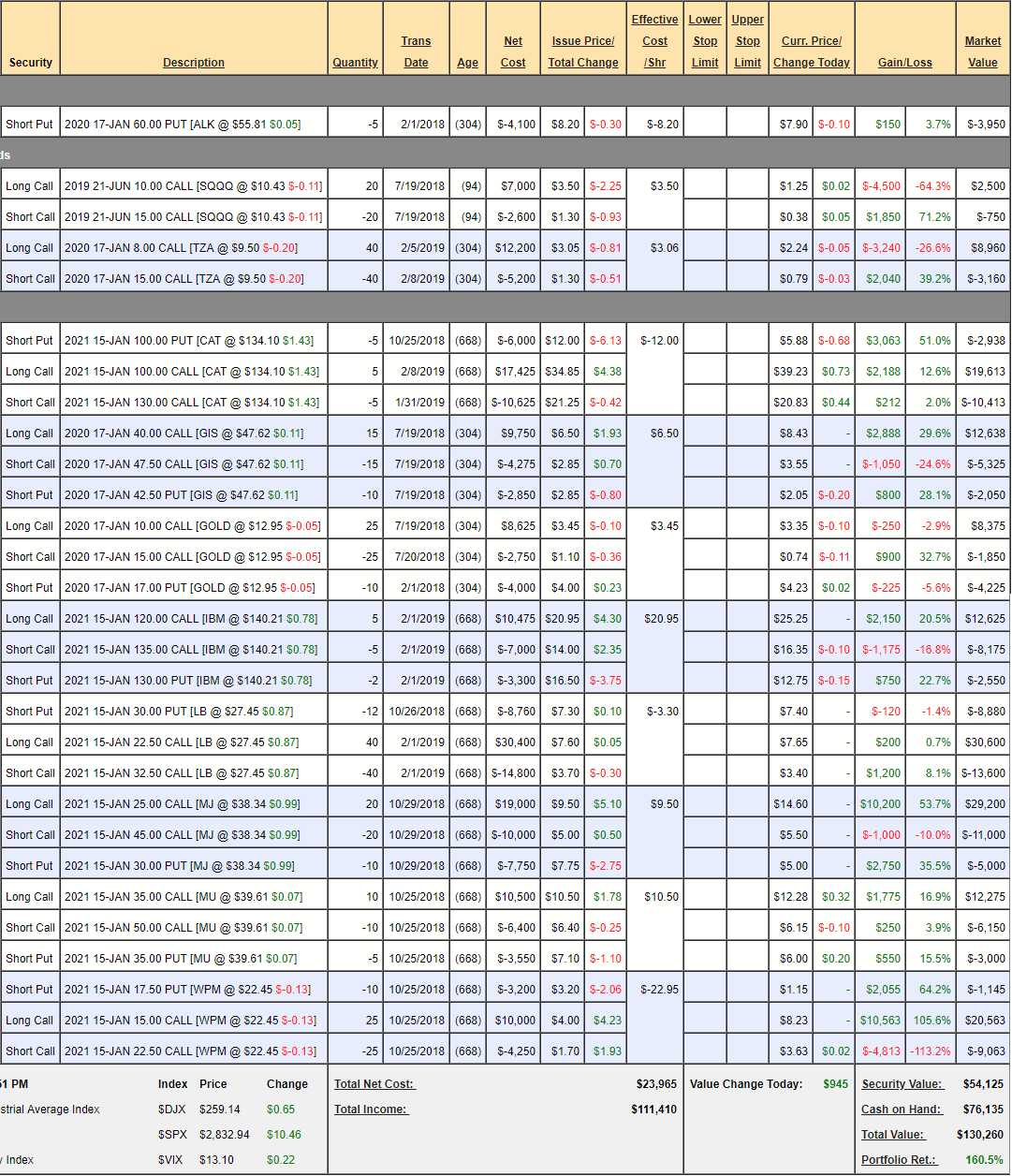

We're not "wrong" in our positioning, just a bit too cautious at the moment, considering the rally. We reviewed our Money Talk Portfolio, which we trade live on BNN's Money Talk, two weeks ago (3/7) as it stood at $125,790 (up 151.6%) and we couldn't change it because we weren't on the show this month but, even left alone, that well-balanced portfolio is now $130,260 (up 160.5%) gaining almost 10% off our $50,000 basis in 12 days while the S&P went from 2,765 to 2,850, which is up 85 points (3%) so we're certainly keeping up with the gains – it's just that we COULD do much better if we were willing to be more aggressive.

The Money Talk Portfolio is hedged and our SQQQ hedge lost $800 and our TZA hedge lost $780 as the rest of the portfolio gained $6,050 but that's exactly how hedges are supposed to work – you give up a little of your upside in order to protect yourself if there's ever a downside – though that doesn't seem possible the way this market has been going.

The "big" news moving the markets this morning is another extension of Brexit and Merkel commenting that she seeks strong relations with the UK, whether they stay or leave. As we've learned the past few years, nothing makes the market happier than kicking the can down the road for some reason.

Speaking of kicking cans – Trump's Budget Proposal puts the country $7.3Tn further into debt over the next decade but it's now being pointed out, even in Murdoch's Wall Street Journal that the budget relies on impossible things just to keep it down to that level – like anticipating $390Bn in revenues from the Affordable Care Act – which Trump is actively trying to repeal. There's also $510Bn in tax INCREASES in Trump's Budget without which, our annual deficit will top $1Tn per year for the foreseeble future. Hard to imagine how the Dollar holds even 95 with this budget.

Of course, Trump wants a weak Dollar as it helps to improve his trade numbers, which have gotten 20% WORSE since he took office. We still have no deal with China and there's not even a high-level meeting scheduled until June – most likely China is now dragging things out so they can deal with the new President in two years or less.

Speaking of less, Bob Mueller has proven to be one of the fastest and most effective Special Counsels in U.S. history, racking up indictments at the fastest pace since Watergate. This video runs through the numerous achievements in the Russia probe (only one of 3 major probes being conducted at the moment) and how despite Trump’s relatively short period in office, the Mueller probe has seen “the highest rate of indictments for his aides than any President EVER.” If it's a Witch Hunt, that's because they are finding A LOT of witches!