At 4am the week turned positive in the Futures.

A bit later, it was announced that Chevron (CVX) was buying Anadarko (APC) for $33Bn AND CVX will spend another $5Bn buying back 2% of their own stock. That's pumping up the energy sector into earnings season as APC is getting a 44% premium to yesterday's close, which is an indicator that the energy sector stocks may be underpriced by quite a bit or it's simply a play to capture Natural Gas assets (/NG), which we are long on.

In our Long-Term Portfolio, we have an aggressive position on Chesapeake (CHK), which we thought was very undervalued at $2.50 and our net $0 position is already up $3,425 but still has plenty of room to grow as it pays $15,000 at $5 so a potential triple from here if all goes well:

| CHK Short Put | 2020 17-JAN 4.00 PUT [CHK @ $3.33 $-0.07] | -50 | 1/8/2018 | (280) | $-6,000 | $1.20 | $-0.18 | $-0.95 | $1.02 | – | $900 | 15.0% | $-5,100 | ||

| CHK Long Call | 2021 15-JAN 2.00 CALL [CHK @ $3.33 $-0.07] | 50 | 2/15/2019 | (644) | $6,000 | $1.20 | $0.51 | $1.71 | $-0.02 | $2,525 | 42.1% | $8,525 |

CHK has 1.5Bn barrels of oil equivalent reserves, 80% of which is /NG, which is the same as APC but you can buy CHK for $5Bn – as long as you are willing to assume their $9Bn in debt but still, $14Bn is a lot less than $33Bn so we are loving our CHK position! CHK is also a position in our Options Opportunity Portfolio – with postions we published over at Seeking Alpha.

| CHK Short Put | 2020 17-JAN 4.00 PUT [CHK @ $3.33 $-0.07] | -25 | 1/8/2018 | (280) | $-3,000 | $1.20 | $-0.18 | $-0.65 | $1.02 | – | $450 | 15.0% | $-2,550 | ||

| CHK Long Call | 2021 15-JAN 1.00 CALL [CHK @ $3.33 $-0.07] | 50 | 12/26/2018 | (644) | $7,450 | $1.49 | $0.91 | $2.40 | $-0.10 | $4,550 | 61.1% | $12,000 | |||

| CHK Short Call | 2021 15-JAN 3.50 CALL [CHK @ $3.33 $-0.07] | -30 | 12/26/2018 | (644) | $-1,950 | $0.65 | $0.34 | $0.99 | $-0.09 | $-1,020 | -52.3% | $-2,970 |

The OOP is a smaller portfolio than the LTP, having started with $100,000 on Jan 2nd, 2018, so we took a more conservative position with a conservative target we've already hit. Still, the cash outlay here was only $2,500 and, at $3.50, it pays us back $6,250 and, as you can see, we've already gained $3,980 though we do have 20 calls uncovered – so we could do better over $3.50.

As a new trade on CHK, I would go with:

- Sell 20 CHK 2020 $4 puts for $1.02 ($2,040)

- Buy 50 CHK 2020 $3 calls for 0.85 ($4,250)

- Sell 50 CHK 2020 $4.50 calls for $0.30 ($1,500)

That nets you into the $7,500 spread for net $710 so $6,970 (956%) upside potential if CHK is over $4.50 in Jan 2021 but, if they get bought sooner, you can collect in full at the close. Because we sold some puts to offset the cost, we risk being assigned 2,000 shares of CHK at $4, which is more than it currently trades for so this is an aggressive play and the ordinary margin requirement on the puts is about $4,000 – so it's still an efficient way to make $6,970 if all goes well.

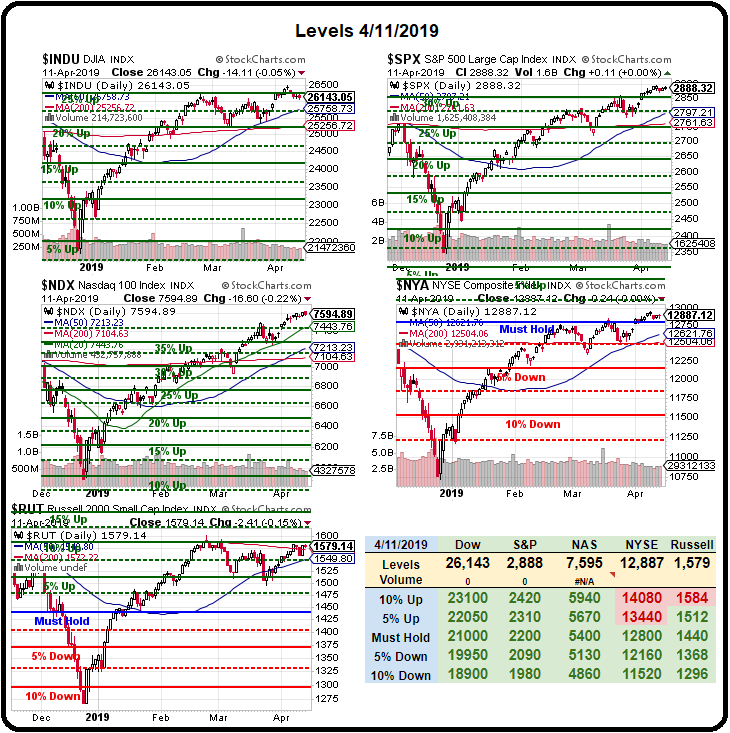

We survived this week's data and we have some bank earnings today and JP Morgan (JPM) already announced a beat and that Dow component is up 2.5% so now Bank Stocks and Energy Stocks are heading higher. I don't think we're out of the woods yet and we'll once again be taking some of our ill-gotten gains and adding more hedges.

1,595 is a good spot to short the Russell (/RTY) Futures but very, very tight stops above 1,600 – as that would be a clear break-out. Yesterday's Silver (/SI) play hit our $14.90 target and popped back to $15, where we took our $500 per contract profit and ran into the weekend! 2,910 on the S&P (/ES) is also a good shorting line.

Last Tuesday (2nd) we went over our hedges in the Morning Report and those trades are cheaper now than they were then but I couldn't sleep over the weekend without them protecting our portfolios.

Have a great weekend,

– Phil