I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

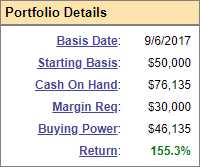

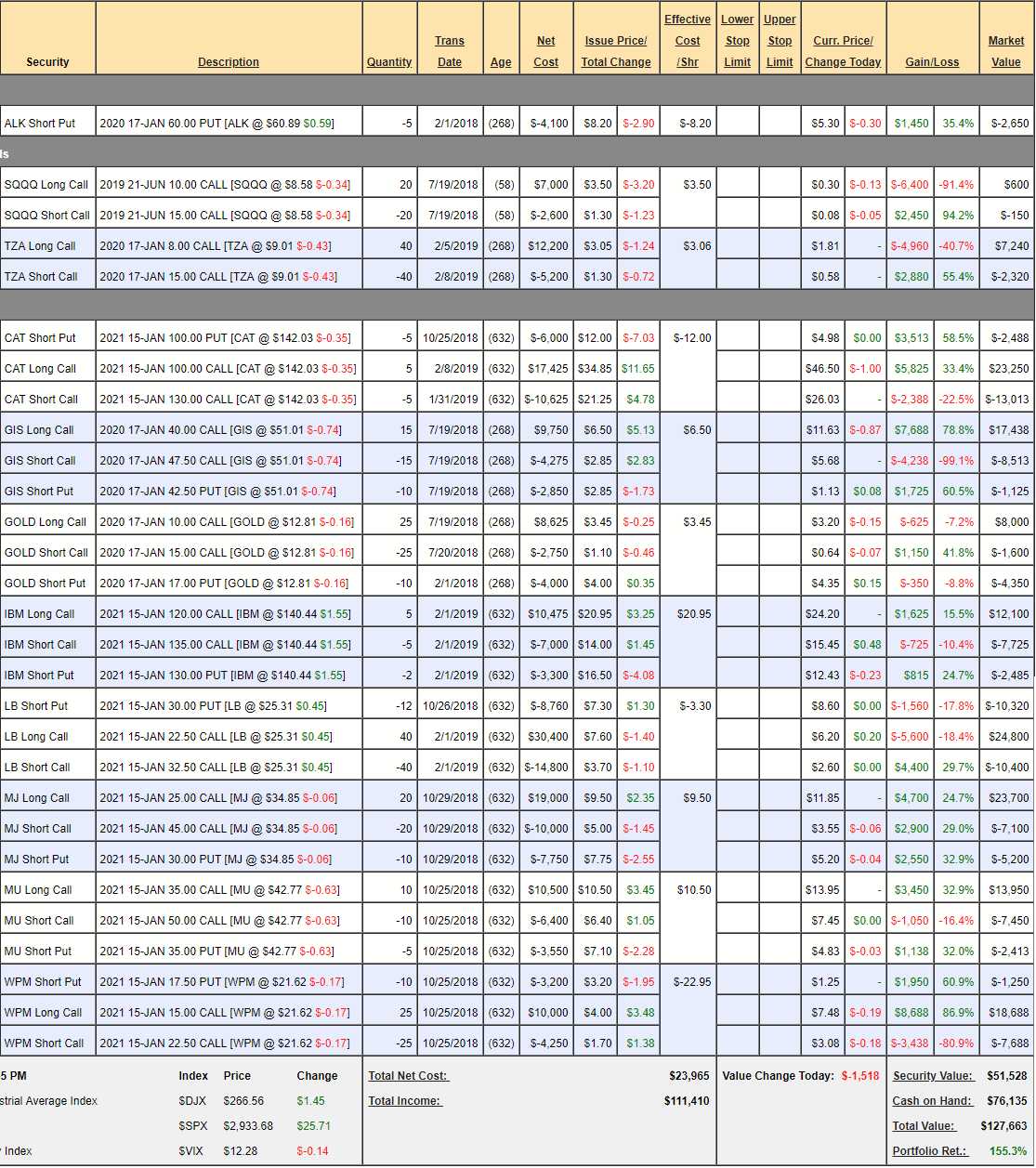

As usual, we will be reviewing our Money Talk Portfolio, which we initiated back on Sept 6th, 2017 to track the trade ideas we would introduce, live on the show, about once each quarter. The idea of the portfolio was to select highly leveraged, high-probability trades that did not have to be adjusted very often (or at all) and, so far, it's been a tremendous success with our initial $50,000 turning into a lovely $127,663 (up 155.3%) at yesterday's close, about 18 months after we got started.

We recently reviewed the MTP back on Feb 15th and, at the time, the portfolio was at $88,922 with, of course, the exact same positions – as I hadn't been on the show since Jan. We did send out an alert (our first ever) to dump GE shortly after that – those alerts go out free of charge on Twitter, Facebook, Seeking Alpha, etc to make sure they were available to all so make sure you follow those feeds. Note that, for each position, we clearly define our expectations and, overall, we expected our positions to make another $76,638 at the time but we've already made another $38,741 (43%) – which is way too fast – so we have to be careful that some of our positions are overbought already.

That's right as FUNDAMENTAL VALUE INVESTORS we believe that stocks – even the ones we like – can be too expensive, as well as too cheap. When they are too cheap, we buy them – when they are too expensive, we sell them. It sounds logical but how many traders actually do it when the time comes?

Now, let's take a fresh look at what we have:

- Alaska Airlines (ALK) – Just a short put that nets us in for $51.80. We're not worried about it. Expect to gain the full $4,100 so $2,650 left to gain.

- Nasdaq Ultra-Short ETF (SQQQ) – A hedge we expect to lose on and so far, so good as we're down about $4,000 with just $450 in value left. Still, we do need hedges so we'll buy back the short June $15 calls at 0.06 ($120). That gives us the flexibility to profit off a Nasdaq dip – if it ever happens. We expect to lose the remaining $600.

- Russell 2000 Ultra-Short ETF (TZA) – This will become our primary hedge as it's still in the money and has more time. TZA is a 3x Ultra-Short so a 20% drop in the Russell should give us a 60% pop in TZA but, starting from $9, that only gets you to $14.40 and that would pay $6.40 per $8 contract so $25,600 worth of protection on this one is accepable as it covers a 20% drop in our portfolio. In a bull market, we expect to lose the remaining $4,920.

- Caterpillar (CAT) – Just had good earnings this morning so we're very confident and the stock is already over our goal. It's a potential $15,000 spread we paid net $800 for and currently the net value is only $7,749 so this trade has another $7,251 left to gain if CAT can hold $130 into Jan 2021. It's still good as a new trade – even if you missed the first $6,949 (868%) worth of gains!

- General Mills (GIS) – Notice we love to buy beaten-down blue chips! This is an $11,250 spread that's well in the money at net $7,800 and I'm confident enough that we'll collect the remaining $3,450 (44% of the current net) that I don't mind leaving this one in play but it's right on the cusp of not being worth it as, clearly, we can do more with $7,800 over 18 months than just 44%.

- Barrick Gold (GOLD) – Gold (the commodity) can't seem to get things going but $1,272 an ounce is still some very healthy profits for GOLD (the company), who pull it out of the ground for under $800 an ounce. This quarter will be worse than last year simply because Gold averaged $1,325 last year in Q1 and more like $1,275 this year so it's likely to be a rocky ride but you can still get into the $12,500 spread for net $2,050 and that makes the upside potential a very nice $10,450 (509%) if GOLD is over $17 (with the aggressive short puts puts) in January. I do NOT think we'll make it on time, however, so I anticipate rolling this spread which means I will not be counting on any profits from it at the moment.

- IBM (IBM) – Is our 2019 Trade of the Year so yes, I am confident we will collect our full $7,500 and the current net is $1,890, so well worth sticking with in anticipation of making another $5,610 (296%) and that's obviously still good for a new trade as who doesn't like making 300% on cash in 18 months off a spread that's starting out 100% in the money, right?

- Limited Brands (LB) – Was our 2018 Trade of the Year along with HBI but this is a re-entry as we cashed the original when they spiked over $35. Now back to $25 we're good for a new trade at net $4,080 on the $40,000 spread so there's $35,920 (880%) upside potential and all we have to do is get back over $32.50 by Jan 2021. I'm pretty confident in that but let's say we strongly expect to make "just" $16,000 on this one at $27.50 and anything else is a bonus.

- Alternative Harvest ETF (MJ) – Lovely name but these are POT companies and we love this sector for 2019 and it already loves us at net $11,400, up $10,150 (912%) from our intial $1,250 cash outlay. At $45, it's a $40,000 spread so there's still $28,600 (250%) left to gain and I'm very confident that an ETF made up of the largest Marijuana Companies in the World can gain another 35% in 18 months so we expect to made the additional $28,600.

- Micron (MU) – They've come back nicely and we're now at net $9,787 out of a potential $15,000 and I have no reason to think we won't collect the additional $5,213 and that's another 53% from here – so worth sticking with.

- Wheaton Precious Metals (WPM) – This was our 2017 Trade of the Year and this one is a triple dip for PSW players and, yet again, it's making us money. Net is now $9,750, which is up $7,200 (282%) from our $2,550 cash outlay but, at $22.50 (and we're almost there), it's an $18,750 spread so another $9,000 (92%) left to gain and I'm super-confident in this one so I'd say good for a new trade – even if you missed the first 282% gains.

So we do have $77,774 that we expect to gain over the next 18 months less $5,520 we expect to lose on our hedges is net $72,254, which would be up another 56.5% from our current $127,663 but we can do much better and we're very confident in our current positions and we do have hedges and we're hardly using any margin (just $30,000) so I guess we should add a couple of additional trades and make some more money, right?

See how easy it is to make these decisions when you know EXACTLY what to expect from your portfolio!

Since we're going to be on BNN in Canada this evening, how about we start with the Bank of Nova Scotia (BNS), who were a Top Trade Idea at PSW on March 20th and haven't gone anywhere since (isn't that great?):

| Year End 31st Oct | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | TTM | 2019E | 2020E | CAGR / Avg | |

| C$m | 21,597 | 23,944 | 24,049 | 26,350 | 27,155 | 28,775 | 29,291 | 31,073 | 33,079 | +5.9% | |

| C$m | 8,347 | 9,300 | 9,066 | 9,398 | 10,276 | 11,106 | 10,805 | +5.9% | |||

| C$m | 6,379 | 7,071 | 7,014 | 7,117 | 8,005 | 8,548 | 8,405 | 8,963 | 9,512 | +6.0% | |

| C$ | 5.11 | 5.67 | 5.67 | 5.77 | 6.49 | 6.82 | 6.67 | +5.9% | |||

| C$ | 5.11 | 5.67 | 5.67 | 5.77 | 6.49 | 6.82 | 6.67 | 7.24 | 7.79 | +5.9% | |

| % | -1.2 | +10.8 | +0.03 | +1.7 | +12.5 | +5.1 | -1.7 | +6.16 | +7.72 | ||

| x | 10.8 | 11.0 | 10.2 | 9.45 | |||||||

| x | 1.75 | 1.79 | 1.32 | 0.81 | |||||||

| Profitability | |||||||||||

What's not to love? $67Bn at $54.50 and they are dropping $8.7Bn to the bottom line while paying a lovely $2.65 (5%) dividend! Apparently, on the Toronto Exchange, they have options out to 2021 so they could even be a good Butterfly play for Canadians but, in the US, options only go out until Dec but still worth it so let's:

- Buy 20 BNS Dec $50 calls for $5.30 ($10,600)

- Sell 20 BNS Dec $55 calls for $2.05 ($4,100)

- Sell 10 BNS Dec $55 puts for $3.00 ($3,000)

That's net $3,500 on the $10,000 spread that's starting out just 0.50 out of the top of the range. It's aggressive as you are obligating to buy 1,000 shares of BNS at $55 ($55,000) and it will use about $11,000 in margin but only through December and we've got plenty sitting around. If all goes well, this trade will return $6,500 (185%) on cash in 8 months.

Our next pick is one that has been baffling to me and that's Natural Gas, which we'll trade through the ETF (UNG). While natural gas production has been skyrocketing, so has consumption, as more and more of it is being shipped out of the country in liquefied form (LNG) and, though demand has so far kept up with supply, we feel that any sort of disruption in demand, which is very common in the fall hurricane season, could quickly escalate prices so we want to construct a play that keeps us in the right place, while we wait for it to be the right time as well.

For the MTP, let's:

- Sell 10 UNG 2021 $20 puts for $2.55 ($2,550)

- Buy 10 UNG 2021 $15 calls for $7.30 ($7,300)

- Sell 10 UNG 2020 $22 calls for $2.10 ($2,100)

The net cash outlay of this $7,000 spread is $2,650 so the upside potential is $4,350 (164%) over the next 20 months but it's really better than that as our longs are Jan, 2021 and the short calls are Jan 2020 so they will expire quicker and, if not deep in the money, we should be able to sell more calls and drop our basis another $2,000+ to almost nothing!

The short puts require just $2,574 in ordinary margin so this is a nice, efficient trade from a margin perspective (returns more than 100% of required margin) and again, we have plenty to spare in this very conservative portfolio.

Notice again how, for every trade, we have a clear plan and clear targets so that, at any given moment, we know if we are on or off track. We KNOW how much we expect to make (now $83,104 with the 2 new trades that are aiming to make $10,850) and we KNOW how much our hedges will make on a 20% market drop ($34,440 at $14.40 on SQQQ and TZA) to offset some of our long losses and that plus our portfolio's $76,135 (60%) CASH position means even a severe downturn is unlikely to hurt us very much.

CONTROL. Control and BALANCE are the keys to successfully managing a portfolio and, if you have those things – you can run a portfolio you only touch once per quarter that still makes market-beating returns. It's not about active investing – it's about KNOWLEDGEABLE INVESTING!

We'll discuss more of this in our Live Trading Webinar today at 1pm, EST and, of course, I'll be on BNN's Money Talk with Kim Parlee at 7pm this evening.

If you want to learn all about how to take control of your portfolio and learn how to invest with total confidence – you can sign up for our Live Member Chat Room over at PhilStockWorld.