A coup!

When's the last time we had a good, old-fashioned coup? There's one going on right now in Venezuela, where Trump-backed opposition leader Juan Guaido has a small, or large (depending who you ask) group of army guys taking on the elected Socialist (Boo! Hiss!!) leader, Nicolas Maduro, who was elected to a 2nd 6-year term a year ago.

“The imperialist U.S. government is directing an operation to impose through a coup a puppet government for its interests,” Mr. Maduro said in a speech from a balcony of the presidential palace. “No one here is surrendering. We’re going to combat until victory.”

Guaido and his troops have apparently taken over part of a highway adjacent to an air base near Caracas, possibly in preparation for landing US or other troops though, of course, it would be completely outrageous for Trump to openly support the overthrow of a democratically elected leader – even if he is a Socialist but, of course – who are we kidding? Do you really think he wouldn't?

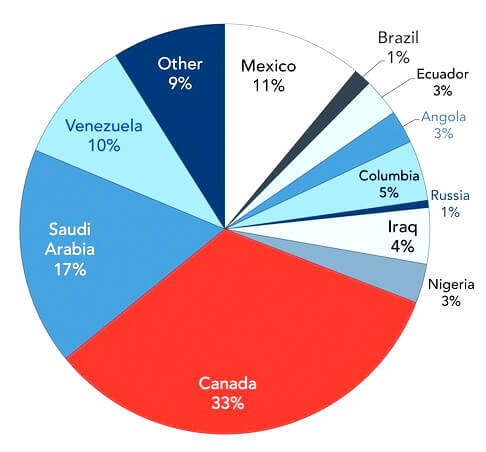

There's a lot at stake here as the US imports 10% of its oil from Venezeula yet it is thought that the country could produce 1-2 Million more barrels per day if the right investments are made but to make the right investments, we need a Capitalist-friendly Government that will allow US-based oil companies (ie. Trump donors) to take over Venezuela's valuable oil assets so – Viva la Revolution!

There's a lot at stake here as the US imports 10% of its oil from Venezeula yet it is thought that the country could produce 1-2 Million more barrels per day if the right investments are made but to make the right investments, we need a Capitalist-friendly Government that will allow US-based oil companies (ie. Trump donors) to take over Venezuela's valuable oil assets so – Viva la Revolution!

Of course, Maduro is no prize and, though he won with 67.8% of the vote, it was only 6.2M out of 32M people voting so very low turnout and very possibly it was a sham election but none of that was proven and it was Henri Falcon who got the 2nd most votes (2M), Guaido wasn't even a candidate!

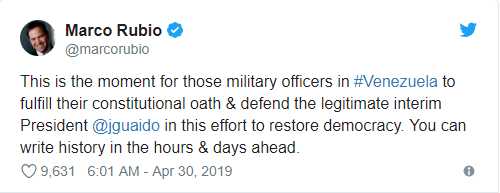

In a REALLY crazy move – even for Republicans, Senator Marco Rubio tweeted out, not just support, but a call to action to overthrow a foreign Government, urging the Venezeulan Military to "fulfill their constitutional oath and defend the legitimate interim President Guaido." I mean – WOW – WTF???

In a REALLY crazy move – even for Republicans, Senator Marco Rubio tweeted out, not just support, but a call to action to overthrow a foreign Government, urging the Venezeulan Military to "fulfill their constitutional oath and defend the legitimate interim President Guaido." I mean – WOW – WTF???

There's a reason the US doesn't do things like this – it leads to global chaos. Can America only be "great" again if we go back to a time when politicians were assassinated and Governments were overthrown on a regular basis? I suppose a World in chaos is great for the carpet-baggers, who swoop in with money and take over the resources of target nations while making Billions in war profits, arming both sides of every conflict. Those were the good old days, right?

Whatever the truth of the matter is, it's certainly chaos and Oil (/CL) is popping back to $65 and, though it's tempting, it can't be shorted ahead of tomorrow's inventory report, which is likely to show a post-holiday draw in inventory. After that, it will be an interesting short but the May holiday weekend will be here soon and that's the start of Summer Driving Season, when demand usually picks up – so we'll have to be very careful about picking our spots.

Meanwhile, we're still waiting on the Fed and watching the earnings reports flood in. Google (GOOG) was a huge disappointment last night and is down about 8% this morning and that's costing the Nasdaq a bit as it's about 10% of the Composite Index's weight. McDonald's (MCD) had great earnings but, up near $200 – it was kind of expected. GE finally had good earnings and they are blasting higher but we got sick of them after the last spin-off and dumped our positions.

Eurozone GDP showed signs of recovering at 0.4% vs 0.2% in Q4, which was up from 0.1% in Q3 so maybe 0.8% in Q2? Either way, it's a lot better than continuing to play dead. China had weak factory data overnight but was bosted back by positive trade talk – so we're back to that moving the markets now. The White House claims a final deal could be worked out this morning, so traders remain optimistic.

Not much else is happening as we're waiting on the Fed.