Is this fun or what?

Is this fun or what?

After being down 500 points in the morning, the Dow almost fully recovered into the close, getting all the way back to 26,400, which was a lovely $2,000 per contract gain on our Futures play from yesterday's Morning Report. Playing a pre-market move like that for a bounce off support – especially when the "news" was a tweet from the President that had no official standing ("the whim of a madman").

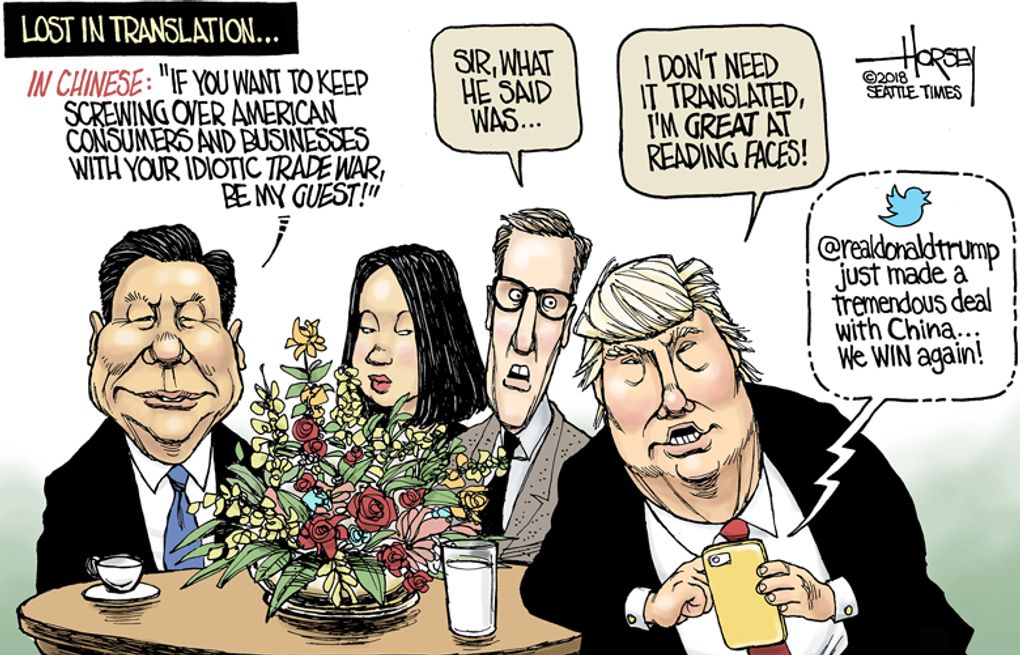

This morning we have Team Trump accusing China of reneging in it's trade commitments, which is an odd thing to say as they are in the middle of negotiating so nothing is actually commited yet. Also, unfortunately, the Trump Administration says many, many things that are not true – so it's kind of hard to take their word over China's – even though they are "on our side". In fact, this past weekend, Trump celebrated his 10,000th false statement since he took office less than 1,000 days ago. Trump has single-handedly created an entire division of fact-checkers, now employed at almost every media outlet and he does keep them busy at over 10 lies per day.

Yesterday's briefing from Lighthizer (the anti-China fanatic) and Mnuchin (withholder of Trump's tax returns), which took place after U.S. markets closed on Monday, made it clear there are deep concerns about the direction of the talks and the Futures tanked again and are still down more than half a point this morning but not so low that we want to go long again.

“The level of brinkmanship on both sides and their obvious mutual distrust has made the path to even a temporary cease-fire a lot murkier than just a few days ago,” said Eswar Prasad, professor of trade policy at Cornell University. “It is likely a cooling-off period will be needed to get the talks back on track, but the imposition of additional tariffs by the U.S. later this week could keep the talks derailed for a while to come.”

“The level of brinkmanship on both sides and their obvious mutual distrust has made the path to even a temporary cease-fire a lot murkier than just a few days ago,” said Eswar Prasad, professor of trade policy at Cornell University. “It is likely a cooling-off period will be needed to get the talks back on track, but the imposition of additional tariffs by the U.S. later this week could keep the talks derailed for a while to come.”

I love the fact that we have actual Ivy League Professors of Trade Policy but they comment from the sidelines while people with no experience whatsoever are in charge of the actual negotiations. You can bet China doesn't pursue such a moronic strategy. In fact, they were scheduled to send their top 100 people to the US to wrap this thing up this week before the Monkey-in-Chief threw his wrench into the process.

You can't run a Government like this. Well, you CAN run a Government like this – that's what they are doing – but it's a clusterf*ck and, stupidly, it's hurting us much more than it's hurting them as US Imports are down just 12% as our Consumers just end up paying more money for the same stuff while our exports (which create jobs) are down 21% over the past year.

Don't get me wrong, market turmoil is fun. We get to make our Futures day trades and, even if we get it wrong, we're just a tweet away from a change in direction.

Speaking of which, front-month Gasoline (/RB) Futures fell to $1.95 this morning and it's sent the July contract (/RBN19) down to $1.92, which is a great floor to play off as it covers two holiday weekend but keep in mind that Gasoline contracts are $420 PER PENNY, so they can be very painful if you get them wrong but we're looking for a pop to $1.95 for over $1,000 per contract in profit and the way I would play this one is to go long one at $1.92 and then double down at $1.90 (if it keeps falling) to average $1.91 on two contracts and then put a stop below $1.90 for about a $1,000 loss but re-enter on any cross back over $1.90.

Aside from the holiday weekends and the start of summer driving season, you have a lot of tension in the Strait of Hurmuz with Iran, which is where 1/3 of the World's oil passes through. So we can cross our fingers and pray for war – won't that be fun? If you are Futures-impaired, you can play the Gasoline ETF (UGA), which is currently at about $31 and we can play it in our Short-Term Portfolio like this:

- Buy 20 UGA July $29 calls for $2.50 ($5,000)

- Sell 20 UGA July $32 calls for $1.40 ($2,800)

- Sell 10 UGA July $32 puts for $2 ($2,000)

That's net $200 on the $6,000 spread so if UGA is over $32 at July expiration (19th) you will make a $5,800 (2,900%) profit. Not bad for less than 3 month's work, right?

See how much fun trading volatile markets can be?