The art of the deal?

The art of the deal?

The best deal Team Trump can hope for this week is to keep the Trade Talks with China from completely collapsing and sending the markets into a tailspin. While you hear idiots on TV saying China is coming to negotiate, Trump has set a midnight TONIGHT deadline on more tariffs and the Chinese response has been to reschedule their arrival from Tuesday to today and I want you to contemplate what unrealistic idiots the TV pundits are when they tell you a guy who just got off a flight all the way from China is going to hit the ground running in order to bend over for Trump and concede on all his points in order to get a deal done by 11:59 tonight.

China's Vice Premier Lui He is landing in DC this morning and is scheduled to have dinner with China-hating Robert Lighthizer this evening but don't be surprised if Lui doesn't even spend the night in Washington because, as Tom Hagen sort of said, "Chairman Xi is a man who insists on hearning bad news immediately."

The die is already cast as Mr. Lui, unlike in previous visits, has not been given the title of "special envoy", which suggests he is no longer empowered to make any trade concessions on behalf of the Chairman. In other words, Xi has already told Trump to shove his tactics and has left no room for negotiation on the contract they sent over to Washington last week so now it's up to Trump to either bend over and accept China's terms or throw a tantrum and penalize Americans with more tariffs.

We're expecting more of a turndown today and a REALLY big sell-off if China leaves with no deal ahead of the weekend though we can expect Team Trump to lie about it and promise things are going great – people are finally catching on to that game and we have to read the Chinese papers to find out the truthy.

Sad.

Powell just made a doveish speech and tanked the Dollar but it's too little, too late as we're selling off hard and fast at the open and that's DESPITE the lower Dollar so NOT GOOD is my summary of the morning action though it is popping our Coffee Futures (/KCZ19) back over $95 and hopefully we'll get another crack to go long Gasoline (/RBN19) at $1.92 as we took an 0.03 ($1,000+) gain and ran yesterday.

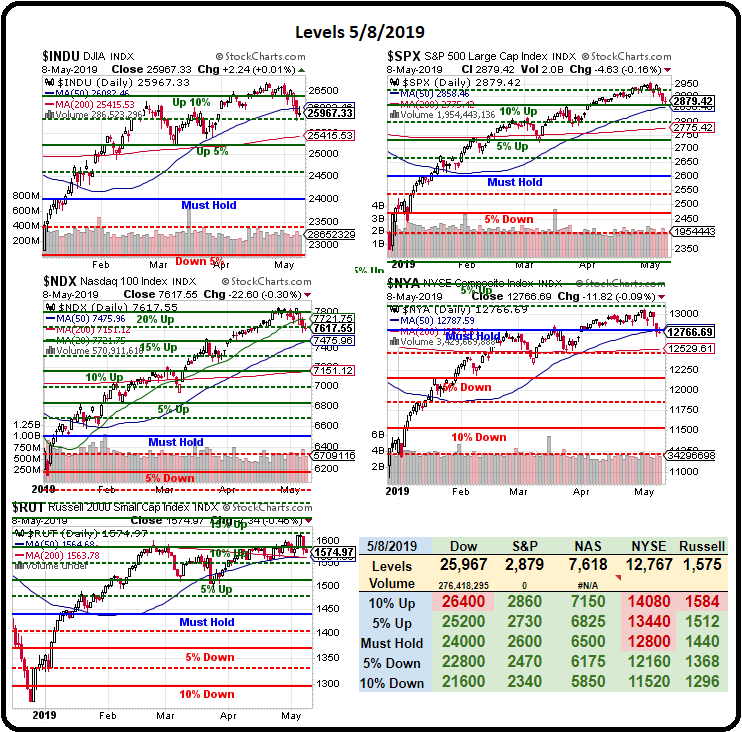

Nasdaq (/NQ) will critically test 7,500 and that should line up with Dow (/YM) 25,600, which was a good long the other day and 2,840 on the S&P (/ES), which is VERY BAD (see yesterday's chart) and the Russell (/RTY) is DOOMED below 1,564, as that's the 50 dma and we're already below the 200 dma at 1,563 and the 200 dma is crossing below the 50 dma and that's called a DEATH CROSS and it means we're all DOOMED!!!!

As you can see from the Big Chart, those dma's are failing all over the place so DOOM!!! is the forecast unless a trade miracle occurs in the next 48 hours. Needless to say we'll be reviewing our hedges this morning to make sure they are protecting us adequately – thank goodness we predicted this or it wouldn't be funny at all!