May has not been kind to the markets.

As you can see from the S&P chart, we're down from 2,950 back to just over 2,800 and it's about a 5% drop (2,802 is exact) and that means, according to the Fabulous 5% Rule™, that we can expect AT LEAST a 30-point bounce to 2,830 but the exact number is 2,832, which is EXACTLY where we are at about 8:30 this morning.

The reason the 5% Rule is so amazing at predicting these levels weeks in advance is that it's not TA, we're merely exploiting the mathematical convergences inherent in bot-trading programs – which dominate trading these days – ESPECIALLY in low-volume markets, like we're having now. In fact, here's the S&P chart we drew on 5/15 – still stuck in the range we expected:

Remember, the 5% Rule can only tell you the range the indexes are likely to track in and we are Philstockworld can only tell you how to profit frtom trading those moves – the rest is up to you.

Speaking of things that were up to you – congratulations to all who stuck it our with us on our Gasoline (/RBN19) trade as we got a nice pop Friday that followed-through into this morning and now we're up over $2,500 on two contracts and we're very happy to lock that in with a tight stop at $1.94 since both Silver (/SI) at $14.30 and Natural Gas (/NGv19) at $2.60 are both back to our buy points as the Dollar pops back to 97.70 so we're happy to switch horses at this spot.

Speaking of things that were up to you – congratulations to all who stuck it our with us on our Gasoline (/RBN19) trade as we got a nice pop Friday that followed-through into this morning and now we're up over $2,500 on two contracts and we're very happy to lock that in with a tight stop at $1.94 since both Silver (/SI) at $14.30 and Natural Gas (/NGv19) at $2.60 are both back to our buy points as the Dollar pops back to 97.70 so we're happy to switch horses at this spot.

Fututres have been all over the place as Trump said yesterday that the US is "not ready" to make a Trade Deal with China. China's Industrial Profits fell in April but that was before the new round of tariffs so it's hard to say if Trump is "winning" or just kicking China while it's down – something the Middle Kingdom will not soon forget. In reality (something the President is not very familiar with), the drop in profits was mainly due to the comparison to high profits a year ago and also to companies trying to take advantage of a tax change on April 1, the NBS said. Companies bought industrial goods in March ahead of the tax cut and then cut back on purchases in April, lowering profits.

There was, however, a bank failure in China this weekend as Mongolia's Baoshang Bank had to be taken over by the Government and that's the first time in 30 years China has had to take such an action.

Since there is no trade deal with China, Trump is pushing for an August trade deal with Japan – so it will look like he's accomplishing something. Keep in mind that we already HAD trade deals with all of these countries – until Trump screwed them up so it's kind of funny to see him crowing about these "accomlishments" when Trump is only partially cleaning up the mess Trump made.

Since there is no trade deal with China, Trump is pushing for an August trade deal with Japan – so it will look like he's accomplishing something. Keep in mind that we already HAD trade deals with all of these countries – until Trump screwed them up so it's kind of funny to see him crowing about these "accomlishments" when Trump is only partially cleaning up the mess Trump made.

Meanwhile, while Trump is closing borders and restricting trade, China is busy pursuing their "Belt and Road" initiative to develop roads, rails and ports connecting China through Southeast Asia, across the Indian Ocean and into Africa and Europe – effectively turning the entire planet into a single trading block – except the US – who were invited to join but, well, Trump…

That's why we aren't going to be able to get China to change just to please Trump. China sees a Western financial system that led the world to the brink of depression with the 2008 financial crisis, and Western Democracies trapped in debilitating political paralysis and Trump is attempting to force them to become more like us – no thanks, they say!

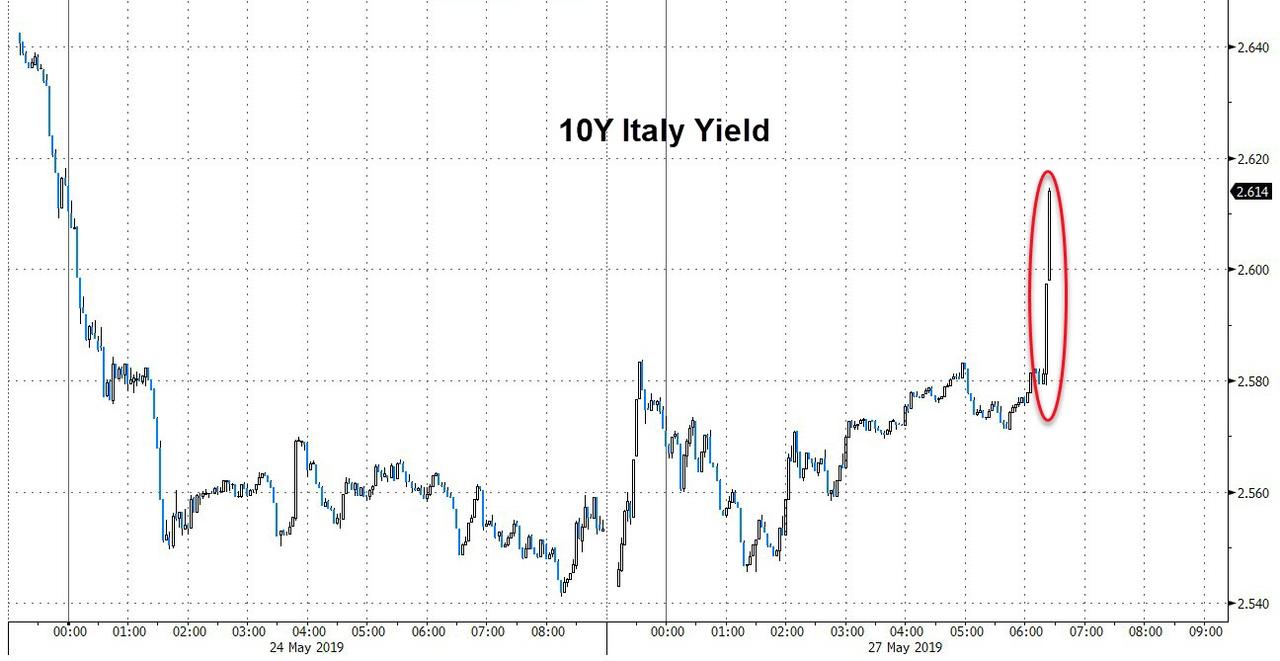

Speaking of screwed-up democracies, Italian bond yields are shooting up today as the EU threatens to fine the country $4Bn for failing to rein in their debt, which seems silly as it only adds more debt they have to rein in… Under EU fiscal rules, the bloc’s members need to keep their deficit below 3% of GDP and debt under 60% of GDP. Countries with debt that exceeds that level need to be reducing it at a satisfactory pace. At 132% of output, Italy’s debt is more than twice the EU limit, and, according to the bloc’s executive arm, not falling fast enough.

Speaking of screwed-up democracies, Italian bond yields are shooting up today as the EU threatens to fine the country $4Bn for failing to rein in their debt, which seems silly as it only adds more debt they have to rein in… Under EU fiscal rules, the bloc’s members need to keep their deficit below 3% of GDP and debt under 60% of GDP. Countries with debt that exceeds that level need to be reducing it at a satisfactory pace. At 132% of output, Italy’s debt is more than twice the EU limit, and, according to the bloc’s executive arm, not falling fast enough.

While 2.6% is not Greece yet, this is not something that's going to go away any time soon as 132% of GDP in debt is clearly unsustainable. Thank goodnees the US only has $21Tn in debt and our GDP is $19.5Tn so that's only 107% of our GDP but we'll be at 130% if Trump's budget stays in place through 2024 – both of which are terrifying thoughts!

Meanwhile, the ECB has it's own problems as their balance sheet is now 40% of the GDP of the entire Eurozone (45% if the UK leaves) and that's even crazier than our own Fed, with $4.5Tn out of $19.5Tn (25%) yet the ECB keeps buying those bonds to keep the rates as low as possible or the debtor nations, like Italy, would simply blow up.

The bottom line is no one is bidding on EU bonds at these prices and the US auctions are deteriorating as well and that is going to be quite a crisis if it becomes a trend so keep an eye on those bonds – they were the canary in the coal mine in 2007 and 2008 and those who ignored those signs found our just how far down the shaft your portfolio can fall when people lose faith in the bond market.