Hope reigns eternal.

Hope reigns eternal.

Today we'll see how well the Non-Farm Payroll Report goes at 8:30 but we're up another quarter-point at the moment (7:30) in anticipation of a strong report, led by Government hiring for the 2020 census. Even with the extra workers, only 180,000 jobs are expected so it's going to be an easy upside surprise and wages are expected to be up at a 3.2% annualized pace with, of course, no sign of inflation – that the Fed can see, anyway…

On the right is the ShadowStats chart of REAL Inflation, which is pegging near 10% using a consistent methodology since 1980 – before the Government began tweaking the measurments to make sure the Data was no longer able to show inflation. In essence, what the Government has done is like measuring the temperature in Celcius instead of Farenheit in order to show you how they have cooled off the planet because they didn't bother changing the units on the chart – it's a huge scam and it's getting more and more out of control as the lies get bigger and bigger to cover it up. As noted by ShadowStats:

Consumer Price Index Has Been Reconfigured Since Early-1980s

So As to Understate Inflation versus Common Experience

- CPI no longer measures the cost of maintaining a constant standard of living.

- CPI no longer measures full inflation for out-of-pocket expenditures.

- With the misused cover of academic theory, politicians forced significant underreporting of official inflation, so as to cut annual cost-of-living adjustments to Social Security, etc.

- Politicians look to expand further the concept of artificially-suppressed cost-of-living adjustments in current budget-deficit negotiations, through the use of the Chained-CPI.

- Use of the CPI to adjust retirement benefits, private income or to set investment goals impairs the ability of retirees, income earners and investors to stay ahead of inflation.

- Understated inflation used in estimating inflation-adjusted growth has created the illusion of recovery in reported GDP.

So the GDP is measured against inflation and, if you pretend there's no inflation you can then attribute all price increases to growth in your GDP while telling retirees and wage-earners that there's no inflation so they don't need more money to live in a $20Tn economy than they did in a $10Tn economy. See how the scam works? It's not just wonky fun for Economists, real people are being hurt by this charade every day!

So the GDP is measured against inflation and, if you pretend there's no inflation you can then attribute all price increases to growth in your GDP while telling retirees and wage-earners that there's no inflation so they don't need more money to live in a $20Tn economy than they did in a $10Tn economy. See how the scam works? It's not just wonky fun for Economists, real people are being hurt by this charade every day!

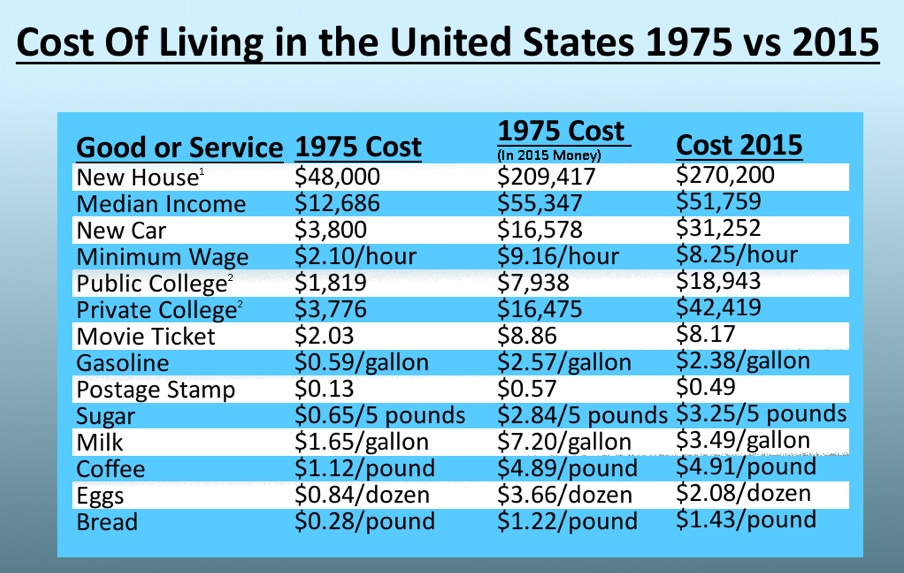

I know this seems extreme and crazy and you may think "why would we not know about this" but it's like those frogs that sit still in water as it's brought to a boil – over 30 years, it's very hard to see what is happening to you as every year you adjust your expectations a little bit lower and put up with a bit more crap until it's just what you are used to. Do you really think things have NOT gone up 4-5 times, as ShadowStats suggests? Let's look at some things we know are true:

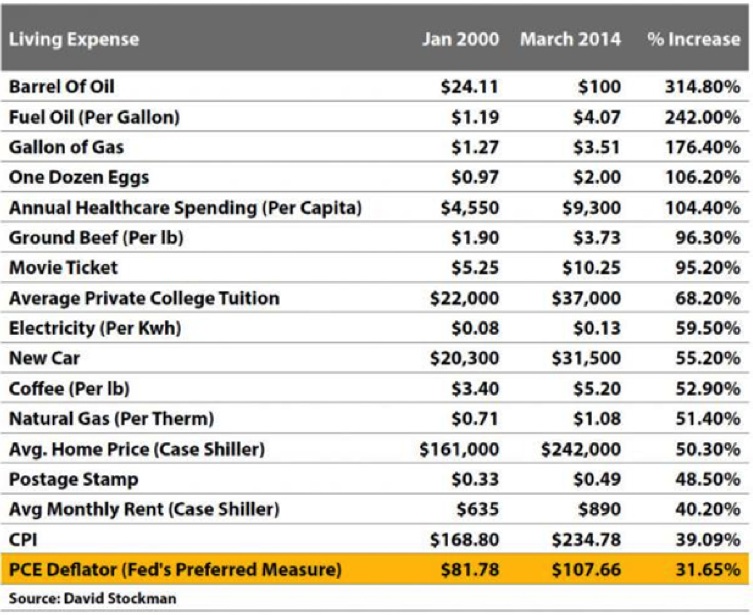

I think stamps are a good, minimum benchmark as they reflect the cost of running the post office with all those employees and trucks and buildings, etc. and they are only allowed to break-even so profit isn't a part of the change. As noted in Chart 2, stamps jumped 48.5% just since 2000 and now they are 0.55 – up another 12% in the last 4 years. Since 1975 (that's the last year they did big surveys) a stamp is up 0.42 or 323% – a lot closer to ShadowStats than the Government's oficial figure.

Even if you are losing just 1% of buying power compared to the official CPI each year, it means you have 50% less buying power than you did in 1969, when we were happy and free and thought one Million Dollars would make us very, very rich:

Peace and love – what were we thinking???

8:30 Update: Only 75,000 jobs! Not only that but April has been revised down by 39,000 jobs and March has been revised down by 36,000 jobs so we've also been lied to for the past two months and that makes the net of this month ZERO jobs as 39 and 36 revised down add up to exactly the 75,000 that have been created. The only reason the market isn't tanking immediately is because the Dollar is diving 0.5% and holding it up. 25,800 is a good short on the Dow (/YM) and 2,850 in the S&P (/ES) and 7,300 on the Nasdaq (/NQ) and 1,510 on the Russell (/RTY).

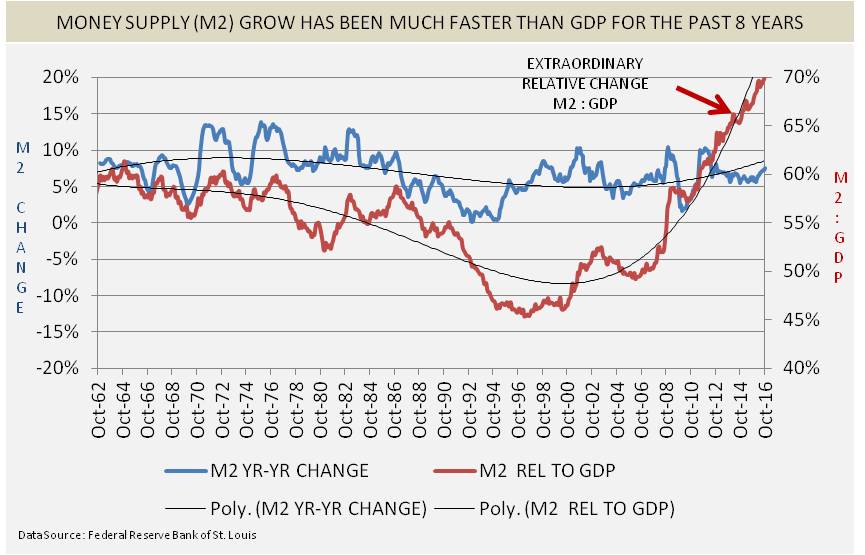

When the Dollar stops falling (probably 96.50), the bounce will hit the indexes harshly and we should get a snap down but keep very tight stops on any shorts as weak job growth and low wage growth (0.2%) can put the Fed back on the table for some more QE and, after all, isn't that what really drives our economy? Why create jobs when we can just print more money, right?

See, as long as we keep creating Trillions and Trillions of Dollars and giving them to rich people, they will be able to buy stocks and get richer and richer and richer and that wealth will then trickle down and make us all rich – it's the perfect plan that's been working since Reagan proposed it back in the 70s which George Bush Sr. called "Voodoo Economics" but is now called the Official Policy of the United States and its Central Bank.

See, as long as we keep creating Trillions and Trillions of Dollars and giving them to rich people, they will be able to buy stocks and get richer and richer and richer and that wealth will then trickle down and make us all rich – it's the perfect plan that's been working since Reagan proposed it back in the 70s which George Bush Sr. called "Voodoo Economics" but is now called the Official Policy of the United States and its Central Bank.

All those Trillions of Dollars do raise the price of the things you buy – especially if they are things rich people also buy like cars (up 722% in 50 years), homes (up 462%) or college (up 1,023%). Those are not things our government weighs heavily in their measurments as they concentrate on things like toothpaste and toilet paper – that we all use every day but a rich person doesn't brush their teeth 5 times more often than a poor person but they can buy 5 houses and 5 cars and send 5 kids to Ivy League Colleges. Poor people – not so much…

As we go into the weekend, Mexico is trying to stave off tariffs but it's foolish as this isn't about them or meeting Trump's insane demands. Like China, Trump does not care about getting a deal done, he just wants to put an additional $75Bn tax on the American people since he's gotten very little blowback from the $125Bn tax he's placed on Chinese products – mostly because he keeps saying, over and over again, that "China is paying for it" and the Billionaire-owned media never challenge him on it and the average Americans seem to have their brains thoroughly washed via repetition.

This gives Trump $200Bn to dole out to his friends and supporters (many of which are in his own family, by coincidence) and he's certainly not looking to cut off that gravy train of off-budget income. What Dictator would?

Have a great weekend,

– Phil