All is well, again.

All is well, again.

How many times are we going to fall for this BS? Turns out Trump had already gotten concessions out of Mexico months ago and his "demands" for border security has already been agreed to so there were never going to be any tariffs on Mexico – it was just Trump stomping his feet and beating his chest in order to look like he actually accopmplished something – as well as to distract us from all the crimes he's about to be indicted for.

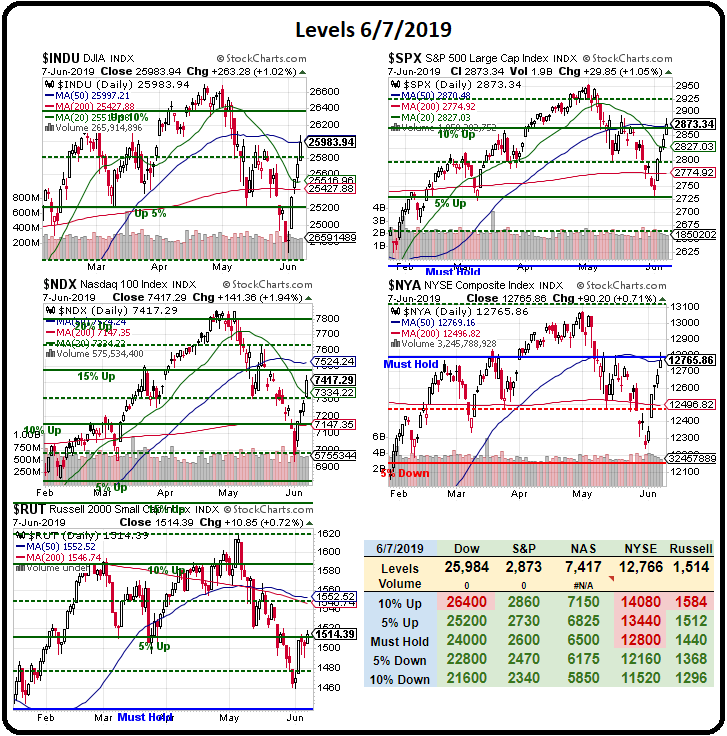

The Futures are up another 100+ points this morning and we're just 500 points away from a full recover – back to our record highs after a 1,000-point drop in May – and it's only June 10th.

The Russell (/RTY) is lagging in the recovery and can be played long over the 1,520 line but with tight stops below because NOTHING actually happened since the Russell was at 1,620 ($5,000 per contract higher than 1,520) – except the fact that the President has once again shows how completely unstable he is and THAT remains a bit of a concern to me – and it should to anyone who has money at risk in the markets.

We completely ignored last week's TERRIBLE Non-Farm Payroll Report and the downward adjustments to the last two reports and the ecitement over possible Fed Rate Cuts was over statements the Fed made that assumed we were placing tariffs against Mexico that would crash the economy – that's now off the table because the Fed, like us, made the mistake of believing something Trump said he would do (10,796 lies in 869 days so far).

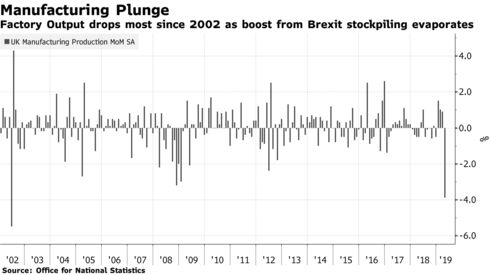

UK Manufacturing Output fell 3.9% in April and that is a REAL thing that actually happened. GDP fell 0.4% in April and puts the entire quarter on track for a 0.3% recessionary drop – adjusted from +0.5% expected just two months ago. These numbers may be skewed by the original Brexit deadline of March 29th, which may have pushed a lot of production and orders into Q1 – ahead of that deadline.

UK Manufacturing Output fell 3.9% in April and that is a REAL thing that actually happened. GDP fell 0.4% in April and puts the entire quarter on track for a 0.3% recessionary drop – adjusted from +0.5% expected just two months ago. These numbers may be skewed by the original Brexit deadline of March 29th, which may have pushed a lot of production and orders into Q1 – ahead of that deadline.

Unfortuantaly, we won't know the truth until next month, when we'll see if there's a trend but Construction in the UK also fell 0.4%, Industrial Production dropped 2.7% and Trade Volume dropped 10.9% on Exports and 14.4% on Imports, which is an all-time record decline. Transportation Equipment Production fell 13.4% as well so, if it is a trend – it's a very quick line to total disaster at this pace.

My new favorite candidate for 2020 is now Andrew Yang, who hit all of my economic talking points this weekend on Real Time with Bill Maher – I'd ask to write for his campaign but, really, it sounds like he's already got me and he does a great job explaining where jobs are really going (automation) and what to do about it (universal basic income):

Stimulus needs to go to people on the bottom where it can trickle UP to the Top 1% – they end up with all the money anyway – this way the bottom 90% at least get to play with it first! He's even talking about paying for it with my VAT Tax though I wish he'd go harder after Corporations to pay their fair share of taxes. Maybe he can team up with Liz Warren and make a dream ticket?

Fox news is already attacking Joe Biden's health – even though the claims are completely baseless. It's the same tactic they used on Hillary – calling her health into question and saying she had a very bad flu and then saying she had brain damage from falling – even though she mopped the floor with Trump in the debates. It doesn't matter if your propaganda is true – as long as you repeat it often enough with conviction, you will be able to get weak-minded people to believe it.

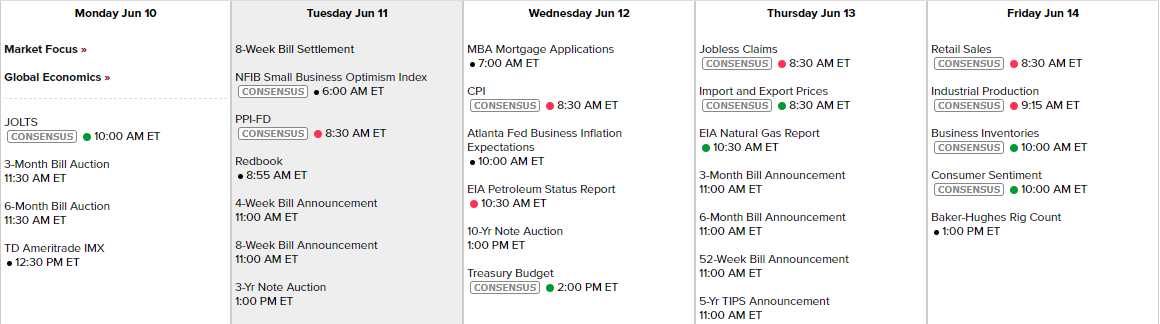

Speaking of the influencers of weak-minded people – there is not one Fed Speaker this week because they have a meeting next Wednesday and it's considered a "quiet period" ahead of the meeting, which they are sticking to for a change. Data-wise, it's a dull week as well with PPI and Small Business Optimism tomorrow, CPI, the Atlanta Fed and a 10-year auction Wednesday, Import/Export Prices Thursday and Retail Sales, Industrial Production and Consumer Sentiment on Friday:

We also have the G20 Meeting coming up at the end of the Month, so of course the believers think Trump will "win" his trade deal with China and that's adding fuel to the bullish fire, as is a $120Bn merger deal between United Technologies (UTX) and Raytheon (RTN), creating an even bigger military powerhouse and consolidating their lobbying efforts to really drive up the Defense Budget Trump said he would get under control but is, instead, up 15% since he took office – and that's without an official war!

We're well over all our bounce lines now so we can't make any bearish bets but what the Nasdaq 100 (/NQ) for a possible rejection at 7,500 and, of course, 2,900 on the S&P (/ES) and 26,200 on the Dow (/YM) also seems to get rejected a lot but we should still squeeze out a quick 15 points on the Russell (/RTY) at 1,535 before that happens and +$750 per contract is a great way to start the week off.

Be careful out there.