The Dow is up 250 points pre-market.

The Dow is up 250 points pre-market.

That's after bursting over 100 points higher in the last 30 minutes of Friday's session. Overall, it's a very low-volume rally, mostly short covering (we will be covering some shorts ourselves) as Trump met with Xi at the G20 and he decided Huawei isn't spying on us after all (despite slandering them all over the world) and that Trump will not put tariffs on another $300Bn worth of Chinese goods but he is keeping the tariffs already in place. Keep in mind this is all to arrive at an eventual deal that is not likely to be substantially different than the deal he broke last year – so why all the celebration?

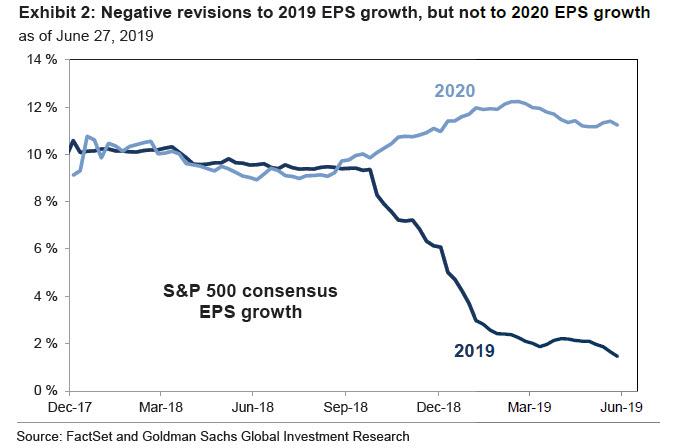

As you can see from the chart above, earnings haven't grown at all this year and it's been Valuation Expansion or Multiple Expansion that's accouted for 90% of the move in the S&P 500 for the first 6 months. Very simply, we are paying much more for the same earnings as last year. Granted a lot of companies did us "China" to excuse their shortfalls and we can imagine, with the Trade War hopefully winding down, that we'll get some real growth but that doesn't mean we're not paying too much for the growth we do get.

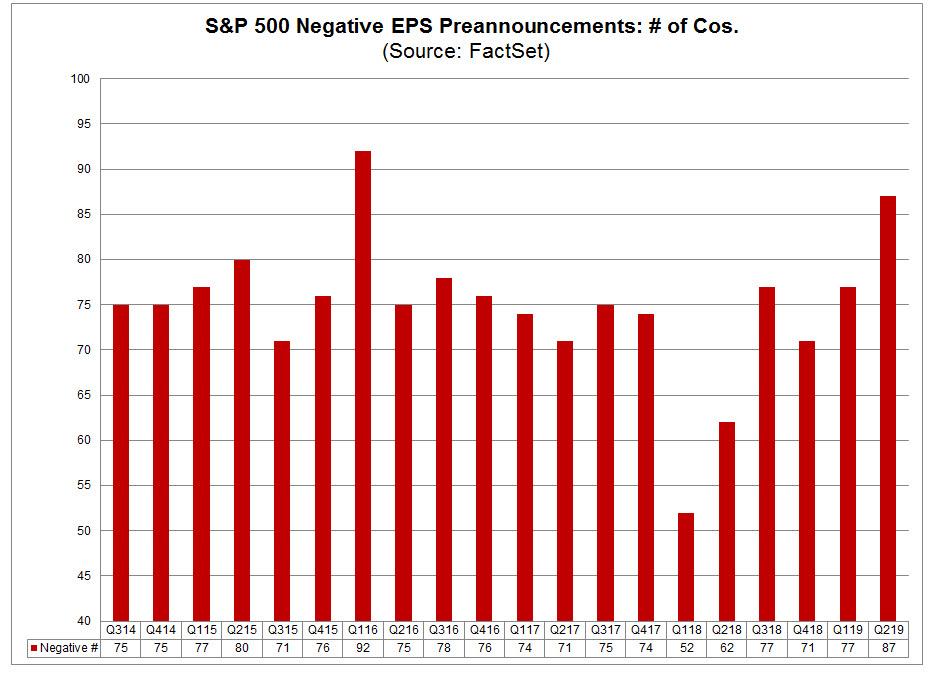

Notice that 87 S&P 500 companies have already pre-announced negative guidance for Q2 and, when we get back from the Holiday weekend next Monday, we'll begin to see those Q2 earnings reports. So, while we hedged heavily into the weekend – just in case the G20 went badly – we will be using those hedges into Q2 earnings season, albeit less aggressively as we sell some covers as well.

Notice that 87 S&P 500 companies have already pre-announced negative guidance for Q2 and, when we get back from the Holiday weekend next Monday, we'll begin to see those Q2 earnings reports. So, while we hedged heavily into the weekend – just in case the G20 went badly – we will be using those hedges into Q2 earnings season, albeit less aggressively as we sell some covers as well.

We know the Fed is certainly in no hurry to raise rates, so that's a big plus for the market but I'm not so sure the Fed is looking to lower rates as we are no in the 121st month of a market expansion – the longest in history (and 104 (86%) months of it came before Trump was President – in case you are wondering).

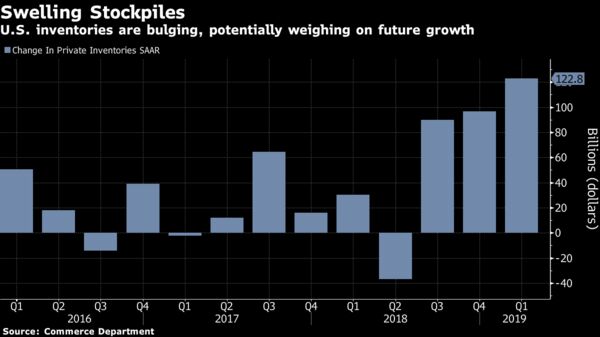

Nonetheless, Economists surveyed by Bloomberg see a 30% chance of recession over the next 12 months and growth has already been slowing as the stilulative effect of the tax cuts begin to fade. Resolved or not (and it will take 3-6 months to finally resolve trade at best speed) the varios trade spats have left a massive build-up of inventory and that will also be a drag on the economy for months to come.

Business Investment has slowed, Construction has disappointed so it's up to the very indebted US Consumers to carry the ball going forward and that puts pressure on Friday's jobs number as we already seem to have forgotten that last month, the May Jobs Report had just 75,000 jobs added and we get the June Report on Friday – interrupting our Holiday Weekend (markets are closed Thursday and no one will show up Friday).

Of course, too high jobs numbers puts pressure on the Fed to raise rates so we don't want too many jobs created in June – just not so pathetic as 75,000…

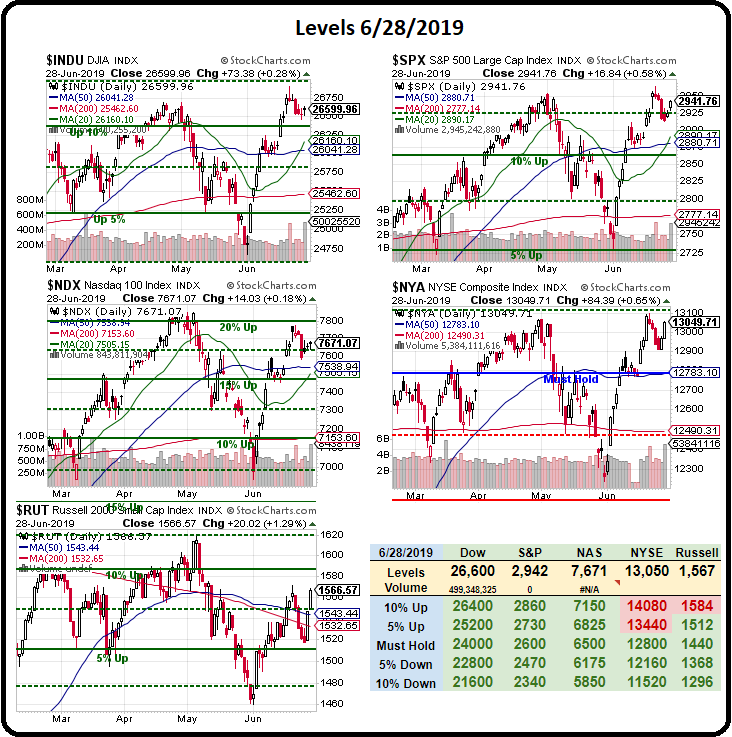

Today is going to be spikey as the skeptics get squeezed by the Trade Talks but what really matters is do we get back to our record highs and, while 2,980 is a new record for the S&P 500, we need to see 26,900 on the Dow, 7,852 on the Nasdaq 100 and 1,620 on the Russell – that's the sign we're waiting for to call this more than just another Trade Relief Rally – those we have every other week.