2,982.

2,982.

That's where the S&P 500 crested yesterday and now we're back to 2,965 this morning after falling to 2,855 yesterday afternoon. We're so close to 3,000 that is makes no sense at all to be bullish into the holiday weekend as S&P 3,000 is going to be a tough line to cross as it's up 2,334 points (350%) from the March 2nd, 2009 low of 666.

Clearly companies are not making 350% more money than they did in 2009 but that's a false benchmark because the stocks were clearly UNDERvalued at the time and 666 was stupidly cheap for the S&P 500 but S&P 3,000 is still going to cause people to question valuations and, as I noted in yesterday's Report, Corporate Profits are very unlikely to justify these record highs and we begin to see those results on July 15th, as Q2 earnings begin coming in volume.

The run to 3,000 has come off our most recent consolidation at 2,400 and before that 2,000 and there's nothing wrong with moving up 20% (400 points) between 2015 and mid-2017 – that's pretty normal for 2.5 years but, just 2 years after that, we're up 600 more points and that's probably a bit much. We WERE having healthy consolidation around the 2,800 mark in 2018, when S&P 500 companies combined for $134.95 per share, giving the S&P 500 a Price/Earnings Ratio of 17.78 at 2,400. For Q1 of this year, we are pacing at $135.73, just a 0.5% improvement but, as we close in on 3,000 on the S&P, that's up 25% – and the P/E Multiple at 3,000 is 22.10 and that's up 24.3% – see the pattern?

I know it may not seem like it when you have a runaway market and it's easy to say that Fundamentals don't matter but they do to the people who aren't trading every day. The silent majority of traders are the buy and hold fund managers who hold stocks in long-term portfolios and have no reason to sell them when they S&P 500 goes up 350% in 10 years (13% annual compounded gains) but God help us all if they do decide to sell because S&P volume is not even 1/4 of what it was before the crash – so what will happen when a lot of people try to sell and find out there are no buyers for that kind of volume? That is the real danger in this kind of sustained, low-volume rally.

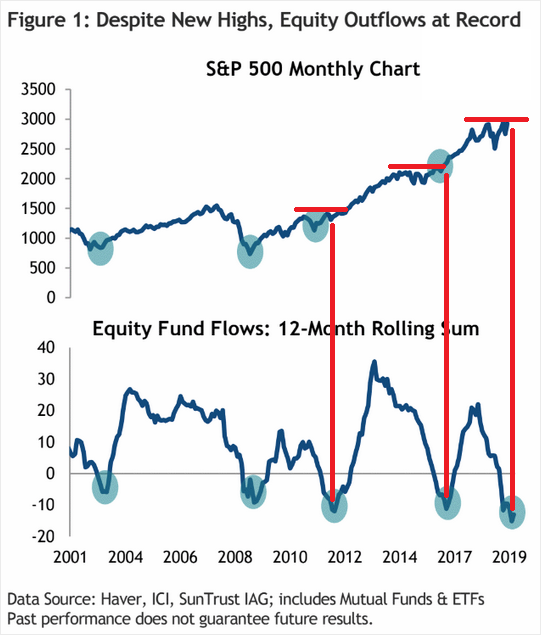

As StJeanLuc noted in our Live Member Chat Room yesterday, funds have been cashing in on this market for more than a year – at an even faster pace than they did in 2007/2008 but the Trump Administration and the Cheerleading Financial Media have done a great job of luring new suckers in to keep the plates spinning for another quarter, and another, and another. Will we ever run out of suckers?

As StJeanLuc noted in our Live Member Chat Room yesterday, funds have been cashing in on this market for more than a year – at an even faster pace than they did in 2007/2008 but the Trump Administration and the Cheerleading Financial Media have done a great job of luring new suckers in to keep the plates spinning for another quarter, and another, and another. Will we ever run out of suckers?

It's hard to say. EVERYONE who bought stocks in 1999 was a sucker but a lot of those suckers doubled their money if they timed it right – it's the ones who were still holding on in March of 2000 that saw everything disappear in the wink of an eye. This is not a Dot Com bubble and this is not a housing bubble – this is simply expectations getting ahead of earnings AND ignoring the deteriorating macro picture.

Far from a wall of worry, nothing worries this market – not for more than a day or two and any positive noises heard from the Government, the Analysts or the Fed are always a reason to rally – no matter how many times they've lied to us before.

S&P 3,000 is going to be a moment to pause and reflect and it will very likely also be a moment to pull back and we'll call it a 600-point run from 2,400 which means a weak retracement is going to be 20% of that run or 120 points so 2,880 our first pullback goal and a stronger retracement would take us back to 2,760 – where we have had some recent consolidation. Holding that would be bullish but not testing it isn't bullish at all – it's just a bigger and bigger air pocket of weak support being pushed under the index. That's not what we really want so we're going to HOPE for a 10% correction this summer.