To ease or not to ease…

To ease or not to ease…

That is the question investors will be looking for Fed Chairman Powell to address when he testifies at 10 a.m. Wednesday before the House Financial Services committee and the next day to the Senate banking panel. Friday's strong jobs report has led to a sell-off as investors now believe the Fed is less likely to cut rates at their end-of-month meeting and of course they shouldn't be cutting with record-low unemployment, rising inflation and a record-high stock market – that would be MADNESS!!!

Of course madness is Trump's sweet spot and he's been hammering on the Fed lately to lower rates because Trump needs to stretch this rally out another year or there's no way he'll get re-elected and he's going to need the Fed's cooperation because this rally has already overstayed it's welcome and is quite overdue for a correction. The Fed, for it's part, wants to RAISE rates so they are then able to LOWER them WHEN it is necessary. If they lower rates when it's not necessary, what are they going to do when it is?

That's the difference between thinking like a child and thinking like an adult, of course and, as our friends in the UK like to point out – Trump is essentially a giant baby with low attention span who likes to repeat catchy phrases with little understanding of the underlying issues and has an absolute melt-down if he doesn't immediately get what he wants.

That's the difference between thinking like a child and thinking like an adult, of course and, as our friends in the UK like to point out – Trump is essentially a giant baby with low attention span who likes to repeat catchy phrases with little understanding of the underlying issues and has an absolute melt-down if he doesn't immediately get what he wants.

Powell, like any Fed Chairman, is supposed to be the adult in the room and tries to intervene only when necessary – generally staying out of politics. The need for an independent Federal Reserve has been recognized by every President in US History – until this one… Even now, Trump is packing the Fed with his own people and is pressuring Powell to step down so he can put another sycophant in charge of our monetary policy – very scary stuff.

Fortunately, the Fed doesn't answer to the President and they don't answer to Congress either but, twice a year, they are required to appear before Congress and explain themselves – though Alan Greenspan was great at making a mockery of that proceeding. Bernie Sanders gave Greenspan a piece of his mind back in 2003 but, sadly, no one listened and we barrelled forward into the Financial Crisis:

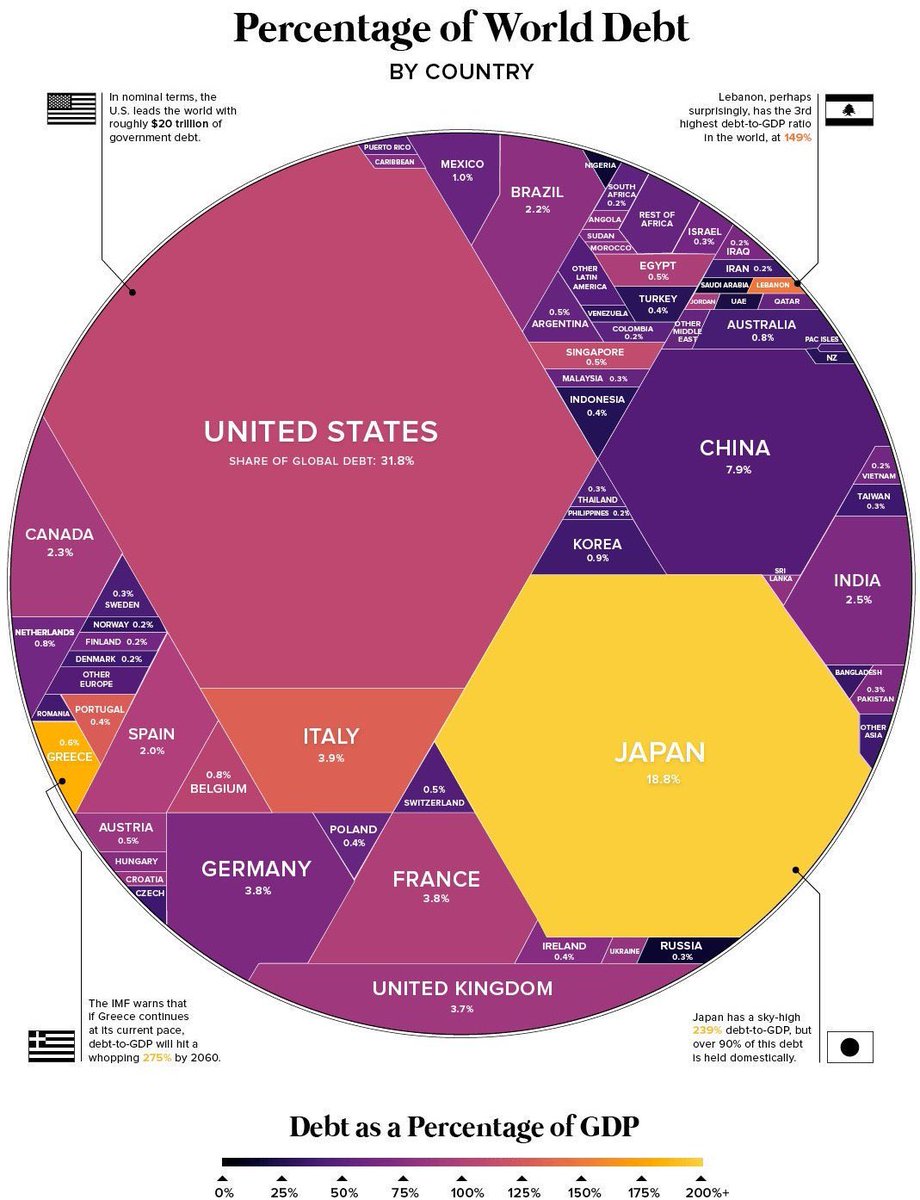

Aside from attempting to prolong the rally (now in month 122), Trump needs an easy Fed to keep the Dollar weak, which strengthens US Trade and makes it look like Trump's policies are working. Also, from a practical standpoint, a country that is $22 TRILLION in debt really can't afford to pay higher interest rates as each 1% increase in rates costs us $220Bn in interest payments.

In fact, the US will once again hit the Debt Ceiling in September and we have been running using "extraordinary measures" to meet our debt obligations since March 2nd, when we crossed the $22Tn limit. Without actual Congressional approval between now and early Sept (so 60 days) the US will default on their loan obligations. Large payments due in early September increase the default risk ahead of a quarterly tax revenue infusion that would come in mid-September and provide some cash relief to the Treasury, the BPC said.

In fact, the US will once again hit the Debt Ceiling in September and we have been running using "extraordinary measures" to meet our debt obligations since March 2nd, when we crossed the $22Tn limit. Without actual Congressional approval between now and early Sept (so 60 days) the US will default on their loan obligations. Large payments due in early September increase the default risk ahead of a quarterly tax revenue infusion that would come in mid-September and provide some cash relief to the Treasury, the BPC said.

A meeting last month among Pelosi, Mnuchin and other congressional leaders ended in acrimony when Republicans said Democrats were asking for too much spending on domestic programs. Mnuchin suggested a one-year debt ceiling increase be attached to a spending bill that would put the budget on autopilot for a year. Lawmakers rejected that proposal, and no follow-up meeting has been scheduled. The Treasury Department could decide to prioritize bond payments over government salary, benefit and vendor payments once the debt limit is reached but we're running on fumes as it is.

Consumer Credit is also at an all-time high, now $4.1Tn, rising twice as fast as our GDP is growing so, in other words, 200% of our GDP growth is due to US Consumers taking on more debt and NOT because more wealth is being created in the US Economy so lowering rates and encouraging more borrowing would like trying to cure heroin addiction by giving out crack.

While we're waiting to hear from Powell, Trump's Economic Adviser, Larry Kudlow made a statement that Powell's job "is safe at the present time" which may be a threat in disguise. It's done nothing to boost the Futures and we'll open down about 100 points and then we'll just have to wait and see what happens.