And we keep going higher!

And we keep going higher!

The S&P is now up 15% for the year and 25% off the December lows and 10% off the June lows, so it's been quite a year for the senior index. Citigroup (C) kicked off earnings season this morning with a decent report but tomorrow things begin to get serious and it will be a jam-packed couple of weeks as July 4th cost us a week so we're a bit behind in our reporting already.

Income at C is up 7% from last year at $4.5Bn for the quarter, which is $1.95/share vs $1.85 expected but revenues were only in-line at $18.5Bn so we're not likely to get a very enthusiastic reaction with the stock already at $72 (we are long C with a 2021 target of $75 in our LTP). There aren't many bank stocks we like but C is one of them so no surprise here. Wells Fargo (WFC) tomorrow will be much more interesing and Johnson & Johnson (JNJ) also reports in the morning and we'll see what they set aside for their talcum powder scandal.

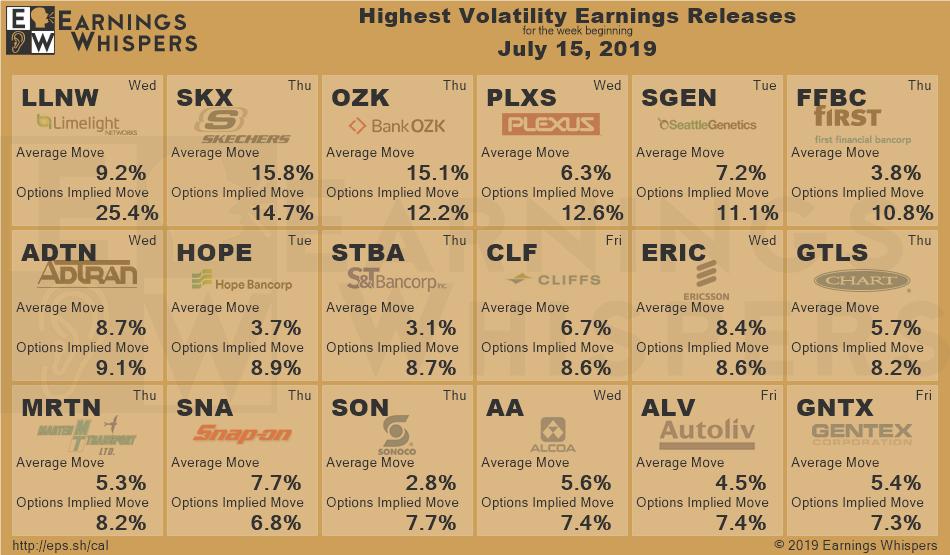

These are probably the most fun earnings to play but it's early in the season and we have little to go on though we are already long on Skechers (SKX) and Cliffs (CLF) though SKX passed our $27 target long agao and we're just waiting to get paid as the spread is netting just $11,025 out of a potential $16,000 so it still has $4,975 (45%) left to gain between now and Jan 17th, 2020 even though it's +20% in the money – aren't options fun?

| SKX Short Put | 2020 17-JAN 30.00 PUT [SKX @ $34.11 $0.00] | -10 | 7/16/2018 | (186) | $-5,280 | $5.28 | $-3.11 | $-3.58 | $2.18 | $0.00 | $3,105 | 58.8% | $-2,175 | ||

| SKX Long Call | 2020 17-JAN 23.00 CALL [SKX @ $34.11 $0.00] | 40 | 7/20/2018 | (186) | $25,600 | $6.40 | $5.55 | $11.95 | $0.00 | $22,200 | 86.7% | $47,800 | |||

| SKX Short Call | 2020 17-JAN 27.00 CALL [SKX @ $34.11 $0.00] | -40 | 7/20/2018 | (186) | $-22,000 | $5.50 | $3.15 | $8.65 | $0.00 | $-12,600 | -57.3% | $-34,600 |

So, as a brand new trade, you can take this spread and make up to 45% from scratch. Of course, we netted in originally for a $1,680 credit and we're making almost 10x more than that if SKX finishes the cycle over $27 – now THAT is what I call fun! SKX is at the top of their trading range and hopefully they pull back a bit on earnings so we can add them to the OOP (though we'll come up with something that makes more than 45% – so dull).

Our favorite kinds of earnings plays are to pick up stocks other peope are throwing away for the wrong reasons but, as I noted above, early in the season we're more worried about playing defense with our existing positions, rather than chasing after new ones unless there's a particularly amazing bargain to be had (like BBBY last week).

Getting back to Cleveland Cliffs (CLF), I can't believe they are still down in the dumps and I'm tempted to add more ahead of their earnings on Friday as Iron Ore pricing has shot up and CLF has the advantage of being a US producer in the trade wars yet the stock is languising around $10.50, which is "on track" for our 2021 $12 target but our spread has only gained $1,100 and it's a potential $8,000 spread that's currently net $1,500 so another $6,500 (433%) potential to gain so, even if you missed our original $400 entry last month – 433% upside in 18 months doesn't suck.

| CLF Long Call | 2021 15-JAN 8.00 CALL [CLF @ $10.51 $0.00] | 20 | 6/14/2019 | (550) | $6,000 | $3.00 | $0.63 | $3.00 | $3.63 | $0.00 | $1,250 | 20.8% | $7,250 | ||

| CLF Short Call | 2021 15-JAN 12.00 CALL [CLF @ $10.51 $0.00] | -20 | 6/17/2019 | (550) | $-3,000 | $1.50 | $0.36 | $1.86 | $0.00 | $-720 | -24.0% | $-3,720 | |||

| CLF Short Put | 2021 15-JAN 10.00 PUT [CLF @ $10.51 $0.00] | -10 | 6/14/2019 | (550) | $-2,600 | $2.60 | $-0.57 | $2.03 | $0.00 | $570 | 21.9% | $-2,030 |

Here's how ridiculously cheap CLF is: $10.50 is just under $3Bn in market cap yet last year CLF had $1.1Bn in profit though $475M of that was a tax credit so call it $625M but they'll pay taxes on that this year so we'll call it net profits of $500M for $3Bn and the p/e is 6x at $10.50 but Iron Ore prices have gone up 50% since the start of the year and that can have a tremendous impact on earnings yet estimates for CLF have barely budged (0.57 expected Fri vs 0.55 last year), so I'm expecting a nice beat and raised guidance.

Here's how ridiculously cheap CLF is: $10.50 is just under $3Bn in market cap yet last year CLF had $1.1Bn in profit though $475M of that was a tax credit so call it $625M but they'll pay taxes on that this year so we'll call it net profits of $500M for $3Bn and the p/e is 6x at $10.50 but Iron Ore prices have gone up 50% since the start of the year and that can have a tremendous impact on earnings yet estimates for CLF have barely budged (0.57 expected Fri vs 0.55 last year), so I'm expecting a nice beat and raised guidance.

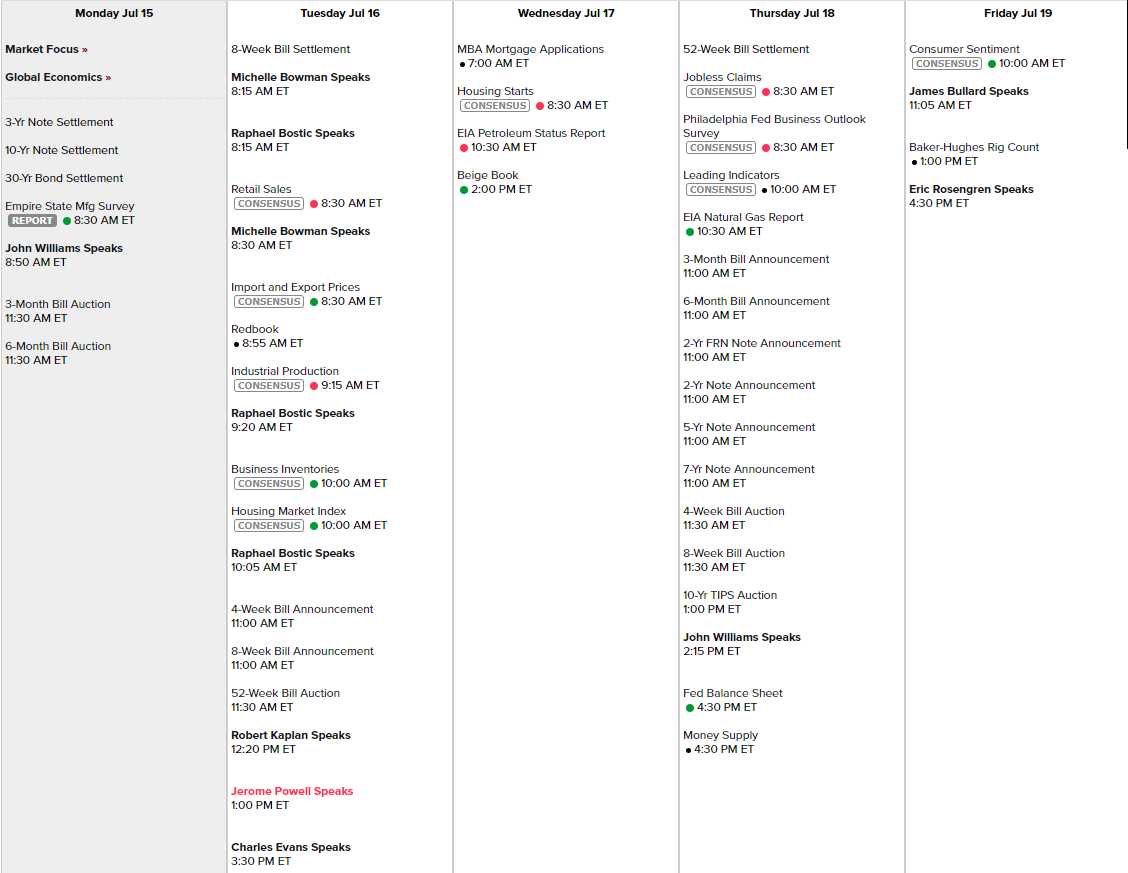

We'll see what joys the earnings season can bring us and we have a ton of Fed speak on tap with 7 speeches just tomorrow and one today, one Thursday and two Friday, all surrounding the Fed's Beige Book Report on Wednesday. We have the Empire State Manufacturing this mornng, Retail Sales and Industrial Production tomorrow, the Philly Fed Thursday and Consumer Sentiment on Friday – along with about 200 earnings reports this week.