So far, so good.

So far, so good.

Just a few days into earnings season but no major blow-ups yet and the S&P 500 is holding up over the 3,000 line but the volume finally increased yesterday and it was down volume, not up. We have to hold 3,000 for the whole weak to make a meaningful breakout and this evening we get earnings from a lot of heavy-weights like EBAY, NFLX and IBM and MSFT reports tomorrow evening so we'll have some clues as to how Big Tech is doing.

Bank earnings have been good so far and Dow components JPM, GS and even JNJ beat their estimates yesterday though the overall index still finished lower as sellers showed up and found not enough buyers to keep the prices level. That's the great danger in a low-volume rally: When it comes time to sell, there's no one to buy it from you and prices can drop very quickly.

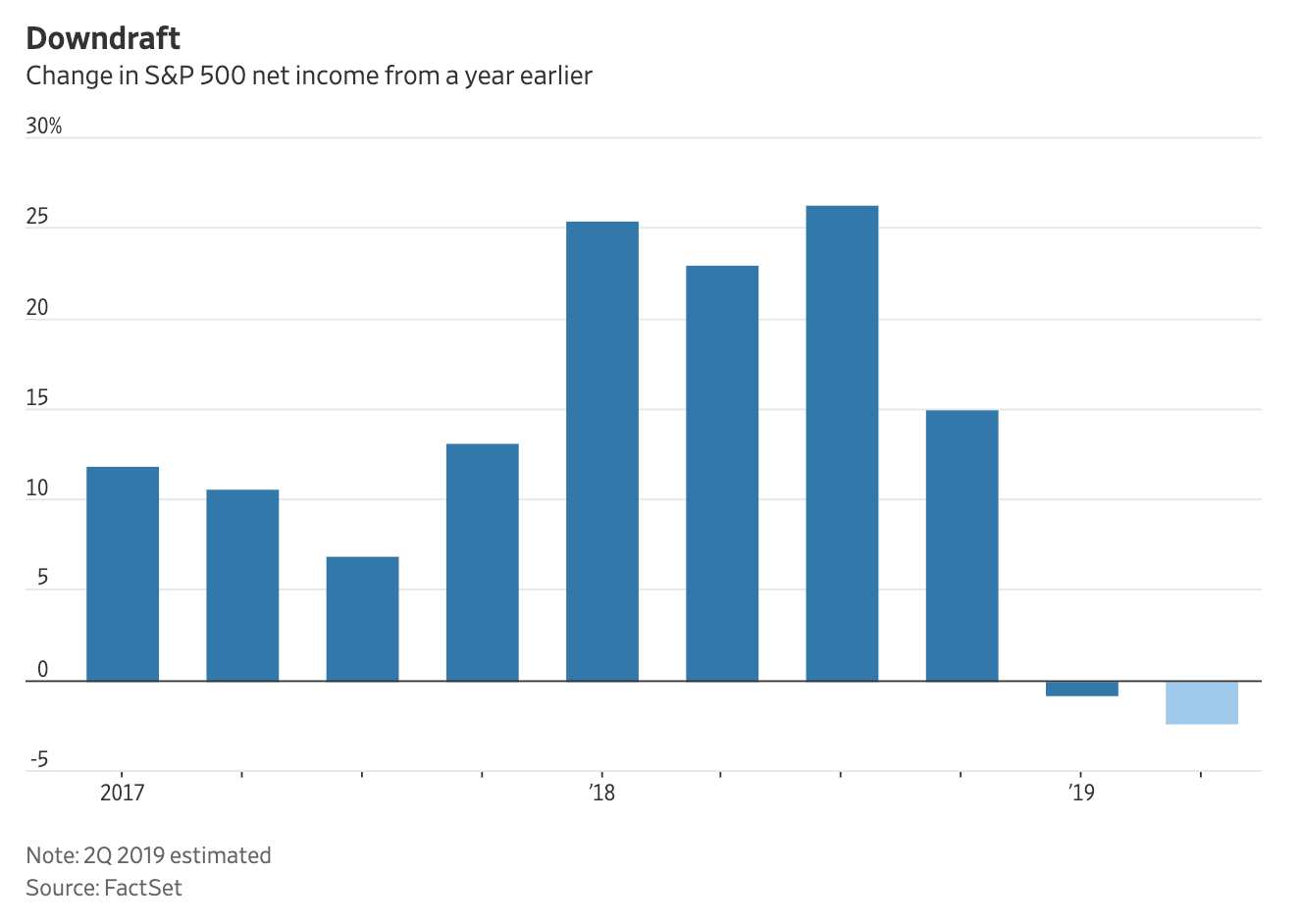

We're in a very strange market at the moment where earnings are clearly coming down but the market just keeps going up. There's a huge disconnect from reality and, as I've said before, Fear of Missing Out (FOMO) is keeping people in but this market can turn ugly very quickly and it's VERY important to have hedges in your portfolios and, keep in mind, CASH!!! is the best hedge there is.

We'll be reviewing our Short-Term Portfolio (STP) this morning (and in our Live Trading Webinar at 1pm, EST) and making sure those hedges are enough to protect our Long-Term Portfolio (LTP) and, if not, then either we need more hedges or less positions!

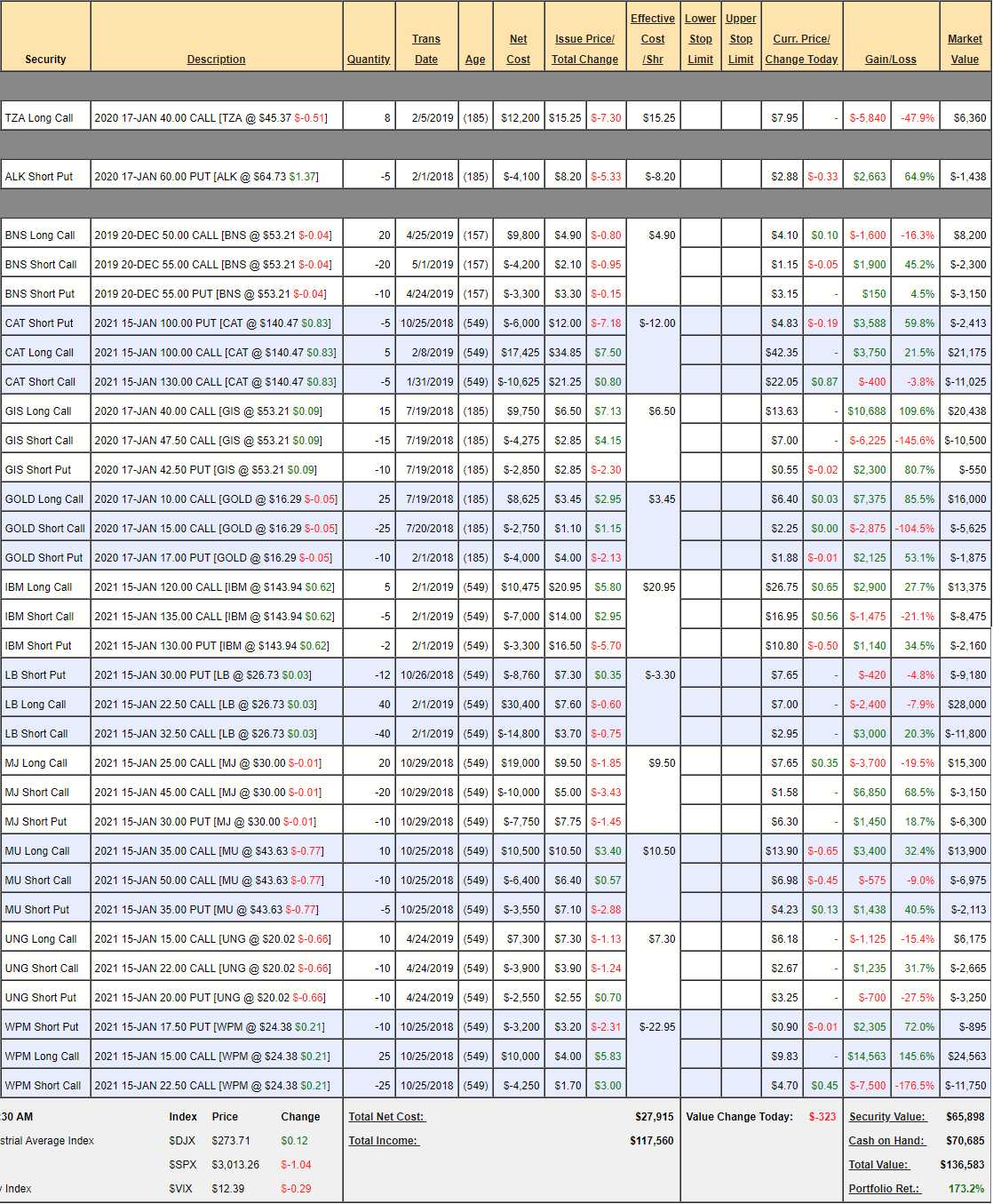

Our Money Talk Portfolio has its own hedges and we last reviewed that over at Seeking Alpha on May 16th at $112,908 and, since we only adjust this portfolio live on BNN's Money Talk show and since I haven't been on since (will be on in August), the positions remain untouched but on track as we're now up to $135,583, so it's been a very good two months with a $22,675 gain, which is 45% of our $50,000 base! SQQQ calls expired worthless and TZA had a reverse split but nothing else has changed but the rally has given us a huge chunk of gains with lots more to come if things keep going well.

- SQQQ ended up being a $7,000 loss and TZA is not faring much better but we had a plan for what the rest of our positions would make if the market didn't head lower and, so far, we're executing that plan, with plenty still to gain if we stay on track.

- TZA – If all goes well, we expect to lose $6,360 on this hedge.

- ALK – On track to gain $1,438 on the short puts.

- BNS – Net $2,750 on the $10,000 spread that's on track to make $7,250 (263%) more so good for a new trade.

- CAT – Net $7,734 on the $15,000 spread is already over target with $7,266 (94%) left to gain.

- GIS – Net $9,388 on the $11,250 spread is pretty much done with $1,862 (20%) left to gain. I know some people would LOVE to gain 20% in 6 months on a blue chip spread that's deep in the money but – yawn….

- GOLD – Net $8,500 on the $12,500 spread means $4,000 (47%) left to gainand we're just about at goal on the put side and well over target for the calls.

- IBM – Net $2,740 on the $7,500 spread that's deep in the money has $4,760 (173%) left to gain, that's respectable for a new trade.

- LB – Net $7,020 on the $40,000 spread is about where we came in with $32,980 left to gain and we're $16,000 in the money so let's hope for nice earnings on 8/21.

- MJ – Net $5,850 on the $40,000 spread still has $34,150 (583%) left to gain so of course this is good for a new trade.

- MU – Net $4,812 on the $15,000 spread has $10,188 (211%) left to gainand that's very respectful.

- UNG – Net $260 is less than we paid on the $7,000 spread and the funny thing is it's $5,000 in the money with $6,740 (2,592%) left to gain – I'd say that's very good for a new trade!

- WPM – Net $11,918 on this $18,750 spread is well on the way and 100% in the money with $6,832 (57%) left to gain, so not too bad if you can be satisfied with 57% in 18 months for a trade that's 10% in the money to start.

See, trading isn't that hard, is it? I think we've only made one adjustment (LB) to this portfolio and, otherwise, these are all original trade ideas that were never otherwise touched. If all goes well, the above trades will make another $117,466 by Jan 2021 less (so far) $6,360 we expect to lose on TZA.

These trade are selected BECAUSE we feel they are fairly bullet-proof as we only do Money Talk once per quarter and we're already miles ahead of expectations. That's why our last 3 Trades of the Year (WPM, LB, IBM) are in it and, in November, we'll be adding our 2020 Trade of the Year (I have no idea what yet) as well.

The lesson of this portfolio is you don't have to constantly touch your portfolio to make good money – just make a few good selections, budget your hedges and let nature take its course!