$75Bn!

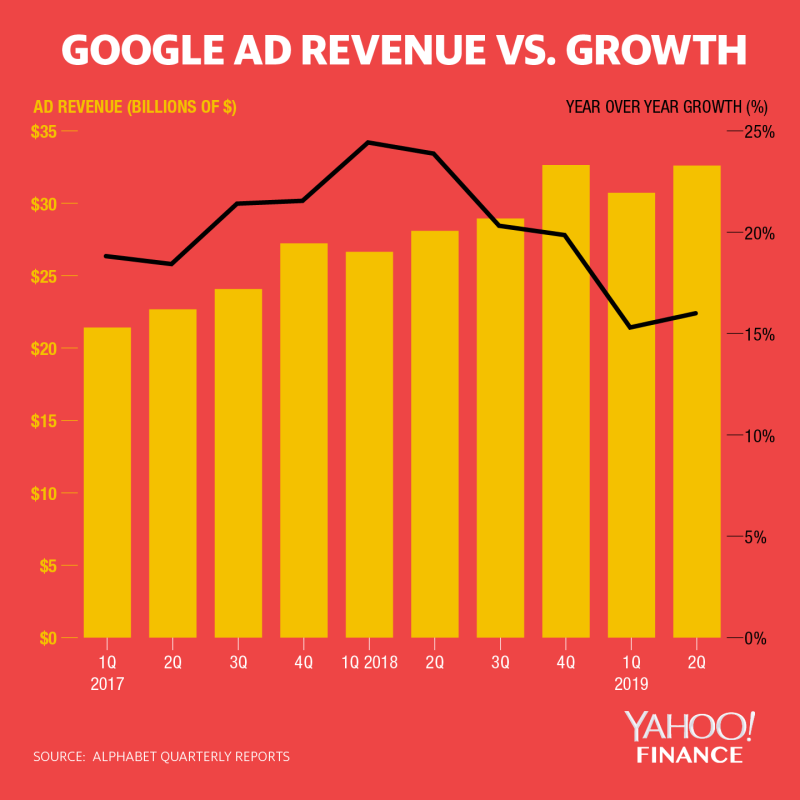

That's how much the market cap of Google (GOOG) gained overnight in a 10% run that brings their market cap to $860Bn and back in contention for the Trillion Dolllar Club. There are only 30 S&P 500 companies valued at more than $75Bn: GE (GE) is only $92Bn, Caterpillar (CAT) is $75.8Bn and CVS (CVS) is $72Bn so, essentially, GOOG added an entire blue chip to their valuation in overnight trading.

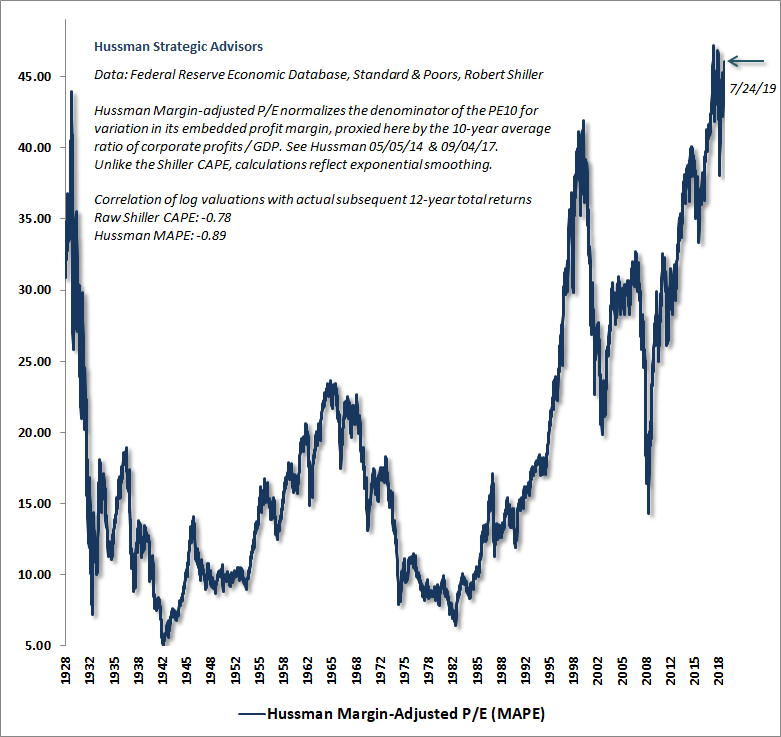

Did $75Bn pour into the company? No, not at all, the overnight trading is very thin with less than 500,000 shares trading and, even at $1,200 per share and even if every transaction were a buy and not a sell, that's only $600M of inflows yet the stock shows that investors gained over 100 times that amount. That's one of the great illusions of the stock market, the APPARENT valuation of these companies has very little to do with actual money flows – it's more like an auction where whatever crazy price the last person bids on the last share sold becomes the price of hundreds of millions of other shares – regardless of whether there is actually demand for them or not.

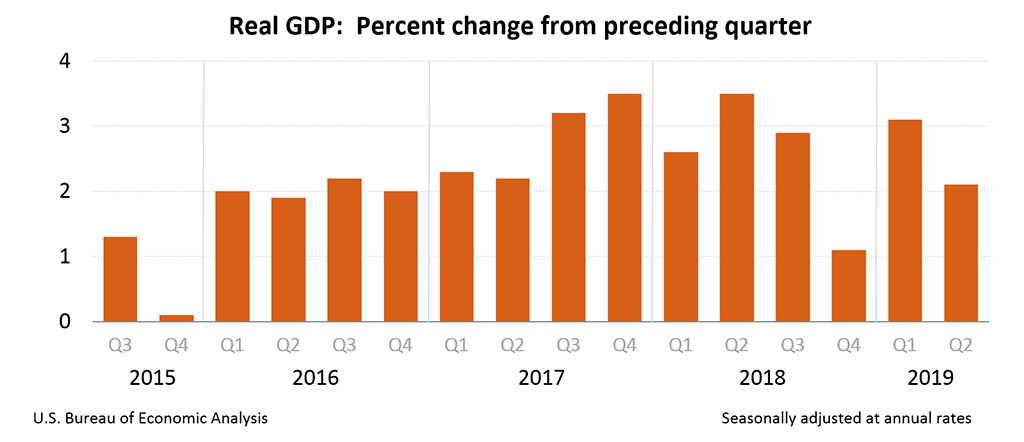

This morning we're going to get our first look at Q2's GDP, which is expected to come in at 1.8% and that's down 42% from Q1s 3.1% growth rate – a very significant slow-down. The Atlanta Fed's GDPNow forecast, in fact, has lowered their projections for Q2 down to 1.3% – quite a bit lower than leading economorons and the market will not likely take it well if the Atlanta Fed turns out to be correct – we'll see at 8:30.

I don't know where "leading economorons" get their data but the Atlanta Fed looks at the same things I do and we both feel the economy is quite a bit weaker than 1.8% growth but this is an advanced estimate and can be wildly inaccurate – so anything can happpen. Here's the data set so you can decide for yourself if 1.8% or 1.3% is closer to reality:

Amazon (AMZN), in fact, had disappointing earnings yesterday as the battle to create a one-day service heats up and begins to eat into the bottom line. Amazon is also having the same issues Netflix (NFLX) is with the cost of content in their Prime Video service but they can't let it go now as it's the main reason people sign up these days as EVERYONE has free two-day delivery now.

8:30 Update: 2.1% – a big upside surprise and that's good but it might not be taken that way by the market as it makes it even less likely the Fed will lower rates next Wednesday as it kind of throws their "slowing" narrative that justifies more easing right out the Window. Not only is GDP well over estimates but so is the "Deflator" at 2.4% vs 1.8% expected and 0.6% in the prior reading indicating a massive uptick in inflationary pressure. Keep in mind the Fed's inflation target is 2% so we're well over that mark and that indicates the Fed should be TIGHTENING policy, not loosening it!

Driving the GDP higher was a whopping 5% increase in Government Consumption (Table 1, line 22) that is responsible for more than the entire beat as Trump uses his out-of-control budget to engineer himself a positive GDP Report – well played Mr. President! Personal Consumption dropped 1% from Q1 and Private Domestic Investment dove from 6.2% to NEGATIVE 5.5%, which would be catastrophic if not washed out by Government Spending and Residential Investment was also negative 1.5% – so the consumers are clearly pulling back.

Exports were down 5.2% and Imports were flat so Trump is not "winning" his trade war at all as we're buying the same amount but selling significantly less – that would be the very definition of losing, actually. Non-defense Government Spending (Trump's parade?) jumped an astonishing 15.9% – you NEVER see double digit jumps like that – what the Hell is he doing with our money???

We'll see what the Fed actually does next week but you can only justify these kind of valuations if Corporate Borrowing Costs remain close to zero and the Government can be expected to keep spending in order to boost the GDP – even while the consumers are cutting back after stretching their credit to the max.

One thing that is different this time – home loans aren't as out of control as they were in 2007 – that's a highly leveraged area of borrowing that we haven't repeated as it was based on an implied home value (that turned out to be wrong) rather than the actual ability to pay. On the other hand, we now have $1.6Tn in student loans, based on the assumption that students will be able to make those payments from future wages – hopefully that premise doesn't turn out to be shaky too.

Have a great weekend,

– Phil