How will July end?

How will July end?

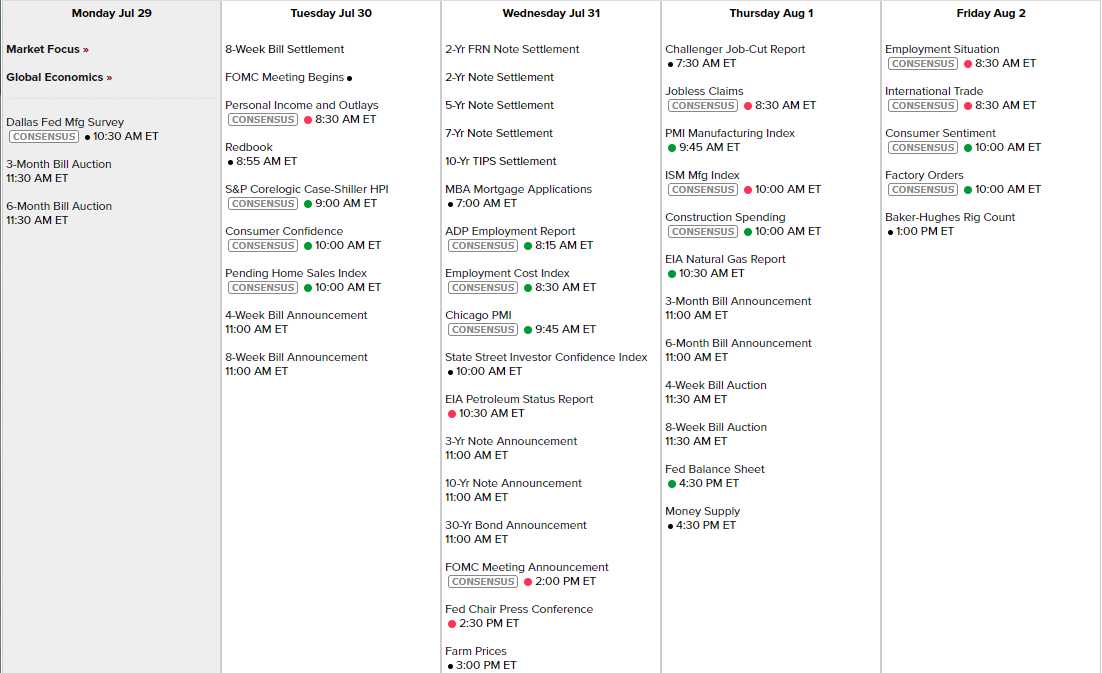

It ends on Wednesday and Wednesday is Fed day and the FOMC announces their rate decision at 2pm, where a 0.25-0.5 cut is widely expected, followed by a speech by Jerome Powell at 2:30, where he pretends to explain why cuts were necessary for some other reason than to please the President. Ahead of that circus, we have the Dallas Fed Manufacturing Survey this morning (10:30), Personal Income and Outlays tomorrow (8:30) along with the Redbook Sales (8:55), Case-Shiller (9:00), Consumer Confidence and Pending Home Sales (10:00).

On Wednesday morning we have MBA Mortgage Applications at 7am, ADP at 8:15, Employment Cost Index (8:30), Chicago PMI (9:45), State Street Investor Confidence (10:00) and Petroleum Status at 10:30. Those are the last data-points that are going to influence the Fed ahead of their "decision" and, of course, there will be hundreds of earnings reports highlighted by the following:

So that's the set-up but the outcome seems to be a given as we no longer have a data-driven Fed but a politically-driven one and no one seems concerned that the independence of the Federal Reserve has been a cornerstone of our economic stability since the Great Depression. While we certainly have our issues with what is essentially a banking cartel operating under the guise of a Government entity – at least they were independent of the White House and ANY kind of check against Presidential over-reach would be welcome these days – as we have very few left – and now the Fed has given up and is about to lower rates when a hike would be more appropriate. That's just crazy!

With interest rates near their lower band, a key transmission channel of unconventional monetary policies – quantitative easing, yield curve control and forward guidance – has been to entice investors to take greater risk and hunt for yield outside of the traditional investment-grade bond market. This has inflated stock valuations, made junk bond yield look like investment-grade, and increased housing prices in major cities where real estate is a prized possession. All of this has exacerbated wealth inequality and is contributing to the social backlash against economic liberalism, according to economists with Nomura Securities.

With interest rates near their lower band, a key transmission channel of unconventional monetary policies – quantitative easing, yield curve control and forward guidance – has been to entice investors to take greater risk and hunt for yield outside of the traditional investment-grade bond market. This has inflated stock valuations, made junk bond yield look like investment-grade, and increased housing prices in major cities where real estate is a prized possession. All of this has exacerbated wealth inequality and is contributing to the social backlash against economic liberalism, according to economists with Nomura Securities.

Another aspect of inequality is uneven distributional impacts, with very low interest rates disproportionately hitting (retirees) who have much of their savings in low-interest bank saving deposits and young people seeking to save for their first home. Wall Street traders are making money buying bonds at a premium, then selling them back to a Central Banker for an even greater premium. But as bond prices rise, yields fall and fixed-income investors aren’t making much off their savings and government bonds anymore.

Corporations like Apple have spent upwards of $100 billion borrowing at low interest and buying back its stock, driving up its share price. That’s made Apple shareholders richer. But unless a retail investor is holding Apple stock individually and not in a stock mutual fund, then it is unlikely they sold despite Apple being up over 25% this year alone. Money goes to money. And QE and low credit costs make that all the easier.

We'll see what the Fed actually does on Wednesday but, with an 0.50 rate cut now expected by most – it will be hard fro them to do anything but disappoint.