Can America seem more out of control?

Can America seem more out of control?

Over the weekend, there were two major shootings (Dayton, Ohio and El Paso Texas) where 30 people were killed and another 53 injured. On Friday in Virginia and Maryland, 5 people were killed and 4 injured, which hardly rated a mention in the US press as it's a daily thing now but Sunday, while Dayton was happening, another 20 people were injured and 2 people killed in 2 incidents in Chicago, 1 in NYC and one in Memphis.

Before you think that Dayton and El Paso just distracted us from 22 people hurt by guns (and this only counts multiple death/injury incidents), keep in mind that, in the previous week (from 7/23 to 7/30), there were 16 mass shootings where 28 people were killed and 62 were injured including a dozen people in Brooklyn you probably didn't hear a thing about. Are we really that numb to this sort of thing that 50 people killed in July and 202 wounded didn't even get our attention? Maybe it's because it was less than the 217 wounded in June (only 34 killed though)?

And again, this is ONLY shootings with AT LEAST 3 people being shot in a single incident. So far, in 2019, we average 1.2 of those every day, 22 of them in schools. It's only Aug 5th but we've had over 450 total shootings in the US this year so it's a very good thing "only" about 1/3 of them are mass shootings or we'd still be picking up the bodies. Maybe that's what it will take – maybe we have to start tripping over all the bodies while we shop before we decide this madness has to end?

And again, this is ONLY shootings with AT LEAST 3 people being shot in a single incident. So far, in 2019, we average 1.2 of those every day, 22 of them in schools. It's only Aug 5th but we've had over 450 total shootings in the US this year so it's a very good thing "only" about 1/3 of them are mass shootings or we'd still be picking up the bodies. Maybe that's what it will take – maybe we have to start tripping over all the bodies while we shop before we decide this madness has to end?

How can you look at these maps and not think something is very wrong with the way we're doing things in this country? How can you let your elected representatives get away with telling you there's nothing wrong with the way we do things? Do they tell you it's violent everywhere? Because it's not!

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/8319829/gun_homicides_developed_countries.0.jpg) The US has 4 times more gun violence of the second worst "advanced" nation, which is Switzerland, where every citizen has a gun. Compared to Socialist Sweden, we're about 10x worse and compared to Australia, where they banned guns, 20x worse – 20 times!

The US has 4 times more gun violence of the second worst "advanced" nation, which is Switzerland, where every citizen has a gun. Compared to Socialist Sweden, we're about 10x worse and compared to Australia, where they banned guns, 20x worse – 20 times!

We have (and I am not joking) more guns than people in the US and no, that's not normal at all! Do you think having more guns leads to more gun violence? You have to be a very, very heavy consumer of Fox News AND have an NRA card to think otherwise but it's surprising how many people just can't seem to make the connection – especially once they are elected to Congress.

You know what would be fun? The NRA is always saying more guns is the solution to gun violence – we should arm teachers and students and crossing guards and have armed hall patrols and if everyone at WalMart had a gun on them, then no one would try anything though that argument falls a bit flat when we just had a mass-shooting at a WalMart in El Paso and what do you think the chances were that no one else was armed in El Paso, Texas? Where were all the "good guys with guns" in El Paso? A 21 year-old kid with an AK-47 was able to walk around a WalMart killing security guards and trained combat veterans who happened to be shopping there.

This all happened just a month after the NRA celebrated a "highly successful year" of getting Texas to loosen its gun laws. The gun that was used to shoot 16 people in Gilroy, California was illegal in that state – so the shooter went next door to Nevada to buy it. State laws don't work because "they" come right over the border with their guns and their bullets and they are murderers but they are not Mexicans – they are white supremicists and, sadly, walls don't seem to keep them out.

Numerous countries have issued travel advisories for visitors coming to the US, citing our culture of gun violence including even Canada, Germany, New Zealand and the UAE, which issued a "special alert" to travelers coming to the United States, as well as those already in the country. The alert warned travelers to avoid attending "ongoing or planned demonstrations and protests in cities around the United States," as well as to be aware in large crowds and tourist destinations. The Bahamas is warning it's black citizens to "excercise extreme caution" when interacting with the US Police – what does that say about US?

Numerous countries have issued travel advisories for visitors coming to the US, citing our culture of gun violence including even Canada, Germany, New Zealand and the UAE, which issued a "special alert" to travelers coming to the United States, as well as those already in the country. The alert warned travelers to avoid attending "ongoing or planned demonstrations and protests in cities around the United States," as well as to be aware in large crowds and tourist destinations. The Bahamas is warning it's black citizens to "excercise extreme caution" when interacting with the US Police – what does that say about US?

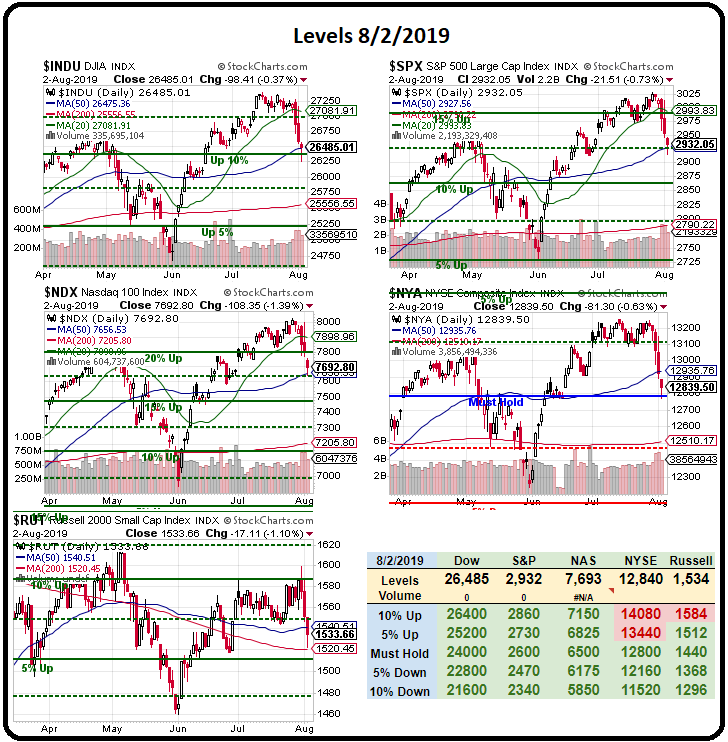

Meanwhile, the markets are starting off down another 1.5-2% this morning as we're completing the first half of the much-anticipated post-Fed correction. We expect to see those 200-day moving averages get tested and that's another 1,000 points down on the Dow to 25,500 so still shortable when it fails the 26,000 line for $2,500 per contract at goal.

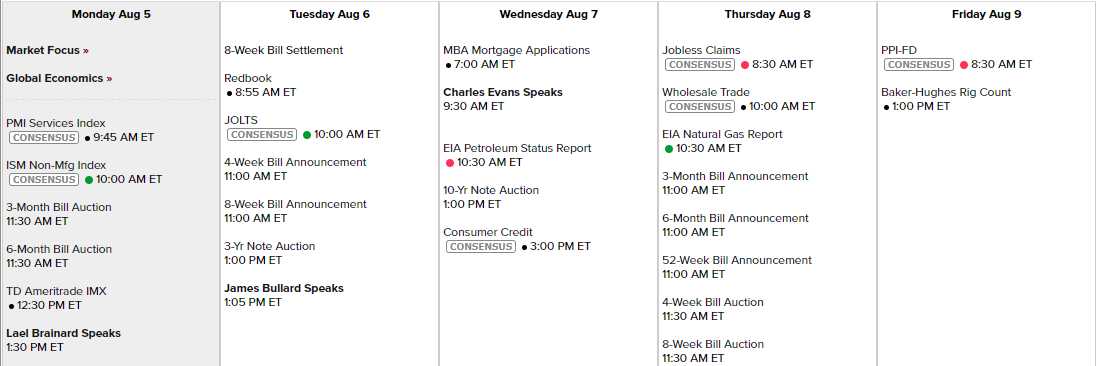

It's a fairly light data week with only 3 Fed speakers so the focus is going to be on earnings as another 25% of the S&P 500 file their reports:

Sadly, there's not much here that's likely to hold us up and Europe has already crossed lower so best to just lie back and enjoy the ride and we'll see where the bottom is together.