The Hong Kong Airport was shut down today, culminating 10 weeks of unrest as the protests grow stronger and stronger over China's attempts to exert more authority over the former British territory. Oddly enough, this is something we thought would happen over 20 years ago, when Hong Kong was first handed over but the Chinese Government is very good at being patient before applying pressure – a lesson Trump is only just now beginning to learn.

Beijing cranked up the warning rhetoric on Friday aiming to put a halt to protests ahead of the weekend but it only intensified the situation and protests turned violent on Sunday with dozens of arrests in numerous clashes with the police. Late Sunday afternoon, thousands of protesters descended on tourist destinations and residential neighborhoods alike, building metal barricades and some throwing bricks and what police identified as smoke bombs.

“We are outraged by the violent protesters’ behaviors, which showed a total disregard of the law, posing a serious threat to the safety of police officers and other members of the public. We severely condemn the acts,” the government said early Monday. In recent public appearances, Hong Kong’s leader, Carrie Lam, has said the government can’t accede to the protesters’ demands.

Meanwhile, over the weekend, Trump indicated he is "not ready" to talk to China in September, likely pushing off any possible progress in the trade dispute into next year. As I keep saying, Trump loves his tariff slush fund and is very unlikely to give it up and he feels the Hong Kong situation is weakening China, so Trump is more likely to increase the tariffs than call them off next month.

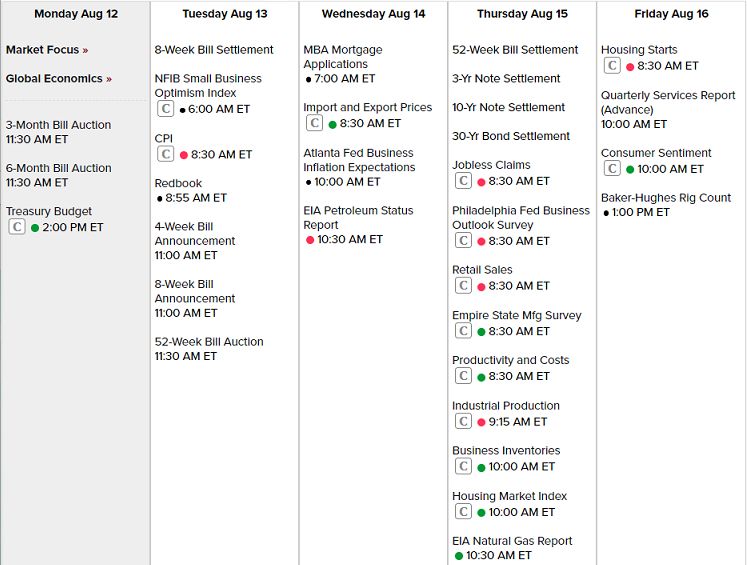

We took a neutral stance into the weekend as our portfolios are well-balanced and we didn't want to make any predictions as we're still in a heavy period for earnings (last big week) as well as options expirations and there's a good amount of data ahead this week as well but, oddly, no Fed speak though the next meeting isn't for a month (Sept 18th).

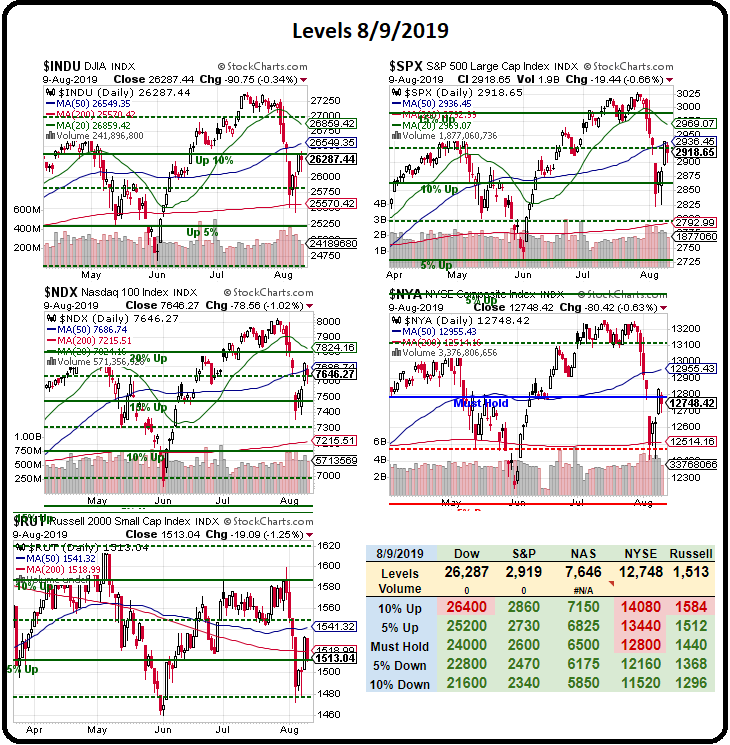

Well, it's actually nice to have a Fed-free week as it will give us more of an idea of which way the market is naturally heading. We're still watching the same bounce lines we were keeping our eye on last week and, as of 8:45, we're back in the red on the S&P 500 and, if our strong bounce lines can't hold – then it's very likely we're going to make another leg down.

- Dow 25,000 is the mid-point and bounce lines are 25,550 (weak) and 26,100 (strong)

- S&P 2,850 is the mid-point and bounce lines are 2,880 (weak) and 2,910 (strong)

- Nasdaq 7,200 is the mid-point and bounce lines are 7,360 (weak) and 7,520 (strong)

- Russell 1,440 is the mid-point and bounce lines are 1,472 (weak) and 1,504 (strong)

They S&P is the only thing that's changed since Friday afternoon, when we reviewed the hedges in our Short-Term Portfolio, but the Dow and Russell are on the cusp – so watch them very closely today. Also, let's watch that 10% line on the Dow at 26,400 – it's not a rally if we can't take that back and, of course the Must Hold line on the NYSE must hold!