Now, where was I?

Before we were so rudely interrupted by yesterday's "rally," I was pointing out how there are simply too many macro fears to shrug off and get bullish. Despite the 70-point S&P stick on China "news" that we'd be having a phone call with them in September, I remained skeptical and we took advantage of the rally to begin closing out some long positions in our Options Opportunity Portfolio, turning it a lot more bearish. I had, in fact, said to our Members right at 9:56 am, in our Live Member Chat Room:

LOL, what a rocket on China Trade news! How silly…

So hard to take this market seriously when it goes up and down 5% based on whether or not we're going to speak to China on the phone in 2 weeks. It's like High School!

The market has, indeed, turned into more of a popularity contest than a true measure of economic activity. The Administration has learned how they can talk the market up or down at will but, as we just saw yesterday – it's a short-lived thing when there's no meat on the bone to back up their statements. Tartiffs are only delayed until Dec 15th after massive blowback on Trump's announcement last week and the "phone call" to China was nothing more than a face-saving attempt by the Administration so Trump could avoid saying he screwed up and misjudged how badly the market would take new tariff announcements.

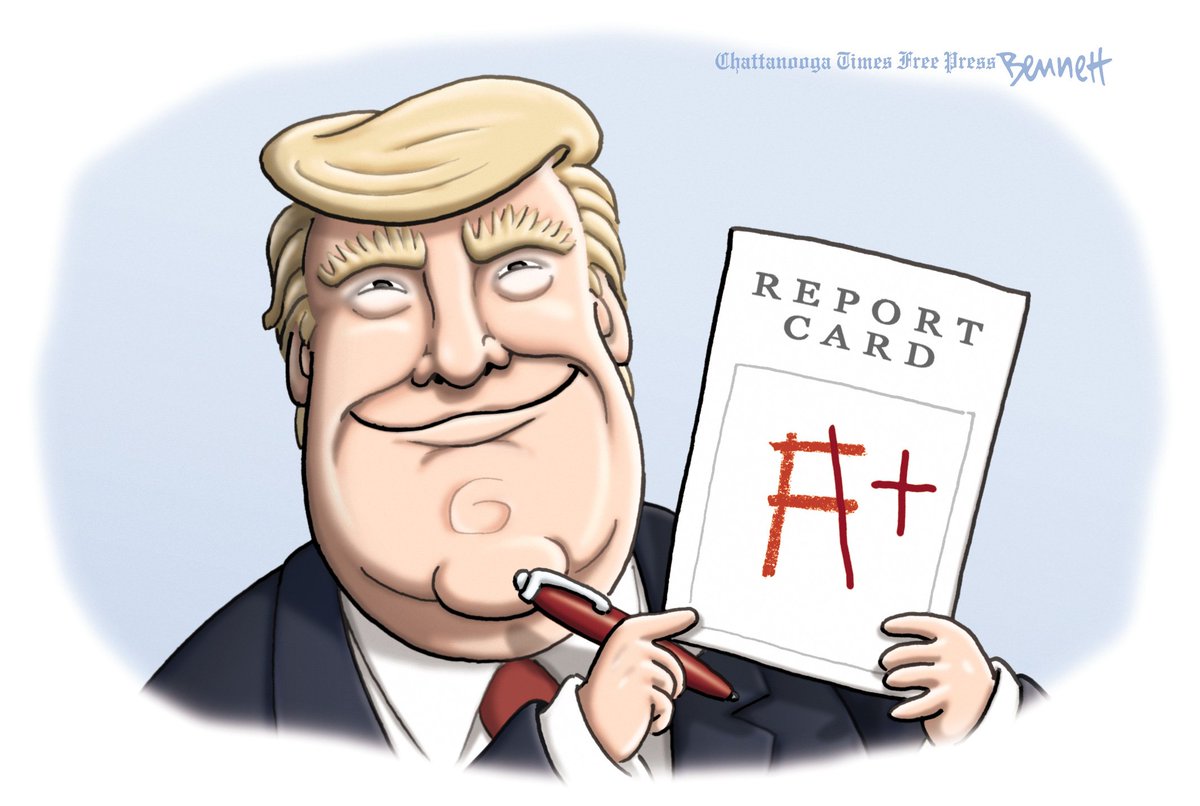

The delayed tariff date will also boost orders into the holidays and give us a better Q4 than we probably would have had as people rush to beat the tariffs with their orders. That's something that will blow back on us next year, but Trump won't have to run on next year's GDP as it won't be over by the election so this year is his "report card" and, like his school career – the President is willing to cheat to get a C.

The delayed tariff date will also boost orders into the holidays and give us a better Q4 than we probably would have had as people rush to beat the tariffs with their orders. That's something that will blow back on us next year, but Trump won't have to run on next year's GDP as it won't be over by the election so this year is his "report card" and, like his school career – the President is willing to cheat to get a C.

The inverted yield curve, which we discussed yesterday, was the "shocking" news that took the markets lower this morning (down 1.5% at 8:30 in the Futures) but the price inflation also played a part – albeit a day late – and we also found out that US Mortgage Debt hit $9.4Tn, above the $9.3Th peak we hit just before the last housing market collapse after a $162Bn surge in Q2. As we've noted previously, total Household Debt is also at a recover $13.9Tn, including $4.6Tn of Student Loans, Auto Loans and Credit Card Debt. This is why Banksters usually do very well (interest and fees) just before the economy collapses.

And, keep in mind that all this debt is made possible by artificially low rates that are plunging the US over $1Tn a year (5% of GDP) further into deficit to sustain. So yes, you are saving interest on your loan repayments but 164M taxpayers are each going $6,097 further into debt that the Government has taken on your behalf – to be paid by you and your children and your grandchildren – just like Jefferson warned us would happen:

Oh, if only there were a party that abided by the principles of our Founding Fathers…

Refinancing homes accounted for half of the new mortgages in the 2nd Quarter and that's a huge, flashing warning sign when consumers have to tap into their home equity to make ends meet. Mortgages remain the largest form of household borrowing but have become a smaller share of total debt since the late 2000s as consumers take on more Automotive and Student Loans, which now stand at $1,500,000,000,000 so, when you see young people walking barefoot – it's not that they are hippies – they just can't afford to buy shoes anymore.

We're doing our Live Trading Webinar at 1pm (EST) this afternoon and we'll go over more of our hedges then.