To trade or not to trade?

To trade or not to trade?

Trump said yesterday that the US and China are scheduled to have a "conversation about trade" without giving any actual details after China said what the media are interpreting as signals they won't retaliate against the latest US increase but I interpreted as the usually vague niceties China tends to utter when they are about to crush you (see yesterday's report). Trump is like a cartoon character – with his economy going off a cliff and an election looming but, standing at the edge of the cliff with China about to push him off he says – NOW I have them right where I want them!

Sadly, this is not how it works in real life yet you can't tell that to investors who are being herded back into stocks by MSM pundits who are screaming BUYBUYBUY – as if this is the opportunity of a lifetime with stocks 2.5% below their all-time highs. I for one am disappointed, traders are supposed to be smarter than the average American yet they fall for this BS? Of course, the very, very low volumes on the S&P indicate not many people are really falling for it. The pattern continues that we have low-volume rallies and high-volume sell-offs so there are actually more sellers than buyers – they are just reeling in the buyers like fish on a hook.

S&P ETF (SPY) volume:

| Date | Open | High | Low | Close* | Adj Close** | Volume |

|---|---|---|---|---|---|---|

| Aug 29, 2019 | 291.72 | 293.16 | 290.61 | 292.58 | 292.58 | 57,899,400 |

| Aug 28, 2019 | 286.14 | 289.07 | 285.25 | 288.89 | 288.89 | 59,696,700 |

| Aug 27, 2019 | 289.54 | 289.95 | 286.03 | 286.87 | 286.87 | 66,668,900 |

| Aug 26, 2019 | 287.27 | 288.00 | 285.58 | 288.00 | 288.00 | 72,423,800 |

| Aug 23, 2019 | 290.92 | 292.76 | 283.47 | 284.85 | 284.85 | 149,161,500 |

| Aug 22, 2019 | 293.23 | 293.93 | 290.40 | 292.36 | 292.36 | 51,666,400 |

| Aug 21, 2019 | 292.48 | 292.86 | 291.72 | 292.45 | 292.45 | 49,524,700 |

| Aug 20, 2019 | 291.77 | 292.36 | 289.95 | 290.09 | 290.09 | 51,596,400 |

| Aug 19, 2019 | 292.19 | 293.08 | 291.44 | 292.33 | 292.33 | 53,571,800 |

| Aug 16, 2019 | 286.48 | 289.33 | 284.71 | 288.85 | 288.85 | 83,018,300 |

| Aug 15, 2019 | 284.88 | 285.64 | 282.39 | 284.65 | 284.65 | 99,556,600 |

| Aug 14, 2019 | 288.07 | 288.74 | 283.76 | 283.90 | 283.90 | 135,622,100 |

| Aug 13, 2019 | 287.74 | 294.15 | 287.36 | 292.55 | 292.55 | 94,299,800 |

Today we're going for 294.50, 2,945 on the S&P 500 (/ES) Futures, which is EXACTLY to the 50-day moving average where we thought we'd top out after this window-dressing session to end the month:

Until we're over the 50 dma and holding it, this is nothing but a move within the channel and, without a concrete trade deal (which seems unlikely), we'll probably stay in the channel – which means we can expect another trip to the bottom, at 2,800 again. That's only 5% off the top so nothing really to worry about but you would think it's the end of the world every time we get these little gyrations.

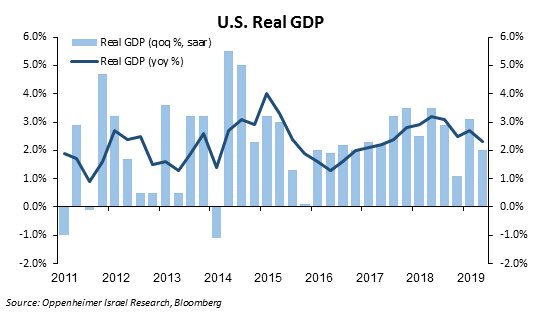

2nd Quarter GDP came in yesterday at an anemic 2%, revised down from 2.1% and my pet peeve about GDP is that it considers rising inventories to be a positive while I consider it things not selling in the warehouse. Also notice the MASSIVE 4.5% increase in Government Spending as well as the hyper-inflationary rise in the GDP price index. All is well? I don't think so!

2nd Quarter GDP came in yesterday at an anemic 2%, revised down from 2.1% and my pet peeve about GDP is that it considers rising inventories to be a positive while I consider it things not selling in the warehouse. Also notice the MASSIVE 4.5% increase in Government Spending as well as the hyper-inflationary rise in the GDP price index. All is well? I don't think so!

The gross domestic product price index measures changes in the prices of goods and services produced in the United States, including those exported to other countries. Prices of imports are excluded so it's a clean measure of US inflation priced in US Dollars and it more than doubled in the last 3 months and that's BEFORE taking into account the July 31st Fed Rate Cut.

Consumer Spending was up nicely and added 3% to the GDP but, of course, Consumers also racked up record levels of debt to get there – so we'll see how long they can keep that up. Government Spending added the other 1% on the positive side (of the major contributions) and the rest netted 2% negative so, very simply, without big increases in spending by the Government and the Consumers they are lying to – we would have been -2% instead of +2% for the quarter. Business Spending fell 1.1%, which contributed to their 5.3% increase in profits (they are not reinvesting in their business, which is NOT a good sign) and Business Investing in Structures was down a whopping 9.4%.

The markets are taking none of this into account and neither did we take any of this into account in 2007 or the first half of 2008, when there were CLEAR signs that the economy was going off the rails but the MSM told people to ignore the worry-warts and BUYBUYBUY what the Banksters were selling – and they did. And it didn't work out so well then.

Making money is not always about staying in the market – sometimes you need to hold onto the money you've made and I REALLY think this is one of those times. We added a LOT more hedging to our portfolios yesterday and we'll add a LOT more today in preparation for what might be a very rough September and, if it's not, I'd rather lose a controlled amount of mony on my hedges than an uncontrolled amount of money on my longs.

Have a great weekend,

– Phil