We're not off to a good start.

Of course we knew last week's "rally" was nothing but BS window-dressing to end the month on a high note, though the indexes were still down overall, giving us a losing month that caused a lot of technical damage on the charts.

The S&P was at 2,900 last September and we held on all the way until early October, and then we crashed into the end of the year, hitting 2,400 at Chrismas, down 17.25% and it took us all the way until April to get back to 2,900 – and here we still are!

"Well we know where we're going

But we don't know where we've been

And we know what we're knowing

But we can't say what we've seen

And the future is certain

Give us time to work it out" – Talking Heads

What is certain is that Trump did carry out his evil scheme to put more tariffs on Chinese products that US Consumers have to pay for and, as we feared (though was denied last week), China IMMEDIATELY retaliated by placing a levy on US crude imports, encouraging buyers to stop buying US OIl, which is exactly what Trump's donors didn't want though, of course, Putin wins again as Russia is China's largest supplier. China also placed tariffs on additional US Goods and the Chinese Government has filed a complaint with the World Trade Organization, who are very likely to rule against Trump so our next crisis may be pulling out of the WTO.

Hong Kong protests are getting worse, not better and we're now 60 days away from a "NO DEAL" Brexit that will throw the EU into chaos and UK Prime Minister, Boris Johnson has said he will call for new elections (they can do that) if Parliament tries to block or delay the date. Meanwhile, that pesky Yield Curve is getting worse, not better and I love this graphic that shows the curve going from last year's "normal" to whatever the F we have now…

Hong Kong protests are getting worse, not better and we're now 60 days away from a "NO DEAL" Brexit that will throw the EU into chaos and UK Prime Minister, Boris Johnson has said he will call for new elections (they can do that) if Parliament tries to block or delay the date. Meanwhile, that pesky Yield Curve is getting worse, not better and I love this graphic that shows the curve going from last year's "normal" to whatever the F we have now…

Last week we got news that US GDP Growth had dropped back to 2% but, as we noted, that was only because Government Spending is completely out of control and adding 1% to the GDP while Consumers are buying on credit and adding 3% to the GDP and, as we say 10 years ago – that can reverse very, very quickly if the sentiment changes.

Meanwhile, the main reason we bumped up our hedges and cashed in a lot of positions last week is because earnings have NOT been good. They have, in fact, been bad and we're now trending at 2.3% growth, which is in-line with GDP but 5.3% lower than was estimated at the beginning of the year yet here we are – still trading at those very enthusiastic highs as if we're growing like a 3rd World country.

Goldman Sachs and Citigroup strategists last month reduced 2019 and 2020 earnings estimates for the S&P 500, citing a sluggish economy, trade war threats and potential currency devaluations. The Purchasing Manager's Index (future expectations of corporate spending) dipped into contraction in August – at 49.9, down from a barely expanding 50.4 in July. This is the first time since September of 2009 the PMI has been below 50!

Freight shipments are, of course, down, with the Cass Shipments Index falling 5.9% in July after falling 5.3% in June after falling 6% in May, that's down 17.2% over the summer. “We repeat our message from last two months: the shipments index has gone from ‘warning of a potential slowdown’ to ‘signaling an economic contraction,’” the July report said. “Although the initial Q2 ’19 GDP was positive, it was not as positive upon dissection, and we see a growing risk that GDP will go negative by year’s end.” I'm sorry, by the way – I'm generally not a doom and gloom guy but when things are doomy and gloomy, it is my job to make you aware of it!

Then there's this thing called The Economic Policy Uncertainty Index, an index designed to measure policy-related worries around the world, hit its ALL-TIME highest level, 342, in June. Let that sink in please – in 2008/9, we were at 200, and now we're closing on on 350!!!

The EPU Index tracks the amount of times newspaper articles use buzzwords related to economic and political uncertainty. Additionally, it measures the number of tax laws set to expire and the spectrum of disagreement among economists: The more dissent, the higher the index goes. The index simmered in July to a level of 280 on hopes the a trade deal between the U.S. and China will be resolved – BUT IT ISN'T – and, in fact, it's now WORSE on Sept 3rd than it was in July.

Needless to say, let's be very careful out there this month. Hope springs eternal that the Fed will give us MORE FREE MONEY!!! – a phrase we used to us back in the Bush years, when that President was doing whatever he could to prop up the economy into the elections. Instead the economy went off the rails right in the fall of 2008, just when Americans were voting and the ended up voting for "change". Sadly, that was all forgotten 8 years later and now we're right back to the same kind of irresponsible policies that crashed our economy in 2008.

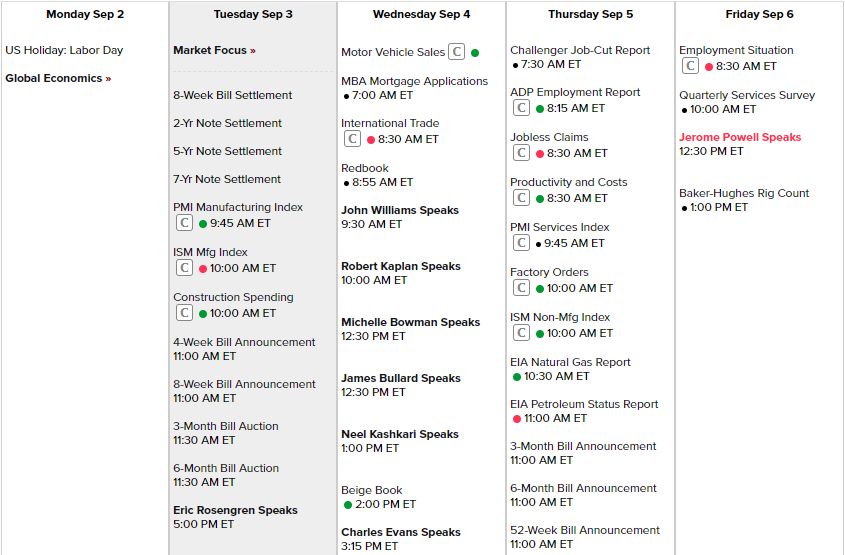

Meanwhile, we are DELUGED with Fed speak tomorrow as there are SIX (6) Fed speadkers scheduled around tomorrow's Beige Book release – which makes me think the Beige Book sucks and needs a lot of spin. Rosengrend goes first this afternoon and Powell goes last on Friday and again, I get the impression he's speaking to save the market because it's a 12:30 EST speech he's making from Zurich, where it will be 6:30 pm – a bit late for a normal conference speech. That's coming after Friday's 8:30 Jobs Report – maybe that's going to suck?

And, believe it or not, there are still earnings going on. It's been a bad quarter for making earnings picks because the macros have been so uncertain that the earnings almost didn't matter in predicting movement so we've simply sat on the sidelines but, as noted above – it's the overal trend towards lower profits that have concerned us.

Hopefully, the trade was has fully escalated at this point as Trump has placed tariffs on everything coming from China. He could make a higher percentage or take other actions (like forcing US companies to leave China) but, for now, we'll see how the market handles the new status quo.