Wheeeeeeeee – this is fun!

We're up another 1% this morning as Trade Talks between the US and China are now officially scheduled to resume – in "early October" and if that isn't worth another 300 Dow points – I just don't know what is? According to the WSJ:

Expectations for a breakthrough in trade talks are low, as tensions have risen between the two countries. Neither Beijing nor Washington specified a start date for the talks, which would be the 13th round in a series of on-and-off negotiations that began in January, after the U.S. initially agreed to hold off on further tariffs to try to reach a trade deal.

“The path to even a modest deal is strewn with many obstacles, as neither side is likely to pull back any of the existing trade sanctions without substantial concessions from the other side,” said Eswar Prasad, a China expert and economist at Cornell University.

Hell, that's got to be worth 1,000 points – doesn't it? We're up 600 points on they Dow since Friday and up 1,200 points off our August 23rd low at 25,400. Correct me if I'm wrong but isn't the trade war the ONLY reason the Fed was considering raising rates and isn't a good part of this last 1,200 point rally based on expectations the Fed will lower rates? So are we now expecting the Fed to lower rates AND to get a China Trade Deal? It's like Santa Clause AND the Tooth Fairy will come on our birthday! I'm sure it has happened to some kid, somewhere – but it's got to be pretty rare – not the sort of thing you should bet your portfolio on…

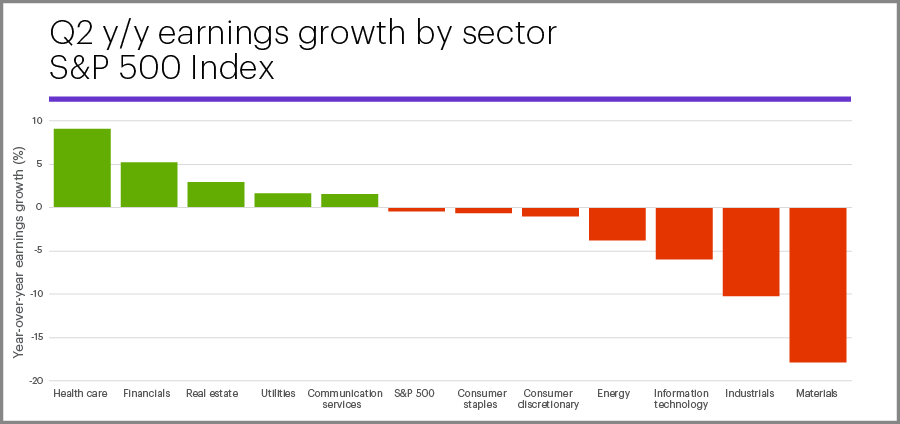

Not only that, but didn't we have a rally in June when trade talks were scheduled for September? That never happened and then we crashed from S&P (/ES) 3,020 back to 2,800 in August and then we began the "Fed will save us" narrative that took us back to 2,950 and now we're going to rally again on trade hopes but, meanwhile, no one seems to have noticed what a disappointment Q2 earnings actually were and how can Q3 possibly be better in the midst of all this turmoil?

I know I'm just a silly Fundamentalist who thinks how much money a company actually makes and how much money a company is likely to make should determine the VALUE of the company and that the PRICE should, at least once in a while, be somewhat in-line with the VALUE but, even as I say it – I realize I sound like an old man sitting on a porch who just doesn't understand the "new" economy, where companies don't need to make money anymore – as long as they have an exciting-sounding idea to disrupt companies that do make money. Once everyone is broke – I'm sure it will all make perfect sense.

Q2 Productivity came in this morning at 2.3%, which is good except Unit Labor Costs went up 2.6% which means, in effect, it's costing more money per unit of productivity so corporations can no longer expect productivity gains to offset the rising cost of labor – that's a pretty big negative to ignore. On the bright side, Unit Labor Costs were up 5.5% in Q1 vs a 3.5% gain in productivity so at least it's not getting that much worse.

Q2 Productivity came in this morning at 2.3%, which is good except Unit Labor Costs went up 2.6% which means, in effect, it's costing more money per unit of productivity so corporations can no longer expect productivity gains to offset the rising cost of labor – that's a pretty big negative to ignore. On the bright side, Unit Labor Costs were up 5.5% in Q1 vs a 3.5% gain in productivity so at least it's not getting that much worse.

We have Factory Orders and ISM Services at 10 and China had huge service growth yesterday so we'll see if the US is keeping up or falling further behind. Why are services outpacing? No tariffs, that's why! That's why Government interference gives you a lot of false data readings which makes it a lot harder to plan your investments – assuming you believe such things matter. We'll be closing in on Nasdaq 8,000, Dow 27,000 and S&P 3,000 this week – so we'll see if the technical matter either.

Fundamentals seem to matter on Signet Jewelers, who I've been banging the table on for quite a while and we just doubled down on our position last week in our Long-Term Portfolio, where we just had 10 short 2021 $20 puts we had sold on 1/24 for $5.50 ($5,500) and they had run up to $10.75 ($10,750) for nearly 100% loss so we rolled them to 20 of the 2021 $13 puts at $5.30 ($10,600) which means we now sold the 20 puts for net $5,350 or $2.675/share so our net entry is now $10.32 – not bad for something that moved so harshly against us but earnings were a blowout and they are up 30%, which is silly but we'll take it.

It's even better news for our Options Opportunity Portolio, where we initiated the trade for Seeking Alpha back on 1/24 and our 8/13 adjustment was:

SIG – Ridiculously under-priced at just $700M at $13.40. We can roll the 5 2021 $20 puts at $10.05 ($10,500) down to 10 of the 2021 $13 puts at $4.70 ($9,400) for net $1,100 but we originally collected $5,850 so still net $4,750 or net $8.25 per long. On the long side, let's roll our 10 2021 $15 calls at $3.40 ($3,400) to 20 of the 2021 $13 ($4.10)/22.50 ($1.80) bull call spreads at $2.30 ($4,600) so spending just $1,200 more to move into a $19,000 spread that's at the money.

We're not there yet ($14.26) but off to a good start now that this sell-off idiocy is over with!

Just when I'm thinking of giving up on Fundamentalism – they pull me back in…