What a crazy week already.

What a crazy week already.

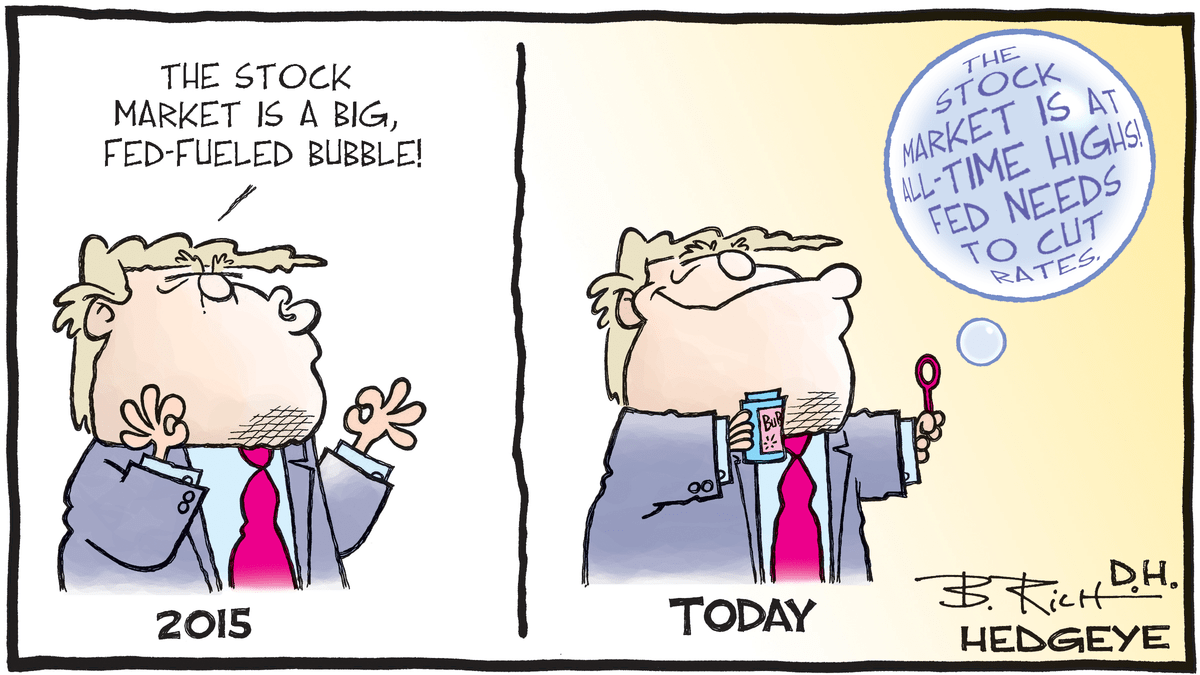

Yesterday the Dow topped out Monday at 26,900 and fell back to 26,700 yesterday, closed at 26,909 and is now up another 40 points in the Futures as President Trump is back on Twitter this morning saying:

The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet…..

….The USA should always be paying the the lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of “Boneheads.”

By the way, that's not my emphasis, that's his – I have no idea how he gets twitter to make giant text like that. In this case, Trump is not wrong(ish) as his "plan" is to have the Fed lower rates to zero and then WE can borrow $22,000,000,000,000 to "refinance" our existing debt (by confiscating existing bonds?) and then sell even longer-term bonds at 0% or maybe even BELOW 0% so PEOPLE WILL PAY US to lend us money in which case the more in debt we go – the more money we'll make forever and ever and ever – what could possibly go wrong with that plan?

The idea that large corporations precisely calculate the interest rate at which they are willing to undertake investment – and that they would be willing to undertake a large number of projects if only interest rates were lowered by another 25 basis points – is absurd. More realistically, large corporations are sitting on hundreds of Billions of Dollars — indeed, Trillions if aggregated across the advanced economies – because they already have too much capacity. Why build more simply because the interest rate has moved down a little? The small and medium-size enterprises (SMEs) that are willing to borrow couldn’t get access to credit before rates went negative, and they can’t now. This simply makes Top 1% corporations richer and consolidates their monopoly as smaller companies can no longer compete on access to capital.

Think about it, if you are a bank and you have to lend to a company at 2% – will you lend money to a company that has even a 1 in 50 chance of not being able to pay you back? No, you're better off just leaving the money in the bank – its not worth the risk to lend to anyone who isn't AA or above. Most companies, especially SMEs, can’t borrow easily at the T-bill rate. They don’t borrow on capital markets. They borrow from banks. There is a large difference (spread) between the interest rates the banks set and the T-bill rate.

The lower rates go, the less inclined banks are to lend and then liquidity dries up and we're really screwed. Right now, the US is able to borrow $1Tn a year (Trump's annual Deficit) BECAUSE we are paying higher rates than the rest of the World. If we offer 1% on our notes, as Trump would like – people will simply stop lending us money – there are actually supply and demand forces to debt notes that even Trump and the Fed can't control. We have an ECB decision today and that matters because, as Barnhardt noted last month:

The lower rates go, the less inclined banks are to lend and then liquidity dries up and we're really screwed. Right now, the US is able to borrow $1Tn a year (Trump's annual Deficit) BECAUSE we are paying higher rates than the rest of the World. If we offer 1% on our notes, as Trump would like – people will simply stop lending us money – there are actually supply and demand forces to debt notes that even Trump and the Fed can't control. We have an ECB decision today and that matters because, as Barnhardt noted last month:

Mario Draghi, chief psychopath of the European Central Bank went full-stupid on June 5th, 2014 and announced mandated NEGATIVE INTEREST RATES on the excess reserves of European banks held and the European Central Bank. What does this mean? It means that when a European commercial bank deposits excess cash reserves with the ECB, the commercial bank must PAY the ECB to store that money. The commercial bank does not earn any interest income on that money, it in fact has a percentage of its deposit CONFISCATED from its account every month by the ECB.

The publicly stated rationale behind this negative interest rate paradigm is “stimulus”. If the banks have to pay to store cash, they will instead lend their excess cash out to customers rather than have a percentage confiscated every month. This is utter BS on multiple levels. These top-tier central bankers know that negative interest rates have NOTHING to do with stimulus, and will, in fact, lead to exactly the opposite. In fact, they know that the inevitable outcome of negative interest rates is the complete nationalization of the banking sector and total governmental control of all capital flows – which means today a CASHLESS ECONOMY.

Banks today are sitting on huge cash reserves because the economy sucks and banks have rightly discerned that lending money into a sucky economy is NOT IN THEIR BEST INTERESTS. If the economy sucks, then lending money to Joe Schmoe to start a business is likely going to end up in default. So, if YOU were a bank and your choice was between losing one percent by depositing money at the Central Bank at negative interest, or losing FIFTEEN percent on your loan portfolio because the economy sucks and a high percentage of your borrowers would default on their loans, which would you do? Well, duh. You would opt for the SMALLER loss of ONLY one percent, and you would continue to hold cash reserves and be VERY stingy with your loan portfolio.

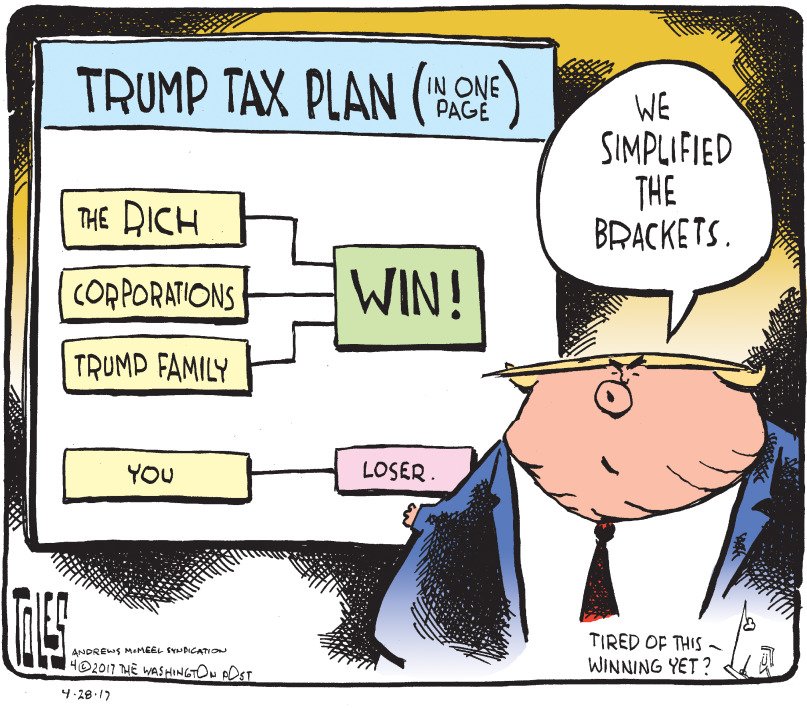

At a certain point in Trump's negative-rate fanstasy, the Fed's "discount window" will fall negative and that means the Fed will effectively pay Banksters (ie. the Top 1%) to borrow money while those same Banksters turn around and charge you to hold onto your money as well. That means the more the banks borrow, the more they make and they don't have to do anything at all with the money because you're paying them to hold yours as well.

And, if you think think this sounds ridiculous, just ask any poor person and they'll tell you that sounds just like how banking works for them as you may not care about a $3 ATM fee in your $50,000 bank account when you take out $200 but think about how a person with a $500 bank account who needs $20 and gets $17 feels. That's how the bottom 40% (120M) of the people in this country live! Then there's the monthly fees and the fees for checks – all those things you probably don't pay because you meet the "minimum deposit requirements" but, guess what, that's all changing now and they are coming after your money too!

Why? Because they've been doing it to the poor for decades and no one stopped them and now they are USED to getting that money and they want more. Of course, it is the bank's duty to their shareholders to make more and more money every year and, if they have squeezed every last cent out of the bottom 40% – who else can they go after. Well, we already know the answer is THE MIDDLE CLASS because we can see it getting crushed already. Once they are done with them, they'll come for you but it will probably take a decade or more so we can ignore the suffering of the middle class just like we ignored the suffering of the poor, right?

Why? Because they've been doing it to the poor for decades and no one stopped them and now they are USED to getting that money and they want more. Of course, it is the bank's duty to their shareholders to make more and more money every year and, if they have squeezed every last cent out of the bottom 40% – who else can they go after. Well, we already know the answer is THE MIDDLE CLASS because we can see it getting crushed already. Once they are done with them, they'll come for you but it will probably take a decade or more so we can ignore the suffering of the middle class just like we ignored the suffering of the poor, right?

And what happens when the Fed is PAYING Banks to borrow money? Well Fed losses turn into Treasury losses and Treasury losses turn into National Debt so the interest Trump thinks he is saving by not paying interest on $22Tn, increase our debt by another $440Bn (2%) IN ADDITION TO the $1Tn he's borrowing in his annual budget so now it's $23.44Tn and then it's $25Tn and it's adding $500Bn a year in losses to the Fed just to pretend the money Trump borrows is "free". Just another scam that makes Trump look good now but burdens our children and grandchildren for the rest of their lives.

And, of course, all that money-printing debases the currency, causing it to lose value and that doesn't matter to me as my stocks and homes and businesses are priced in Dollars so their prices simply go up as the Dollar weakens but for poor people who are paid in Dollars and need those Dollars every day to buy commodities like food and clothing and pay for rising rents – the destruction of the buying power of the Dollar is devastating.

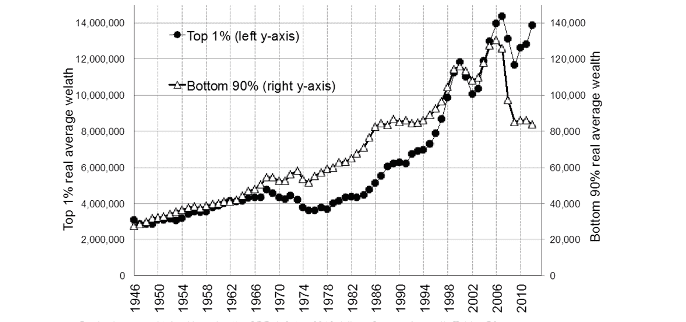

As you can see from this handy chart, Trump and the Top 1% already own 43% of our (their) Nation's wealth and the next 4% own 29% more and the 15% below them own 21% leaving just 7% (I kid you not) to be divided up among the Bottom 80% and these ZIRP Fed policies will DRASTICALLY increase that wealth gap and, as I said above – there's not enough left for the Bottom 80% to give – so guess who they are coming after next?

20 years ago, the Top 1% had 36% of the Wealth but the Bush Tax Cuts and the market and housing crash caused the poor to give up their assets and guess who picked them up? So the Top 1% gained 7% in the past 20 years and they certainly don't want to see LESS growth in the next 20 years, do they? So where's it going to come from? Who will get less so they can have more?

And, of course, it's not so much the Top 1% – they will eventually lose their wealth too because the Top 0.1%, just 320,000 US Citizens, own 25% of the wealth and that's doubled since 1990 and up from 7% in the late 70s (pre-Reagan). Unfettered Capitalism is now transferring wealth from the Bottom 90% to the Top 0.1% at a record pace but it's not fast enough for our Top 0.1% President or the other Members at Mar A Lago.

Be careful out there!