And we're back (again).

And we're back (again).

As we expected, the stops are being pulled out to give us a boost into the end of the quarter and we still have the Fed's Randy Quarles speaking at 8:30 followed by Patrick Harket at noon in order to buffer what's likely to be a poor Durable Goods Report at 8:30 and a poor Consumer Sentiment Report at 10. We also get the Farm Price Report at 3pm and the China situation doesn't bode well for that. We also still have Monday, that's the 30th.

Not that we care because we CASHED OUT last week – but it's still fun to watch from the (mostly) sidelines. President Trump considers the stock market to be some kind of scorecard for his Presidency the same way frat boys count how many girls they slept with and call it their "love life". Still, that means that, behind closed doors, Team Trump is doing whatever they can to boost the market so the boss can feel good about himself – despite all the things he should be feeling bad about.

Yes, despite all the spin, this isn't the Mueller Report and Trump is still getting impeached because this is a very simple, 9-page document that very clearly outlines a single, impeachable offense and so, despite Team Trump's protestations – there WILL be an impeachment though it's still doubtful the Senate will have 60 votes needed to actually remove Trump from office – but the elections will do that.

That's why the Health Care ETF (XLV) is taking a downturn – on fears of a Warren Presidency as it's not likely she will take a kind eye towards excessive profits in the Pharma space but this is a bit of a replay of late 2009, when we took advantage of the sell-off ahead of Obama's first term and the coming of Obamacare to pick some very successful health care plays (see my "2010 Outlook – A Tale of Two Economies") – so I recommend a re-read and we'll update some of the picks on our new Watch List.

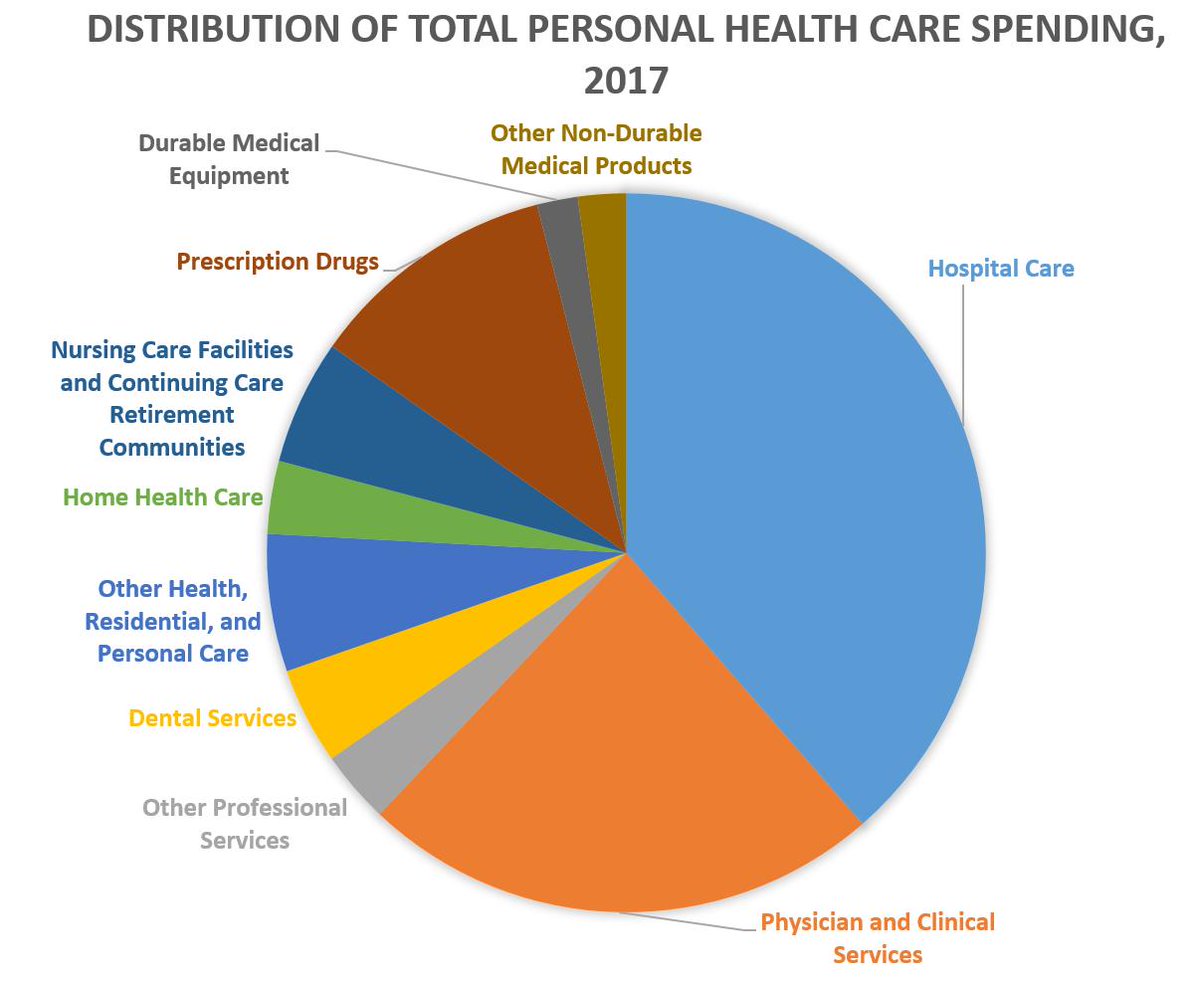

It's not all bad news for Health Care as there may be some cost pressure but just cutting out the Insurance Companies and their team of coverage deniers, salespeople and endless commercials in exchange for just walking into a doctor and getting fixed FOR FREE is going to save this country 1/3 of their $4,000,000,000,000 health care costs.

It's not all bad news for Health Care as there may be some cost pressure but just cutting out the Insurance Companies and their team of coverage deniers, salespeople and endless commercials in exchange for just walking into a doctor and getting fixed FOR FREE is going to save this country 1/3 of their $4,000,000,000,000 health care costs.

When the GOP says "You don't want someone standing between you and you Doctor" – they want you to forget that someone already is – your insurance company and, unlike the Government, your insurance company is OBLIGATED to make a profit by giving you the least medical care possible. As Nixon's WH Counsel (like Guiliani) and since-convicted felon (like Guiliani?), John Ehrlichann said when he set up the for-profit HMO System (it used to be illegal to profit off your health needs in America – when it was Great): "This is a private enterprise one. Edgar Kaiser is running his Permanente deal for a profit and the reason he can do it… all the incentives are toward LESS MEDICAL CARE because the less care they give them, the more money they make."

And that's where we stand today, almost 50 years later, with 20% of our GDP now being spent on Health Care. 75% of that health-care spending flows through insurance companies and JUST the 8 largest insurance companies in Americal take in over $500Bn in revenues and, although they make only about $30Bn in "profits" – THAT's NOT THE POINT because – if we had Universal Health Care – the ENTIRE $500Bn funciton they provide – AND WE PAY FOR – would not be necessary.

When the Republicans try to scare you by saying Universal Health Care would cost $3Tn a year – they are ignoring the fact that we are spending $4Tn now! Also, aside from cutting out the middle-man insurance companies – we would empower the Government to negotiate REASONABLE fees (and profits) for medical goods and services. You DO want a powerful Negotiator standing between you and your health-care provider on your behalf – don't you?

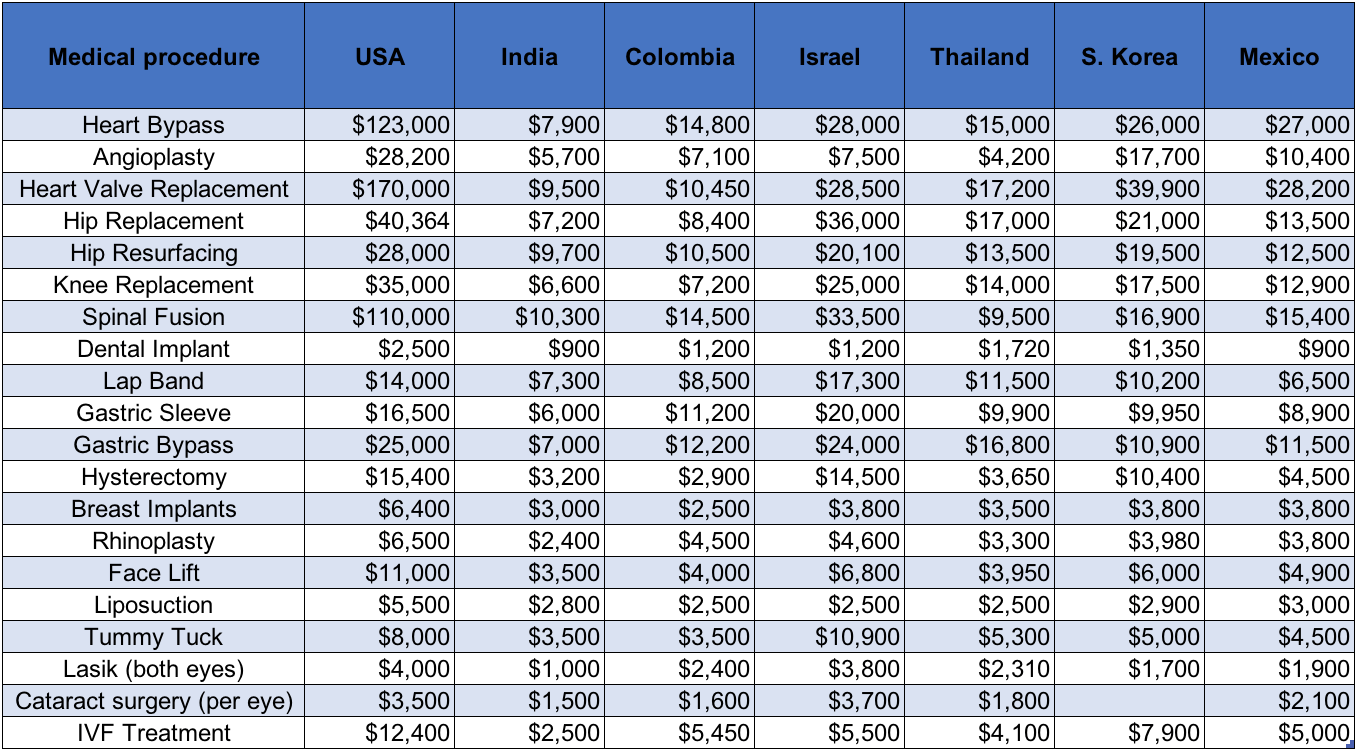

I couldn't find a more recent chart comparing US to Europe (and, by the way, those "-" mean ZERO) but here's one comparing our costs (up over 50% in 5 years) to Asian countries – makes you cry….

So, like in 2010 – there is going to be good and bad in the health-care sector if we have a Warren Presidency. Though they may be paid a little less, there will be 30M more people covered in a Universal Plan – that's 10% of the population so 10% more revenues will offset things like no longer paying $50 for an advill in the hospital. One of the big problems we have with health care is the insuance companies pay the hospitals less so the hospitals charge more and then they insurance companies pass it on to the consumers and it spirals higher and higher and the insurance company makes more money – so they have no incentive at all to stop it.

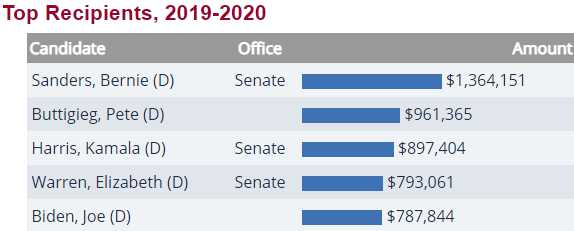

Health Insurance Companies pay the average GOP Congressional Representative $144,000 a year and twice that to Senators in addition to the $550M they spend on lobbying our 535 Congrsspeople ($1,028,000 each) on an annual basis. Oddly enough, they have been throwing money at the Democrats in the current cycle – trying to buy SOMEONE off if they can. There's $1Bn that wouldn't have to be spent if we had Universal Health Care...

Health Insurance Companies pay the average GOP Congressional Representative $144,000 a year and twice that to Senators in addition to the $550M they spend on lobbying our 535 Congrsspeople ($1,028,000 each) on an annual basis. Oddly enough, they have been throwing money at the Democrats in the current cycle – trying to buy SOMEONE off if they can. There's $1Bn that wouldn't have to be spent if we had Universal Health Care...

Meanwhile, as we wrap up the week, Durable Goods were not as bad as we thought, up 0.2% but still way down from 2.1% in the prior reading. Consumer Spending, on the other hand, was only up 0.1% vs 0.3% expected so it's a mixed signal to take us into the weekend.

Have a good one,

– Phil