It's the last quarter of the decade!

It's the last quarter of the decade!

That's right, we've already gotten through the first two decades of the 21st Century without destroying the planet. Unfortunately, the odds are getting a lot higher against us for decades 3 and 4 and by 5 we're a long-shot to finish – so it's a good time to check off that bucket list…

As you can see from JP Morgan's S&P 500 Chart (click for a bigger version), the poor RSI line (bottom) lookes tired and we're pretty well set-up for a repeat of last October if things don't improve but certainly we can Unimpeach Trump, Make a Deal With China, Have a Happy Brexit, Bring Peace to the Middle East, Resolve the Hong Kong Protests and reverse Japan's Aging Problem by Christmas – heck, I bet Jared Kushner can get that all done by Hanukkah!

Speaking of Jared Kushner, here he is burning evidence over the weekend… Just kidding, he's in Hong Kong, still protesting the Government and, at this point, we need to consider that nothing is going to make the Hong Kong protesters happy so what will happen next? China is celebrating their 70th Anniversary tomorrow and they are trying not to have it stained with blood so they've been very restrained but the streets of Hong Kong are literally on fire and they will be forced to respond in the very near future.

This is week 17 and 1,753 protesters have been arrested and 4 have died (but all ruled suicides) and the police have used 2,731 cannisters of tear gas (I wonder who make that?) but demonstrations have gotten worse, not better and many protesters have sworn to die rather than surrender though, frankly, it's not very clear what it is they actually want.

This is week 17 and 1,753 protesters have been arrested and 4 have died (but all ruled suicides) and the police have used 2,731 cannisters of tear gas (I wonder who make that?) but demonstrations have gotten worse, not better and many protesters have sworn to die rather than surrender though, frankly, it's not very clear what it is they actually want.

It's become kind of a protest for protest's sake. Origninally, the protests were against having Hong Kong citizens extradited to China for trials – that's something I would have protested too, but Hong Kong withdrew that bill and the protesters won but now they want "More Democracy" and, as Americans, we're not really qualified to say what that even is anymore.

To a large extent, the problem is that Hong Kong is like San Francisco – it's been a magnet for radicals who left mainland China for the relative freedom of British rule for 100 years. Then, in 1997, England's lease ran out and the handover began and China wisely called for a 50-year transition so a whole generation could get used to the idea, but now we're at the halfway point and China has begun to exert a bit of authority and Hong Kong citizens are cying foul at any sign of Chinese encroachment into their lives.

89% of the people in Hong Kong insist they are not Chinese but "Hong Kongers" with only THREE (3) percent of people 18-29 identifiying as Chinese citizens – even though their passports say they are. Check out this video of students, who every day form a human chain that stretches for miles before they go to school, chanting and singing protest songs to start their day.

89% of the people in Hong Kong insist they are not Chinese but "Hong Kongers" with only THREE (3) percent of people 18-29 identifiying as Chinese citizens – even though their passports say they are. Check out this video of students, who every day form a human chain that stretches for miles before they go to school, chanting and singing protest songs to start their day.

At the same time as this is going on, the Chinese have to deal with an American President who is disrespecting their Government and its leaders. China will need to assert its authority somewhere, soon – and that's one of the reasons we went to CASH!!! into the 4th quarter – this is a bit too dangerous to predict.

Meanwhile, in America, we still cling to the hope that our Constitution protects us from tyranny so we mostly sit back complacenty, waiting for the wheels of justice to grind along and give us good Government without requiring any of us to get off the couch. Fortunately, we have a few idealists who still get out there to remind us that there is an out there – I know this for a fact because I saw it on Facebook and I did my part by clicking "Like"!

Meanwhile, in America, we still cling to the hope that our Constitution protects us from tyranny so we mostly sit back complacenty, waiting for the wheels of justice to grind along and give us good Government without requiring any of us to get off the couch. Fortunately, we have a few idealists who still get out there to remind us that there is an out there – I know this for a fact because I saw it on Facebook and I did my part by clicking "Like"!

Trump's impeachment is actually moving forward pretty quickly because Nancy Pelosi cleverly laid our the groundwork for it with a sweeping set or rule changes when the Democrats took control back in January in an operation called "Lawfare" to make sure they had a system in place that the Senate couldn't block and Trump couldn't wriggle out of, which is why Trump, last week, attempted to declare that Nancy Pelosi was no longer the Speaker of the House (NOT something he has control over).

"All" is a very good word to use when you fact GOP lawyers who look for any sort of ambiguity to deflect or delay legal actions. ALL is a very clear word and does not leave a lot of room for interpretation. This is where Team Trump is running into trouble as even the stuff they hid on "classified" servers are still fair game for the House to have a look at and ANY actions that violate the Constitution or Trump's Oath of Office are subject to extensive investigation.

So this isn't going away, no matter what you heard on Fox over the weekend…

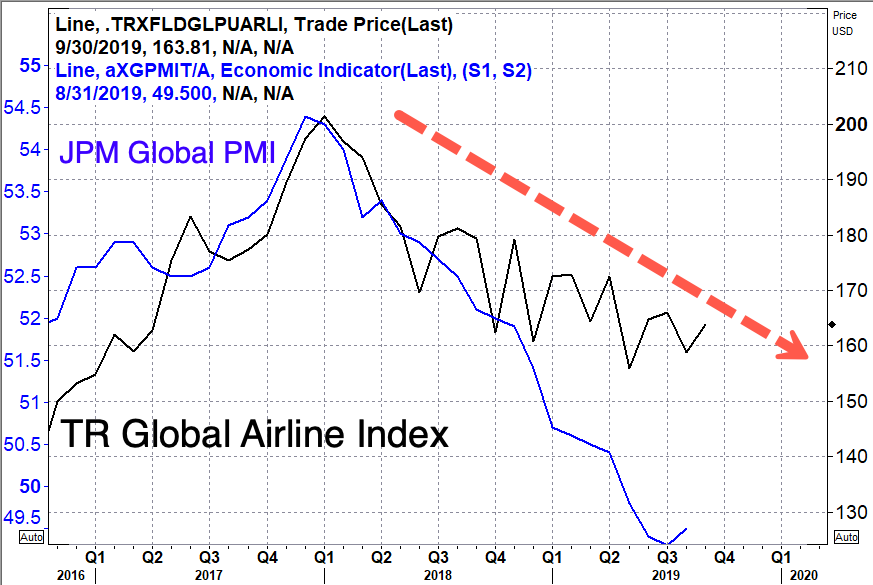

We just got a GDP Report on Thursday showing just 2% annual growth and, over the weekend, Los Angeles Airport (LAX) showed International Travel volumes down 3.1% from least year and Air Cargo Tonnage fell 8% in August and is now down 4.7% for the year – a very bad indicator of things to come of this trade war keeps dragging along. Contrary to what you have heard (again on Fox) the US is not immune to the Global Slowdown that is evident everywhere we look and gosh – this is such a flashback to my warnings of 2007 and 2008!

We just got a GDP Report on Thursday showing just 2% annual growth and, over the weekend, Los Angeles Airport (LAX) showed International Travel volumes down 3.1% from least year and Air Cargo Tonnage fell 8% in August and is now down 4.7% for the year – a very bad indicator of things to come of this trade war keeps dragging along. Contrary to what you have heard (again on Fox) the US is not immune to the Global Slowdown that is evident everywhere we look and gosh – this is such a flashback to my warnings of 2007 and 2008!

Trump made a comment about the US limiting investments in China and, over the weekend, China said "US investment curbs will have ‘significant repercussions" – doesn't sound like we're going to drop all that and come to terms in the next 30 days, does it? China's state-owned outlet criticized the move by the U.S. politicians, saying that they “seem to believe that a decoupling from China will be simple” and “won’t significantly impact its economy.”

Meanwhile, China’s top trade negotiator will be leading the country’s delegation to the U.S. for the next round of discussions one week after China’s National Holiday, Commerce Ministry Vice Minister Wang Shouwen said Sunday. “We look forward to the 13th round of negotiations,” Wang said in Mandarin, according to a CNBC translation. “We hope both sides, on the basis of equal and mutual respect, jointly take care of each other’s concerns and, with a calm attitude, use negotiations to resolve differences, and find a resolution that’s beneficial to both sides.” That and $5 will get you a Pumpkin Spiced Latte but don't hope for more…

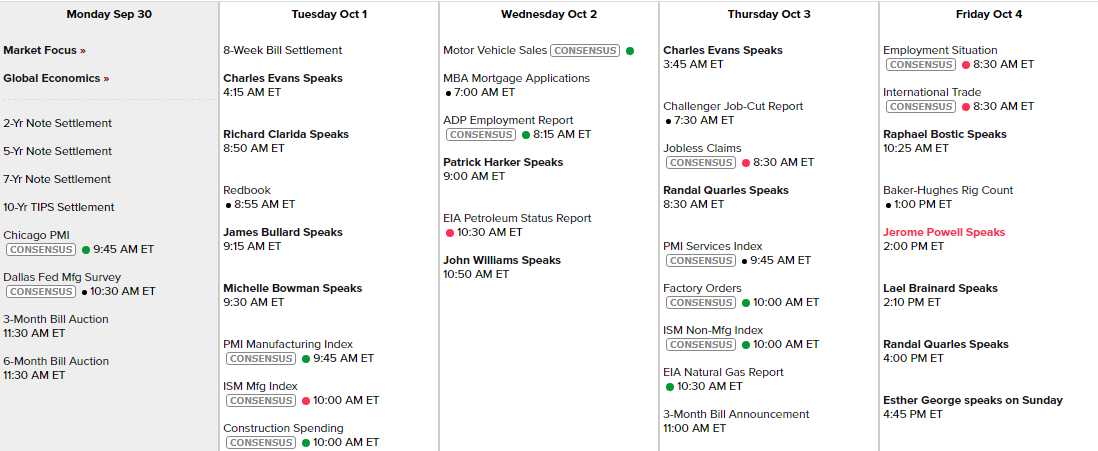

It's going to be another busy week of Fed speak with FIFTEEN (15) speaches in FOUR (4) days including Chaiman Powell on Friday at 2pm. Clearly the Fed is worried about something but not today – because it's the last day of the month and they can count on the Fund Managers to pump up the end of the quarter but we have Chicago PMI and the Dallas Fed this morning and tomorrow it's PMI, ISM and Construction Spending and, of course, Friday is Non-Farm Payrolls and that has been trending South, so 5 Fed Speakers on Friday to mop up that mess.