That's right, we're now expecting Trump to fix everything.

That's right, we're now expecting Trump to fix everything.

Well, at least fix trade and the markets are up another 1% this morning, now having recovered the vast majority of last week's drop in aniticipation of a Trade Deal with China (which is not going to happen) and Fed Rate Cuts (which certainly won't happen if we get a Trade Deal with China) and, of course, because the Global Economy is great and can only get better so why worry about paying all-time highs for stocks who are literally warning you that Q4 will have some "challenges"?

Of course, we're still in a situation where there's really nothing else to do with your money other than put it in US Equities. Bonds take your money, Banks take your money, Real Estate is still dicey, Bitcoin is hardly even a thing anymore, Oil has been decaying – not much left other than equities so we hold our noses and invest. Well, WE don't – we cashed out last month but that is what people seem to be doing. We're going to wait to see this round of earnings reports and guidance before we give our beautiful CASH!!! back to the markets.

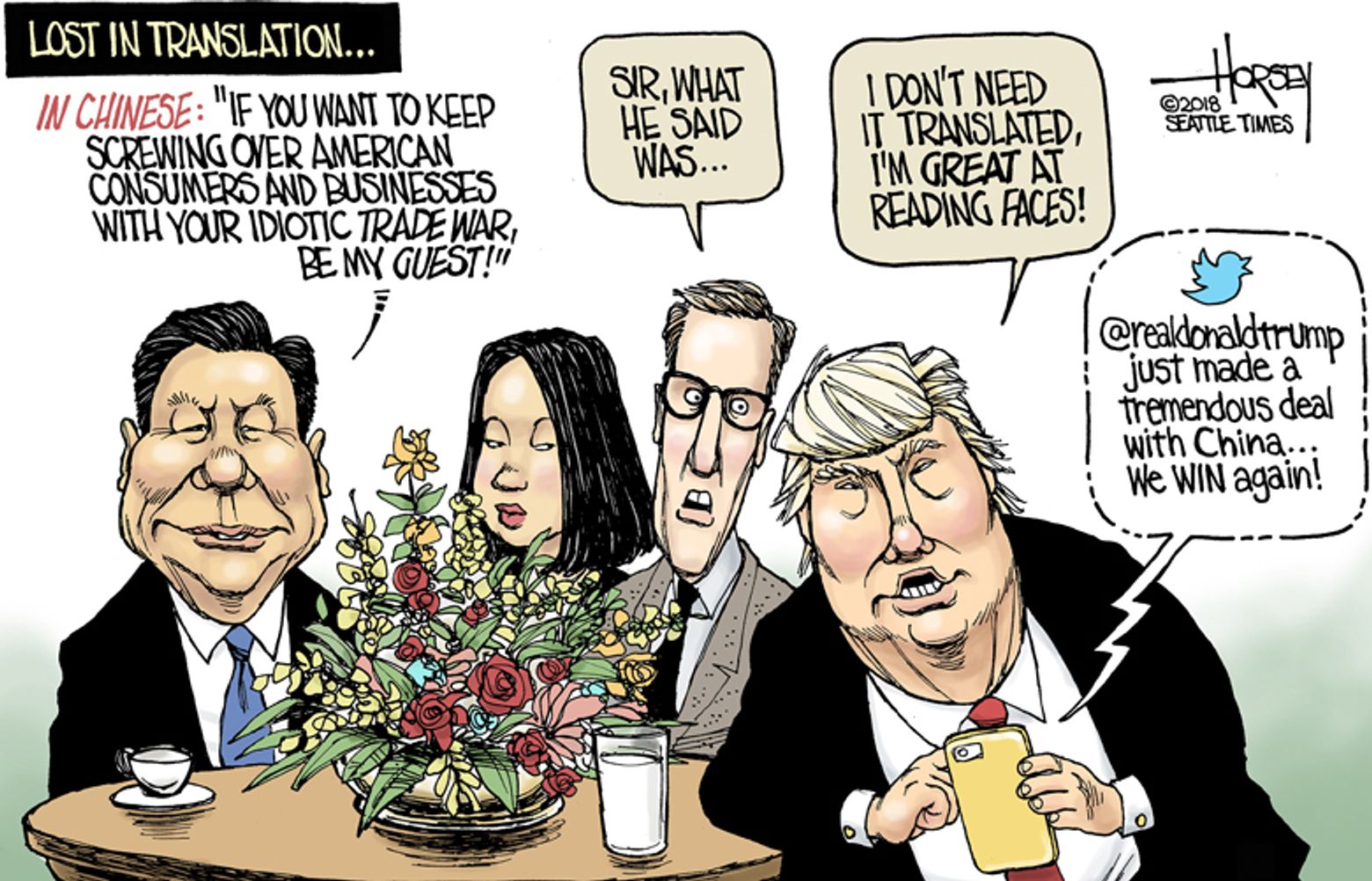

Yesterday, President Trump said day one of the Trade Talks went very well and, since we know Donald's a man of his word, the Futures have kicked into over-drive. The meeting Trump has with China's Vice Premier, Liu He, are not until 2:45 this afternoon so it seems impossible that an actual deal could be accomplished by the market close at 4pm so we'll go into the weekend without knowing for sure and it all could reverse before trading resumes on Monday – not the best premise I've ever heard – that's for sure!

If there is a trade deal, and even if there's not, we like Freeport-McMoRan down at $9 as they should rebound nicely if there is a trade deal and, even if there isn't, it's still a nice "buy and hold" over the long run.

Since we actually do want to own it for the long-term, we can add it to our Short-Term Portfolio for now and move it to the Long-Term Portfolio when we start it up again (probably November) but, for now, we can make the following play in our $100,000 Portfolio:

- Sell 5 FCX 2022 $10 puts for $2.90 ($1,450)

- Buy 10 FCX 2022 $5 calls for $4.50 ($4,500)

- Sell 10 FCX 2021 $10 calls for $1.50 ($1,500)

That's net $1,550 on the $5,000 spread but notice we bought 2022 longs and sold 2021 short calls so, if FCX does head over $10, we can roll the short calls to higher strikes in 2022 (the 2022 $12 calls are now $1.40) and potentially add another $2,000 to the spread's potential. As it stands, it's a relatively small commitment to buy 500 shares of FCX at $10, which is aggressive as it's over the current price but only $5,000 and this trade only uses $916 of orindary margin and will return $3,450 (222%) in profits if FCX is over $10 in Jan of 2022 – not a bad 2-year return on very little outlay!

We're jumping into FCX today because it will get away from us if there is an acutal trade deal and, if there's not, we'll be happy to double down to a larger position at a lower price and then wait, very patiently, for the trade issues to one day be resolved – even if it's by Elizabeth Warren in 2020 as there is pretty much no way Trump can be re-elected (assuming he isn't impeached first) if we go into those elections still in an economic war with China.

Whether all the illegal fundraising and election interference carried out by Giuliani's right-hand men will tie back directly to Donald Trump (who's personal attoney is Rudy Giuliani) is anyone's guess. Trump says he's innocent and disavows any knowledge of these men or the hundreds of thousands of Dollars they gave to his campaign – despite the fact that they were one of the largest donors to a super-pac Trump had formed – I'm sure it is all fine…

Parnas and Fruman were arrested at Dallas airport as they attempted to flee the country but fortunately, they were able to get Trump's former lawyer, John Dowd, to represent them despite the obvious conflicts of interest (assuming they are not all co-conspirators), which is nice because Dowd still has technical confidentiality regarding Trump – so probably no one has to be murdered to keep them silient this time.

“I don’t know those gentlemen,” Trump said Thursday when asked about the new charges, adding he hadn’t discussed them with Giuliani. However, Parnas and Fruman had dinner with Don Jr and then with President Trump at the White House in early May of 2018, shortly before they donated to the pro-Trump super PAC, according to since-deleted Facebook posts captured in a report published by the Organized Crime and Corruption Reporting Project, a nonprofit U.S.-based media organization.

“I don’t know those gentlemen,” Trump said Thursday when asked about the new charges, adding he hadn’t discussed them with Giuliani. However, Parnas and Fruman had dinner with Don Jr and then with President Trump at the White House in early May of 2018, shortly before they donated to the pro-Trump super PAC, according to since-deleted Facebook posts captured in a report published by the Organized Crime and Corruption Reporting Project, a nonprofit U.S.-based media organization.

Their political giving—aimed at Republicans—was funded in part by an unnamed Russian donor, the indictment alleges. Federal law bans foreigners from contributing to U.S. elections. A limited liability company created by the men was used to disguise the source of some of the money, the indictment alleges. In July, Parnas accompanied Giuliani to a breakfast meeting with Kurt Volker, then the U.S. special representative for Ukraine negotiations. The two had lunch with Giuliani at the Trump International Hotel in Washington on Wednesday, according to a person who was in the hotel and saw the three together – just before they attempted to leave the country.

Move along folks, nothing to see here…

Have a great weekend,

– Phil