Here we are again.

Here we are again.

The S&P 500 is back to 3,000, the Dow 27,000, Nasdaq 7,950 and Russell 1,550 so all is well(ish) for the moment. Earnings have been, so far, on track for most of our early reporting companies but notable misses from big companies like AA, GS, UNP and ERIC have kept investors slightly concerned while the economic reports have generally been trending down.

We'll see the Leading Economic Indicators Report at 10am but it doesn't really matter as we have Kaplan at 9, George and Kaplan at 10, Kashkari at 10:30, Clarida at 11:30 and Kaplan again at 5pm so whatever message Kaplan is selling is one the Fed is looking to make sure is repeated over and over again.

I'm not sure what they are doing with Kaplan as his 9am is supposedly in Washington, DC while his 10am is scheduled for Denver but he's an economist, not a physicist – so he probably doesn't know that's not physically possible… On Wednesday, Kaplan said the Fed was "actively debating issuing a digital currency" so BitCoin fans may want to pay attention to his speeches as well.

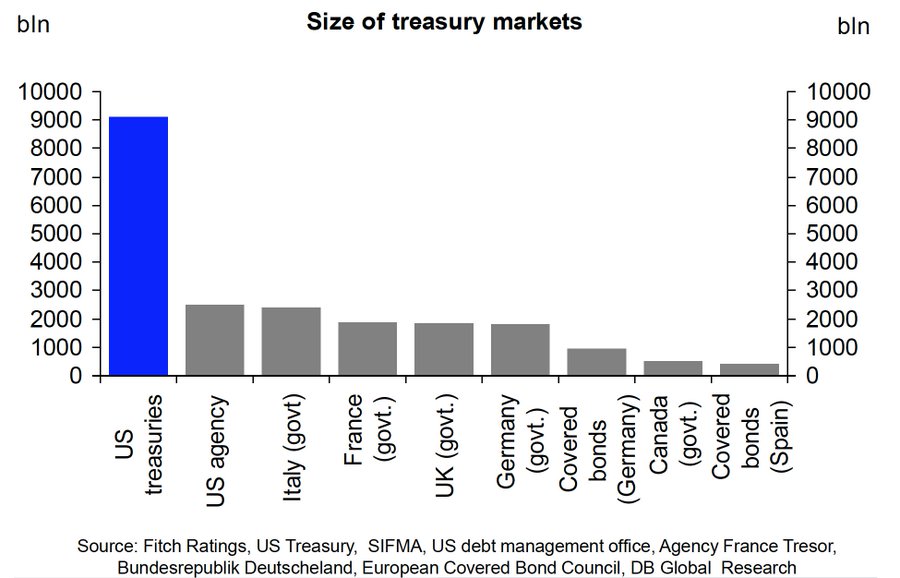

Kaplan also "admitted" what I've maintained for years – that the Fed's ZIRP policy is a reaction to the US Government's $23 TRILLION in debt because each 1% of interest paid on bonds now translates to $230Bn out of the Government's budget. Kaplan also noted: “People around the world are working real hard to try to find alternatives to dollars and dollar infrastructure because the more they’re invested in that, the more susceptible they are to sanctions, tariffs and what’s going on right now.”

Meanwhile, China's GDP dipped to 6% and that's the official number – it's probably really below 5%. That sent the Shanghai Composite 1.25% lower and that will be a drag on Global Markets into the weekend and again, I'm wondering what catalyst we now have to push us over the 3,000 line on the S&P and I'd still rather go short here than go long (/ES).

All the bullish boxes have been checked now – Earnings Beats, Brexit Deal, China Deal, Rate Cuts, Iran calmed down, Venezuela calmed down (by Putin), Impeachment already boring…. All these things have gone "right" in the past couple of weeks yet still we struggle to get over 3,000 on /ES. Why? Because 3,000 is still overvalued and we were ignoring the things that are now fixed anyway. If any of them subsequently go wrong – THEN we have trouble!

Have a great weekend,

– Phil