Courtesy of Pam Martens

WeWork is just one more in a long series of Wall Street scandals that prove that the universal banking model is little more than a thinly-disguised wealth transfer system from the pockets of average Americans to the 1 percent.

Just two months ago WeWork’s two lead Wall Street underwriters, JPMorgan Chase and Goldman Sachs, were planning to offer WeWork’s shares to the public investor at a valuation in excess of $47 billion. Now we are learning that the company may run out of money next month and has an actual valuation of $8 billion or less.

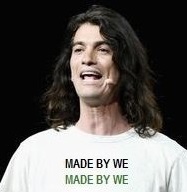

WeWork’s founder, Adam Neumann, who was attempting to cash out of his company that had never made a dime of profits in its nine years of existence and had run up losses of $900 million in just the first six months of this year, will walk away as a billionaire according to a report in the Wall Street Journal this morning. According to the Journal, the Japanese SoftBank is planning to take over the mess and plow in more billions in a private buyout. SoftBank already has $10.5 billion invested in WeWork so it is effectively doubling down on a bad trade – something that even rookie stockbrokers know better than to do.

The obvious questions are why did two seasoned underwriters agree to bring this dog of a company public; why did JPMorgan, pre-IPO, shower Neumann with more than $100 million in personal loans despite his egregious conflicts of interest with WeWork, a company it was planning to bring public; what does it say about the capital allocation process in the United States that this charade came so close to going public and when the ethically-challenged Neumann can walk away as a billionaire? Neumann was buying up real estate and then leasing it to WeWork. He also trademarked the name “The We Company” and sold it back to the company for $5.9 million. (The money was returned after the deal was reported in the media.)

Goldman Sachs and JPMorgan Chase are known as “universal” banks. Each is the owner of a commercial bank which takes in federally-insured deposits from moms and pops across America while also owning an investment bank that underwrites and trades in high risk stock and bond offerings. That is a combustible mix that is completely incompatible with U.S. statutory mandates for the “safety and soundness” of commercial banks whose deposits are backstopped by the U.S. taxpayer.

…