Now China is saying they doubt there will be a Trade Deal.

Now China is saying they doubt there will be a Trade Deal.

China's agreement to buy $50Bn worth of farm products did not have a specified time frame in the first place. They historically buy about $24Bn a year so there's little chance, even logistically, that they could buy another $50Bn in a single year or two years. We do not, in fact, even have an extra $50Bn worth of products sitting around – we'd have to divert products we sell to other countries to China – which would be idiotic. Of course, you can never get a straight answer out of the Trump Administration but analysts have noted that China's farm purchases have already dropped to $9.1Bn during the trade war so simply going back to the old levels lets Trump claim he "added" $15Bn a year to what they were buying – smart!

.1565052056249.png)

The devil is clearly in the details and we were supposed to get details at the APEC Conference in Chile on Nov 17th but that's been cancelled due to riots (people like to eat) but it turns out China has been walking back the idea of signing a deal with Trump all of last week and, for their part, China never said anything about $50Bn in the first place – that was pure Trump fiction from a rally on the 11th, in which he told the crowd how his advisers wanted him to accept $20Bn but Trump heroically said "No, make it $50Bn!" and China immediately bent over and accepted his terms. That's how it played out in Trump's head…

This renewed uncertainty is ruining Powell's Rate Party as the Fed did indeed cut rates another 0.25% yesterday, to 1.5% sending the Treasury ETF (TLT) back to our shorting zone above $140. The last Fed Meeting of the Year is Dec 11th and it's doubtful they cut rates again but, more importantly, the minutes to this meeting should be out around Nov 21st and we doubt the bond bulls will find much to love there. In our Short-Term Portfolio (STP), we can add:

- Buy 10 TLT Jan $148 puts at $8.75 ($8,750)

- Sell 10 TLT Jan $140 puts at $3 ($3,000)

- Sell 10 TLT June $145 calls at $3.50 ($3,500)

That's net $2,250 on the $8,000 spread so $5,750 (255%) upside potential if TLT is back below $140 at the June expiration. Our worst case is we end up short 1,000 shares of TLT at $145, which would be miles above the historical average of 85. Rates in the US would have to go negative next year for us to sustain this level on TLT – it's not likely to happen as most countries are now pushing back on negative rates.

Still, we're at an all-time high on the S&P and we're likely to hold up into the weekend so things look bullish and the President yesterday called this "The Greatest Economy in American History":

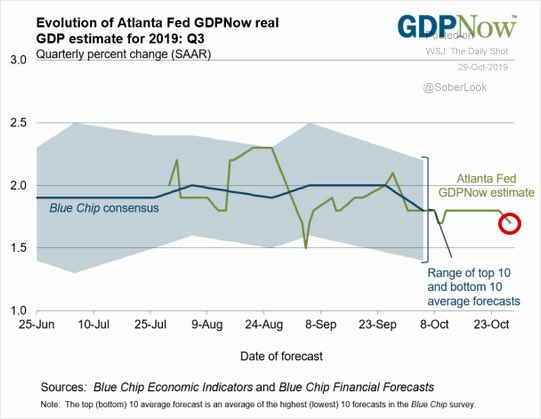

That was the day after the Atlanta Fed's GDP forecast was lowered to 1.7%:

Thank goodness President Trump doesn't have Donald J. Trump to worry about because that guy would have called him out on his BS "growth":

Take your pick!