Another day near 3,100 on the S&P.

Another day near 3,100 on the S&P.

Kentucky seems to have voted Democrat Andy Bshaear to be the new Governor but current Governor, Matt Bevin refuses to concede, so that will drag on all day and maybe longer. In Virginia, however, Democrats completely flipped the state blue, taking over the Senate and the House in a state that had been dependably Republican. These are not good signs for the GOP in November or Trump now as Bevin was a huge Trump supporter and Trump personally flew down there and campaigned hard for him Monday night.

If GOP Senators, Congresspeople and Governors find no use for Trump's support – it's not a great leap to imagining they will find no use for Trump and his unbreakable wall of GOP impeachment blockers may begin to crumble. Kentucky is Mitch McConnell's home state and "Moscow Mitch" only won 2014 56% to 40% against a throw-away candidate for the Dems (Alison Grimes). Bevin won in 2015 52.5% to 43.8% and is out on his ass today – Mitch is getting nervous to say the least – as he hasn't had a real job since 1985.

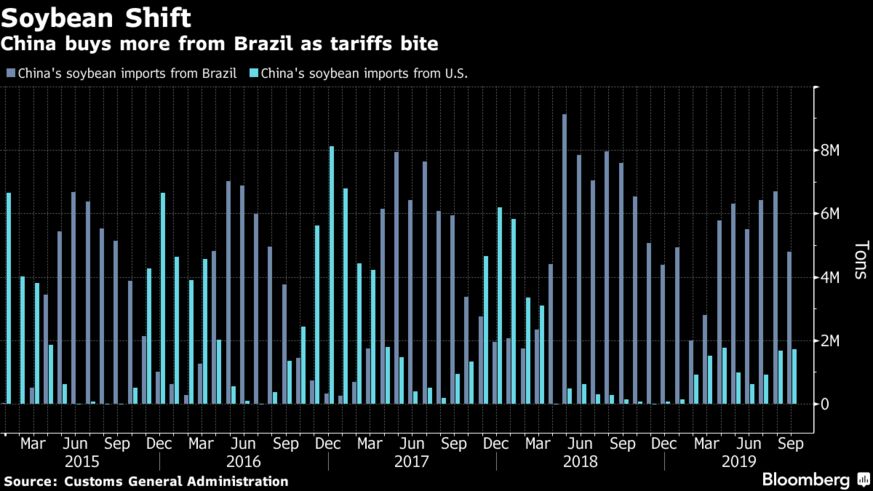

Meanwhile, according to Bloomberg's excellent new "Terms of Trade" section (and according to me yesterday), China is insisting Trump drop all tariffs in order to move forward with the signing Trump is promising on Nov 17th. In other words, there is no actual deal and Trump's lying to the American People and claiming there is one has now painted the US into a corner where Trump will be forced to concede to China in order to cover up his lies – that's why these things matter!

Meanwhile, according to Bloomberg's excellent new "Terms of Trade" section (and according to me yesterday), China is insisting Trump drop all tariffs in order to move forward with the signing Trump is promising on Nov 17th. In other words, there is no actual deal and Trump's lying to the American People and claiming there is one has now painted the US into a corner where Trump will be forced to concede to China in order to cover up his lies – that's why these things matter!

From the Chinese perspective, the argument is that if they are going to remove one big point of leverage and resume purchases of American farm goods and make new commitments to crack down on intellectual property theft — the key elements of the interim deal — then they want to see equivalent moves to remove tariffs by the U.S. rather than the simple lifting of the threat of future duties.

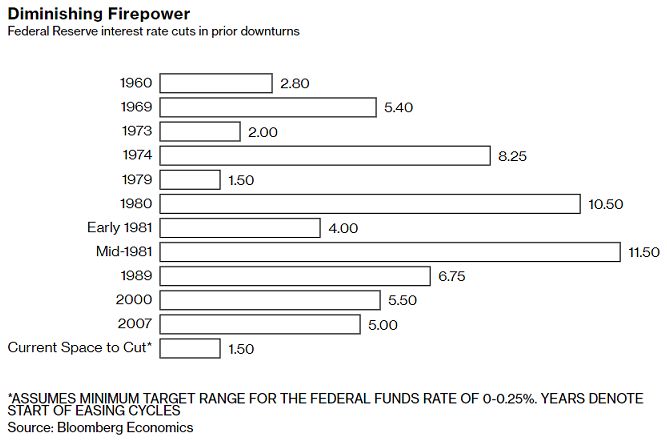

Also according to Bloomberg, the risk of a US Recession in 2020 has dropped from 50% to 26% in the past few months and that's a pretty consistent message we're getting in the MSM. However, one has to wonder if it's just the manipulation of the Top 1% media owners who need bottom 99% bag-holders to come back and take these stocks off their hands at record highs.

Also according to Bloomberg, the risk of a US Recession in 2020 has dropped from 50% to 26% in the past few months and that's a pretty consistent message we're getting in the MSM. However, one has to wonder if it's just the manipulation of the Top 1% media owners who need bottom 99% bag-holders to come back and take these stocks off their hands at record highs.

As you can see from this chart, the Fed is in no position to save us and, according to the WSJ, investors (like us) have put $3.4Tn into CASH!!! and Wall Street is pulling out all the stops to convince us it's safe to get back in the water and buy those stocks at all-time highs because of course they are only going to go higher – tha'ts what stocks do – right?

Investors said the rising cash reserves reflect several worries that have become prevalent among money managers over recent months, as flare-ups in the trade war with China and uneven U.S. data sparked bouts of volatility in markets. Many are concerned that stock prices have climbed to unsustainable levels relative to companies’ earnings at a time when the U.S. economy is slowing.

Sandy Villere, portfolio manager at the $2 billion Villere Balanced Fund, is keeping 17% of his portfolio as cash, up from the usual 10%. Mr. Villere believes valuations have become stretched and prefers to wait for another dip before jumping in again. “We don’t have to swing at every pitch,” said Mr. Villere, who added two new stockholdings to his portfolio when markets slid last December. “Right now, we’re struggling to find high quality at reasonable prices.”

That's pretty much what I've been saying to our Members.

Be careful out there…