Wow.

Wow.

I mean WOW! Check out the headline on the front page of today's Wall Street Journal. Is it really "news" to say the same thing, over and over again for month after month? I guess it is news to traders because, once again, we're up in pre-market trading. This is just what we were talking about yesterday, MADNESS!

I guess it helps distract Conservative readers from the headline in the NY Times that says: "Impeachment Inquiry Tests Ties Between Barr and Trump" as it turns out Trump put pressure on Barr to make an official statement that his Ukraine call was "perfect" but Barr refused to say the President did not commit a crime when Trump demanded the Ukraine launch an investigation of Joe Biden and his son in exchange for the military aid Congress had already approved for our NATO allies in the Ukraine.

Mr. Trump on Thursday angrily denied a report in The Washington Post, which was confirmed by The New York Times, that he wanted Mr. Barr to hold a news conference to say that the president had broken no laws, only to be rebuffed by the attorney general. In a Twitter post, Mr. Trump called The Post’s article “pure fiction,” adding: “We both deny this story, which they knew before they wrote it. A garbage newspaper!” Mr. Barr, however, did not publicly deny the account.

Perhaps if Trump hadn't already had Barr make a fool of himself attempting to exhonerate the President in the Meuller Report, Trump would still have some political capital to spend but the sheer volume of scandals surrounding the President makes it hard for Barr to be the point man defending every crime – lest he himself become an impeachable obstructor.

Perhaps if Trump hadn't already had Barr make a fool of himself attempting to exhonerate the President in the Meuller Report, Trump would still have some political capital to spend but the sheer volume of scandals surrounding the President makes it hard for Barr to be the point man defending every crime – lest he himself become an impeachable obstructor.

Barr is getting into hot water as he's been in the loop as half the witnesses called by the House Committee investigating the matter have refused to testify. Failure to answer a Congressional subpeona is a jailable offense but, so far, the House is just skipping ahead to the next witness and will re-call the dodgers next week in the public hearings so they can publically defy Congress and then there will be an investigation as to whether Barr and the President encouraged them to ignore the subpeonas – another impeachable charge of obstruction.

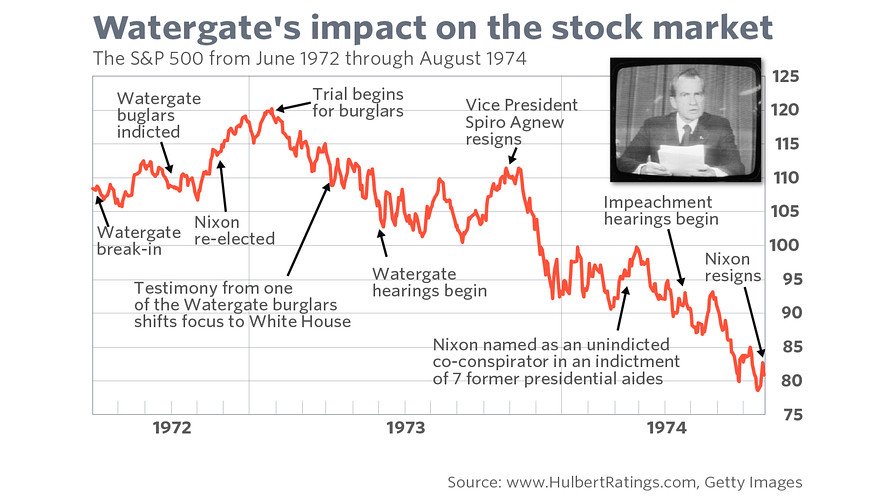

I know none of this seems to matter to the stock market but, as I have warned before, the Watergate Hearings began in May of 1973, almost a year after the actual break-in and Nixon wasn't officially indicted until March of 1974 and the market thought it wouldn't actually happen and was back close to it's 1972 highs but once the hearings actually began – the market dropped 20% in short order.

It kept falling, all the way to 60 after Nixon finall resigned in Aug of 1974, 50% off the highs. To distract America from the hearings, Nixon went so far as to end the war in Vietnam but it was too little, too late – much like the China Trade Deal – if it happens at all. So far, our markets have completely ignored the political turmoil and have soared to new highs and maybe it doesn't matter if the President is indicted and removed from office and our Government is in turmoil heading into next year's election.

But maybe it does matter and we should continue to be cautious – just in case….

Have a great weekend,

– Phil