And now there's no trade deal – again.

And now there's no trade deal – again.

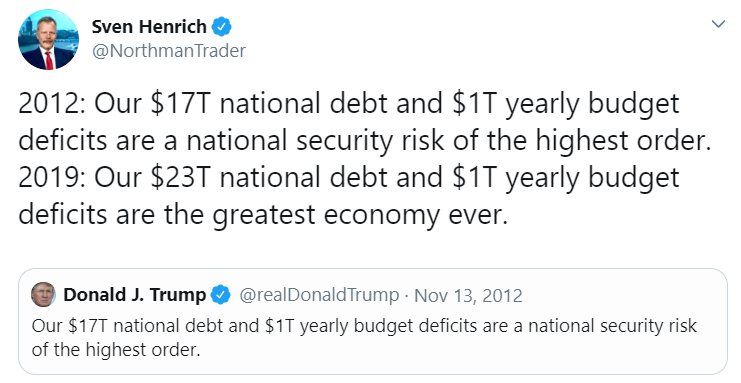

Keep in mind that, a month ago, we were told the deal was ready to sign and it amazes me that, almost every day, the Financial Media carries articles that say "President Trump Says Great Progress Being Made" as that's like running headlines saying "Boy Who Cried "Wolf" Says There's a Wolf". Are we seriously that dumb? Apparently, you can fool some of the people ALL of the time because someone is that dumb and the market rallies EVERY SINGLE TIME on the same news it rallied about last time.

Remember, all Trump even promised was a LIMITED deal, a part one of 5 or whatever because there was no way they could even pretend to be close on an overall deal. In fact, 100 Economists polled by Reuters don't expect a real trade truce until 2021 – let alone next week. While the median probability of a Recession for the coming year fell to 25% from 35% last month, the Economic Growth outlook remained modest.

Over 80% of 52 respondents to an additional question said the Fed had done enough to delay the next recession but that already-modest growth forecasts were largely left unchanged. "I think in terms of the risks, they are probably still tilted towards the Fed maybe cutting rates once more at some point in the coming months if growth slows further, certainly if there is some renewed breakdown in trade talks," said Andrew Hunter, senior U.S. economist at Capital Economics. "But barring that, it does look like they have done enough to avert a recession. In our baseline forecast, there is growth slowing a little bit further over the next couple of quarters but starting to recover next year."

I gave my own Economic Forecast last night on Money Talk, embracing the uncertainty:

As you can see, the NYSE has indeed been drifting along under the 13,500 line for two years after breaching it early in 2018. The NYSE is the broader-market index and is less influenced by a few high-flying stocks and gives us a much more realistic view of real market performance than the more selected (and curated) indexes. After all, don't forget that, in the last 5 years, the Dow kicked out AA, BAC, HP, T and GE and replaced them with GS, NKE, V, AAPL and WBA. Apple alone, since joining the Dow in 2015, has gained $145 and at 8.5 Dow points per Dollar – that's 1,232.5 added to the Dow by AAPL alone (vs T, who are up $6 over the same period).

As you can see, the NYSE has indeed been drifting along under the 13,500 line for two years after breaching it early in 2018. The NYSE is the broader-market index and is less influenced by a few high-flying stocks and gives us a much more realistic view of real market performance than the more selected (and curated) indexes. After all, don't forget that, in the last 5 years, the Dow kicked out AA, BAC, HP, T and GE and replaced them with GS, NKE, V, AAPL and WBA. Apple alone, since joining the Dow in 2015, has gained $145 and at 8.5 Dow points per Dollar – that's 1,232.5 added to the Dow by AAPL alone (vs T, who are up $6 over the same period).

The same thing happens in the S&P, the Nasdaq and the Russell all the time as they frequently re-balance by tossing out underperformers for whatever is new and hot. Of course, that's what you should do with your portfolio and it makes a good case for using index funds but the main point is – it DOES NOT tell you the "health" of the economy – the indexes are a measure of how top-performing stocks are doing – nothing more.

In my next segment on Money Talk, I discussed the value plays we did like for our new Money Talk Portfolio:

Officially (as previewed in yesterday's Morning Report), our first 3 trade ideas for the new Money Talk Portfolio are:

- Sell 4 IBM 2022 $135 puts for $20 ($8,000)

- Buy 8 IBM 2022 $120 calls for $23 ($18,400)

- Sell 8 IBM 2022 $140 calls for $12 ($9,600)

IBM is down a bit this morning so it shold be easy to fill.

- Sell 10 SPWR 2022 $8 puts for $3 ($3,000)

SPWR is also lower, so should be easy to fill.

- Sell 15 GOLD 2022 $17 puts for $3.50 ($5,250)

- Buy 30 GOLD 2022 $13 calls for $5 ($15,000)

- Sell 30 GOLD 2022 $17 calls for $3 ($9,000)

GOLD is up a bit but the spread should be the same net $2 ($5.35/$3.33 was the last on each) and you can wait for a dip on the put sale or just sell 5 at $3+ and see what happens. If you never get the fill, then the spread is in the money and your net would be $4,500 on the $12,000 spread and that's still $7,500 (166%) upside for a spread that was never in danger. Any time it goes lower over the next 2 years you can sell the puts – so no reason to take less than our target.

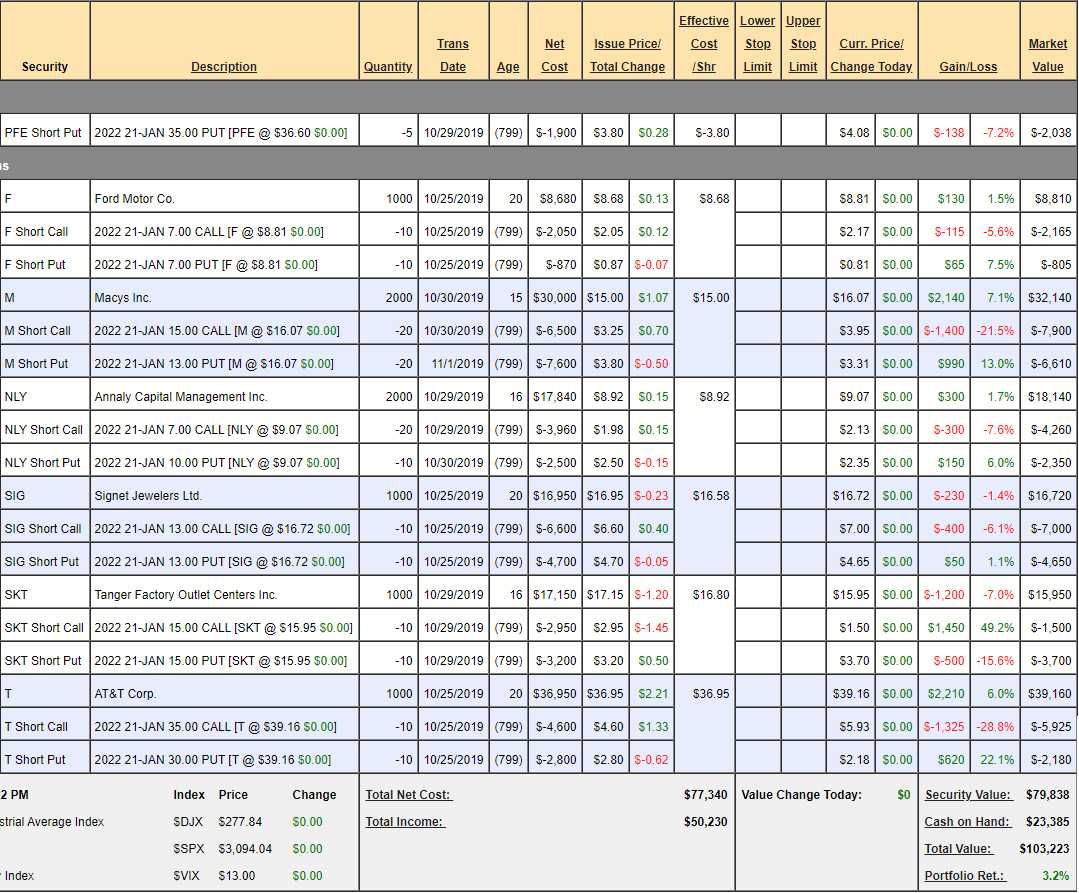

See, trading isn't hard, is it? That's why we gained 148% in two years in the prior Money Talk Portfolio – we take lots of small plays that have big pay-offs. The Dividend Portfolio, on the other hand, is like pulling teeth. It's only designed to make about 15-20% a year and it's right on track up 3.2% in the first month but YAWN!!!

Of course, INVESTING is not supposed to be Gambling, is it? This is the sort of thing you should be doing with the bulk of your money – INVESTING in nice, safe, steady, dividend-paying stocks that will SLOWLY but surely, build your wealth over time. We're only using $17,500 in margin at the moment so, over time, we'll likely double the number of positions and goose our returns but, for now, this will do just fine – though I very much doubt we'll average 3% a month – we just happened to make good picks to start.

And that is what it's all about – stock picking. In any kind of market environment, there are stocks that are likely to perform well going forward but it takes a lot of hard work and even more PATIENCE to identify them AND make a good entry. That's why we have our Watch List – which we went over in yesterday's Live Trading Webinar (replay here).