Larry Kudlow says things are going great!

Larry Kudlow says things are going great!

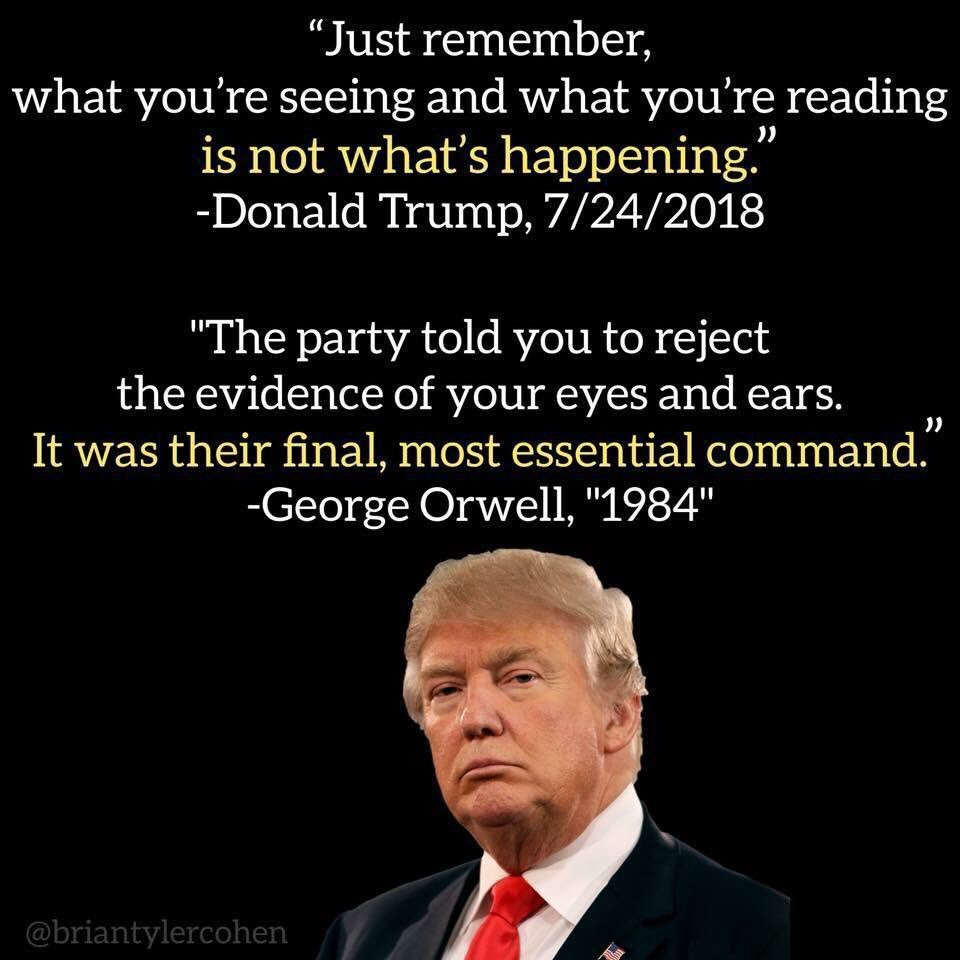

That's enough to pop the indexes another half a point overnight because there is ALWAYS about to be a trade deal with China and we ALWAYS celebrate it as if it's a surprise party – over and over again. As George Orwell said:

"And if all others accepted the lie which the Party imposed -if all records told the same tale — then the lie passed into history and became truth. Who controls the past,' ran the Party slogan, 'controls the future: who controls the present controls the past. And yet the past, though of its nature alterable, never had been altered. Whatever was true now was true from everlasting to everlasting. It was quite simple. All that was needed was an unending series of victories over your own memory. 'Reality control', they called it: in Newspeak, 'doublethink'."

You need to read 1984 to understand the current political climate in the US, where the (Grand Old) Party practices constant Doublespeak and is always rewriting the past. "If you tell a lie often enough, it becomes the truth" is another basic tenet of modern propaganda and it's no coincidence the Orwell worked for the British Propaganda Office in the Spanish Wars and WWII as he imagined a society where the truth was subject to change at the whims of whichever party controlled the media – which would become so invastive that there was a screen in every room – watching you as much as you were watching it.

Even Orwell never imagined we'd actually be forced to carry screens with us at all times AND that they would add a microphone AND a GPS tracker AND transaction tracking – so "THEY" would know what we were doing every second of every day. Gosh, they even track our heart-rates now!

Even Orwell never imagined we'd actually be forced to carry screens with us at all times AND that they would add a microphone AND a GPS tracker AND transaction tracking – so "THEY" would know what we were doing every second of every day. Gosh, they even track our heart-rates now!

“But what is peculiar to our own age,” Orwell wrote, “is the abandonment of the idea that history could be truthfully written”; that there is a “body… of neutral fact on which neither [historian] would seriously challenge the other.” ?

So we can accept the party's lies and all be good citizens. The good citizens of Oceana had jobs and enjoyed their rations and they hated the enemy of the moment (whoever the Government chose) and they cheered the economic reports, which always managed to beat the expectations that were lowered just before the reports came out. It was best not to think about it. Actually – it was a crime TO think about it...

Speaking of crimes, no big excitement from the first two days of impeachment testimony. We already know Trump did it and the witnesses are confirming Trump did it, so it's all very boring hearing different versions of how Trump did it.

Speaking of crimes, no big excitement from the first two days of impeachment testimony. We already know Trump did it and the witnesses are confirming Trump did it, so it's all very boring hearing different versions of how Trump did it.

As long as they can keep us distracted with constant "trade wins" (and now the deal is broken up into 5 parts – so this will drag on for a year) – we'll always have Party victories to celebrate and distract us from any unpleasantness – untill they can spin their scandals into triumphs once again.

It's all very fascinating to watch – I just wish it were happening somewhere else…

Have a great weekend,

– Phil