500,000 Jobs!

500,000 Jobs!

That's the NEGATIVE "adjustment" we're going to see in the prior year (March 2018-2019) Non-Farm Payroll report according to the BLS, when they announce their revision in February. That means that the average job reports have been exaggerated by 40,000 jobs per month. That's a staggering number – it's a number so large it's never happened before – yet not a peep about it in most of the MSM? One of the most critical data reports we get in the US is overstated by an average of 20% per month!

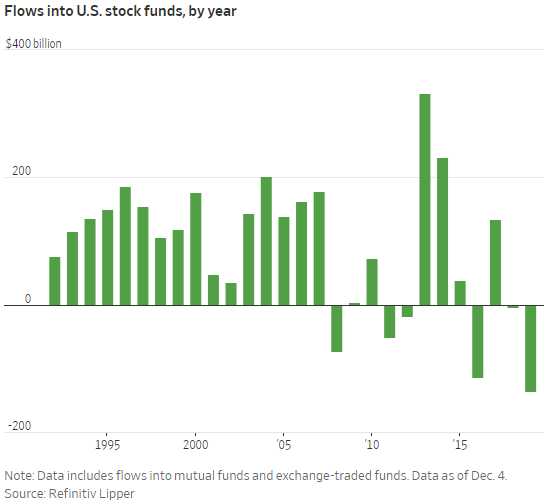

None of this, of course, makes any difference to Traders, who are still paying whatever price the market gets marked up to – even while Investors (who are NOT traders) pulled $135.5Bn OUT of the US market so far this year – more than they pulled out in 2001, 2008, 2009 or any other year on record – EVER!

As you can see from the chart, this is no small event and now it's 3 of the last 4 years that money has flowed OUT of the market – even as the market has gotten more and more expensive for those that stayed in it. We got out in September – cashing in our bloated Member Portfolios and we've only put a small amount of that cash back to work since and perhaps we're being overly cautious but a chart likes this makes me think we're not being cautious enough.

Analysts say the trend highlights investors’ apprehension toward a stock market buffeted by the long-running U.S.-China trade war and lingering worries about a potential recession. Stock funds have bled money over seven consecutive quarters, dating to the second quarter of 2018—when trade tensions between the U.S. and China ratcheted higher. As much of this money floods into Treasuries, it's also a key factor in keeping rates down (so far, with higher note prices indicating lower rates).

All this can reverse in a heartbeat and that would be very inflationary, potentially caused by a Trade Deal with China, which could have people running out of bonds and back into the market. That means we can certainly expect to see some "Secret Santa's Inflation Hedges" for 2020. We haven't done those since 2017 as there hasn't been any inflation pressure but I think 2020 might be our year and GOLD is already our Trade of the Year for 2020.

Not only are outflows tremendous but the biggest buyer of US Stocks is still US Corporations, companies buying back their own stocks at ever-spiraling prices – accounting for +$480Bn of the -$135.5Bn of total flows. Without them, the S&P would be lucky to be at 2,000 – let alone 3,000! companies can’t sustain the pace of those buybacks, leaving the market potentially vulnerable if other investors don’t pick up the slack. Corporate demand for equities is already down 20% from last year, Goldman said, as tepid earnings growth, along with trade and political uncertainty, have led companies to trim their spending.

Not only are outflows tremendous but the biggest buyer of US Stocks is still US Corporations, companies buying back their own stocks at ever-spiraling prices – accounting for +$480Bn of the -$135.5Bn of total flows. Without them, the S&P would be lucky to be at 2,000 – let alone 3,000! companies can’t sustain the pace of those buybacks, leaving the market potentially vulnerable if other investors don’t pick up the slack. Corporate demand for equities is already down 20% from last year, Goldman said, as tepid earnings growth, along with trade and political uncertainty, have led companies to trim their spending.

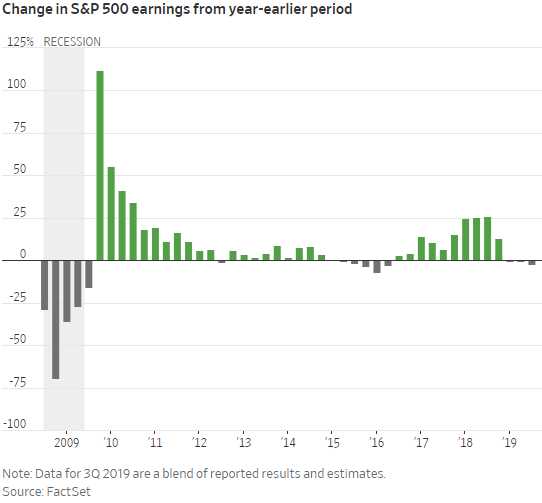

Actually, tepid isn't the right word as earnings for all 3 reported quarters this were lower than they were last year and that means we are looking at a potential recession in the next couple of years but, again, Traders DO NOT SEEM TO CARE! 72% of NABE Economists are expecting a Recession by the end of 2021, Goldman Sachs says EVERY SINGLE ONE of their Private Equity clients are preparing for a recession and Morgan Stanley Wealth Management sees the S&P 500 potentially ending 2020 at 2,750, so please forgive me if I keep hammering this point home to my readers but, for a change, I don't think Goldman Sachs is wrong…

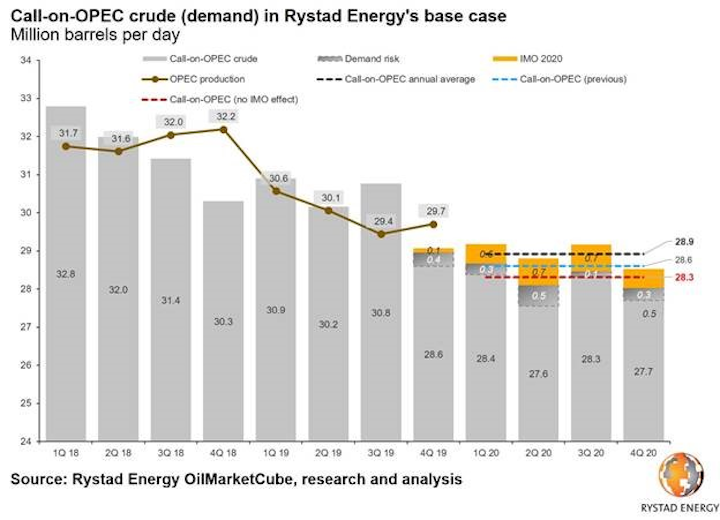

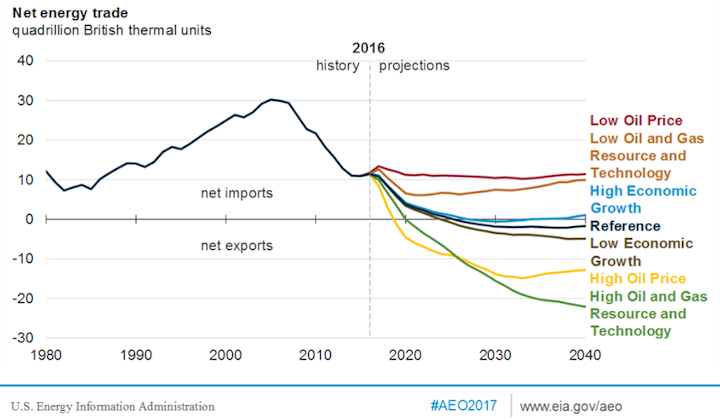

They are wrong about oil though. This weekend, Goldman raised their 2020 Forecasts on oil to $63 on Brent ($55ish on WTIC) from $60 because OPEC+ agreed to bigger than expected output cuts. I say that's silly because now OPEC has about 3Mb/day of spare capacity – so why should there be a risk premium in oil as there's almost no possible disruption that can lower the actual availability of oil?

They are wrong about oil though. This weekend, Goldman raised their 2020 Forecasts on oil to $63 on Brent ($55ish on WTIC) from $60 because OPEC+ agreed to bigger than expected output cuts. I say that's silly because now OPEC has about 3Mb/day of spare capacity – so why should there be a risk premium in oil as there's almost no possible disruption that can lower the actual availability of oil?

Imagine you have 6 Slurpee Machines with 3 flavors each and one of the flavors is Lime and it's not selling well so OPEC agrees to turn off the Lime in 2 of their 6 machines – hoping to increase the selling price. Will that make the price of Lime go up? Will it make Lime even seem scarce? You hardly ever see Pina Colada Slurpees but, when you do, you don't whip out your credit card and start bidding do you? No, because you don't want Pina Colada, you want Coke! Everyone wants Coke – that's why they are always out of Coke!

Oil is not Coke but there are tasty alternatives like Natural Gas and Electricity and Hydrogen and, as you can see from the above chart, Oil is starting to look like Lime, with demand down more (3.5Mb) than they are cutting – so there's still a glut and demand goes down by 18 more barrels every time someone trades in a 20 mpg car for an electric car (really, do the math!).

Tesla is delivering 400,000 cars in 2019 – there's 7.2M barrels of oil that won't be needed anymore but, even worse for OPEC is that EVERY new car gets an average of 35 mpg and that uses 44% less gasline than their old car that gets 20 mpg and we're selling 17M cars a year in the US alone and 90M world-wide so if 90M old cars used 1.6B barrels to go 15,000 miles each (40 gallons/barrel) then, at 35 mpg, the new cars only need 964M barrles – 700M barrels less PER YEAR and OPEC has, so far, only finally stated cutting 3Mb/d (1.1Bn barrels) this year but the problem just keeps getting worse and worse and worse for them – every time a new car is sold…

These are good charts. It also means $84Bn per year back in the pockets of new car buyers (about $1,000 each) to spend in their own countries instead of sending them out to OPEC and other big oil companies – who are surely rich enough already. Actually, the Saudi Royals depend on Aramco to provide for their lavish lifestyles and so do their people – who don't really have a lot of other industries – as they never thought this oil party was ever going to end. We'll have to watch that situation closely.

Of course, civil unrest in Hong Kong, Chile, Argentina, Iraq, Iran… also doesn't seem to bother traders. Much like 2007 – NOTHING seems to bother traders – until it does…