That was the advice given to Watergate reporters Woodward and Bernstein by their source "Deep Throat" (don't Google that!) suggesting that political corruption can be brought to light by examining money transfers between parties. The Trump Administration took in $7.2Bn in tariffs in the form of taxes paid by American Consumers and Companies in October alone. That number will increase to over $10Bn/month if Trump goes through with his threat to add more Tariffs at the Sunday night deadline.

“According to an analysis of data from the President’s own Department of Commerce, American businesses, farmers and consumers – and not China – have paid $42 billion in additional taxes because of these tariffs,” stated Americans for Free Trade spokesperson Jonathan Gold. “Yet even when faced with this staggering number, it’s still unclear whether the president will follow through with his threat to raise taxes yet again on December 15th with another rounds of tariffs, this time on primarily consumer-facing products like toys and consumer electronics.

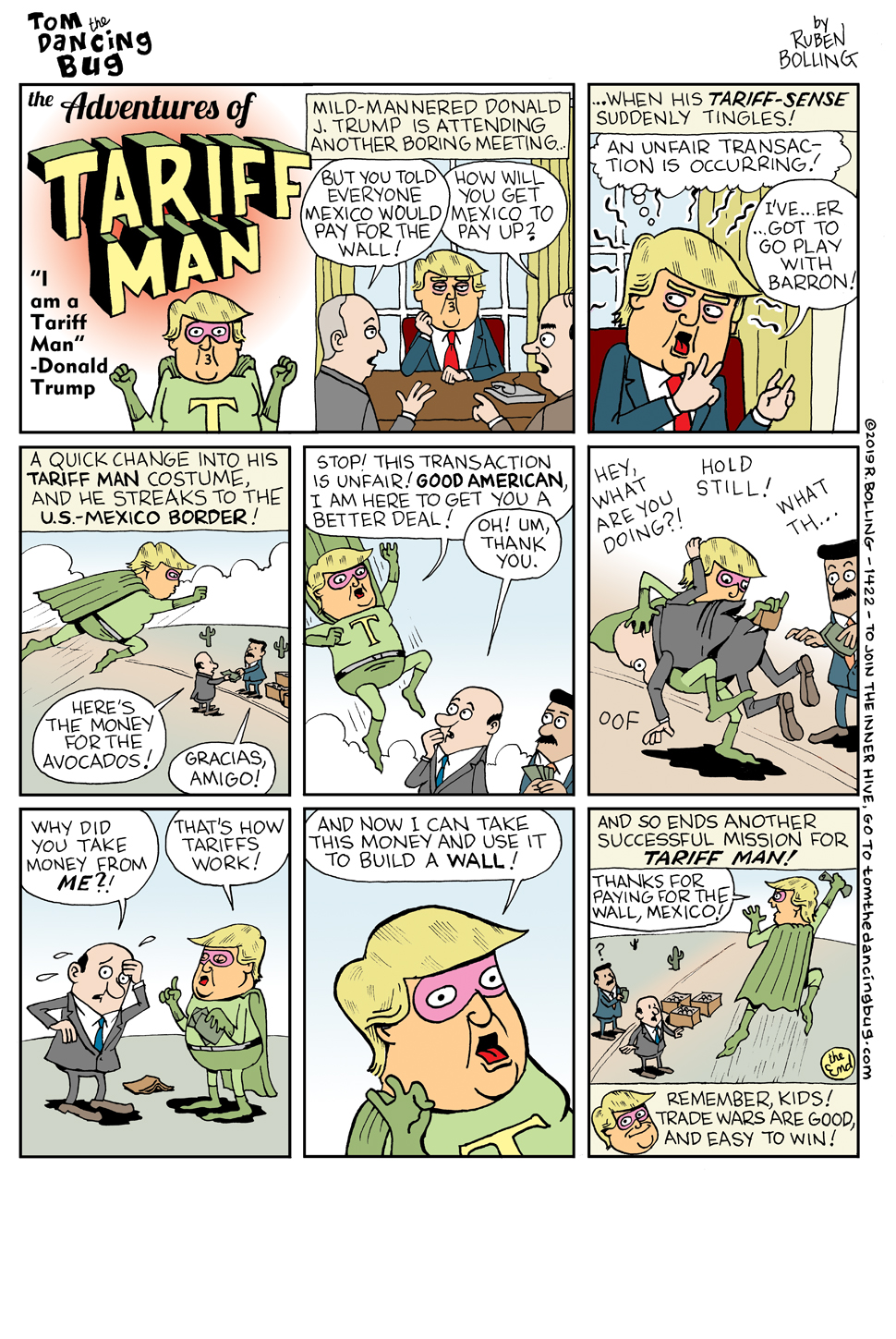

China’s government and companies in China do not pay tariffs directly. Tariffs are a tax on imports. They are paid by U.S.-registered firms to U.S. customs for the goods they import into the United States. Importers often pass the costs of tariffs on to customers – manufacturers and consumers in the United States – by raising their prices.

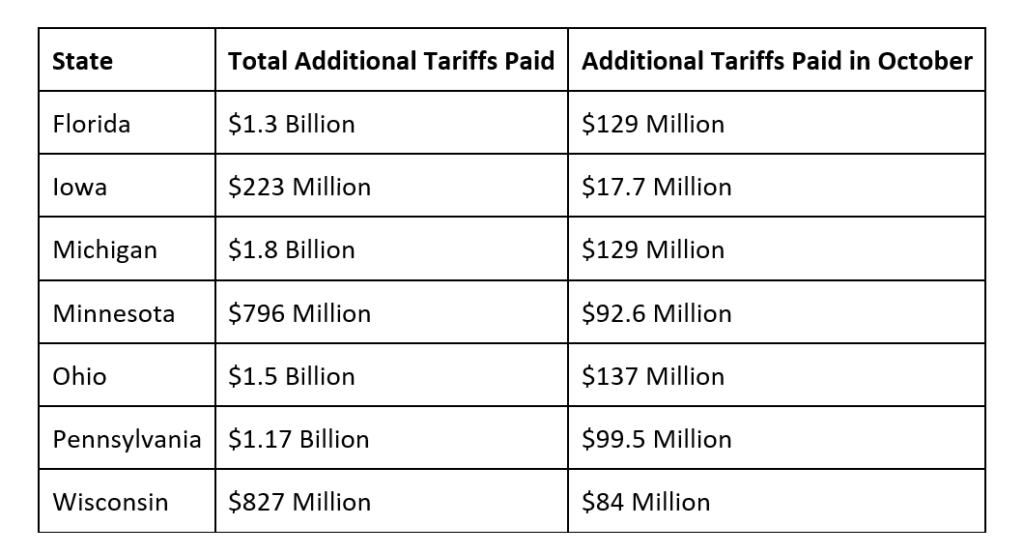

The trade war has hit swing states particularly hard. In seven of the top swing states (Florida, Iowa, Michigan, Minnesota, Ohio, Pennsylvania and Wisconsin), Americans have paid a combined additional $7.66 billion in taxes because of these tariffs. In Michigan alone, businesses, farmers and consumers have paid an additional $1.8 billion in taxes. For the month of October, people in these seven states have paid an extra $687 million, including almost $138 million in Ohio alone.

The trade war has hit swing states particularly hard. In seven of the top swing states (Florida, Iowa, Michigan, Minnesota, Ohio, Pennsylvania and Wisconsin), Americans have paid a combined additional $7.66 billion in taxes because of these tariffs. In Michigan alone, businesses, farmers and consumers have paid an additional $1.8 billion in taxes. For the month of October, people in these seven states have paid an extra $687 million, including almost $138 million in Ohio alone.

As these states face higher and higher tariffs, their economies begin to suffer. Unemployment is rising in key swing states like Michigan and Wisconsin, with Moody’s Analytics estimating the trade war has reduced U.S. employment by 300,000. Farm bankruptcies have risen 24 percent since September of last year, and some of the hardest hit areas are in must-win swing states. And the manufacturing industry, which plays a pivotal role in many swing states, contracted for a fourth month in a row in November, with ISM Chairman Timothy Fiore saying, “Global trade remains the most significant cross-industry issue.”

Trump then turns around and uses this money to buy votes, handing out over $28Bn in bailouts to farmers in swing state – yet another quid pro quo for his big campaign contributors, as small farmers (under $10M) got less than 15% of the bailouts with factory farms (big Trump donors) getting the lion's share of his gifts.

A slush fund is defined as "A reserve of money used for illicit purposes, especially political bribery."

Legal experts and members of Trump's own administration have serious questions about the Department of Agriculture (USDA) doling out $30 billion to farmers harmed by Trump's ongoing trade war with China, according to the Washington Post (I know – FAKE NEWS!). Two USDA officials told the Post that they worried the massive bailout program, administered through the Commodity Credit Corporation, goes far beyond the legal limits intended by the New Deal law. "It was obvious they were stretching their legal authority," one USDA official told the Post. A former USDA official who worked there during the Trump administration added that, "They're doing it really fast and shorthanded."

Legal experts and members of Trump's own administration have serious questions about the Department of Agriculture (USDA) doling out $30 billion to farmers harmed by Trump's ongoing trade war with China, according to the Washington Post (I know – FAKE NEWS!). Two USDA officials told the Post that they worried the massive bailout program, administered through the Commodity Credit Corporation, goes far beyond the legal limits intended by the New Deal law. "It was obvious they were stretching their legal authority," one USDA official told the Post. A former USDA official who worked there during the Trump administration added that, "They're doing it really fast and shorthanded."

"They're essentially using it as a political slush fund to backfill for the cost they're imposing on agriculture through the trade war," Neil Hamilton, former director of the Drake Agricultural Law Center, told the Post. "Congress never said, 'Go spend $28 billion trying to make people whole because of this trade war you created.' That's just something they have cooked up." The nearly $30 billion price tag also has many experts questioning the program. During President Obama's tenure, the largest bailout for farmers was a 2018 program to help cotton farmers, which cost $216 million. Trump's taxpayer-funded farmer bailout program costs more than 100 times that amount.

The bailout funds, which overwhelmingly go to White Farmers (99.5%), are often not enough to make up for the losses from Trump's trade war. "The MFP has almost exclusively benefitted white men and their families, who appear to be disproportionately upper middle-class or wealthy," New Food Economy reported. "These payments further entrench already drastic inequalities in agriculture, along racial, ethnic, gender, and class lines."

The bailout funds, which overwhelmingly go to White Farmers (99.5%), are often not enough to make up for the losses from Trump's trade war. "The MFP has almost exclusively benefitted white men and their families, who appear to be disproportionately upper middle-class or wealthy," New Food Economy reported. "These payments further entrench already drastic inequalities in agriculture, along racial, ethnic, gender, and class lines."

Even in states with a relatively high number of black farmers, the money still mostly went to white-owned farms. "In Mississippi, for example, where 38 percent of the population is black and 14 percent of farms have a black principal operator, according to the 2017 Census of Agriculture, only 1.4 percent of the $200 million distributed to farmers through the MFP went to black operators," New Food Economy noted.

Of course, giving money to rich farmers while forcing their neighbors into bankruptcy is the ultimate real estate grab – perhaps Trump isn't as dumb as he seems…

To add insult to injury, Agriculture Secretary Sonny Perdue was caught recently mocking farmers who were struggling as a result of the tariffs. "What do you call two farmers in a basement?" Perdue joked with a group of Minnesota farmers in mid-August. "A whine cellar," Perdue said, generating boos from the crowd.

While Trump's Big Farm buddies are being bailed out, American households will still be hurt from the higher costs foisted upon them by Trump's trade war. Experts estimate the average family will be forced to pay $1,000 more next year because of the trade war, a higher amount than most Americans will receive as a result of the 2017 GOP tax law, which promised tax relief for the middle class.

9 am Update: After I published this PSW Report, the Administration has indicated they are considering NOT increasing tariffs on Dec 15th and will continue to negotiate with China. I don't know if it was because of me but I'm always happy to help! 8)

"

"