At his annual end-of-year news conference in Moscow on Thursday, Putin denounced the impeachment proceedings as "spurious" and said the US Senate is unlikely to remove Trump. He said Trump's presidency is far from over as Republican lawmakers "are unlikely to want to drive out of power a representative of their own party."

To show off his puppeteering skills, Putin made words come out of Trump's mouth all the way in Michigan while having Trump flash the "White Power" sign to the crowd, who burst into applause. Now, I don't know when we decided the "OK" sign was now the White Power sign and I'd love to give Trump the benefit of the doubt but it's not like he can't know that the OK sign is not OK – it's been a controversial topic involving his supporters all year long and just this weekend, West Point and Annapolis launched investigations into students who flashed it during the Army-Navy game.

This is not the first time Trump has been accused of flashing the White Power symbol during a speech and it's a very interestering time to be stirring it up again, what with him being impeached on the same day and all but Vladimir Putin says Trump should not worry as he can't see his GOP Senators reversing the votes he worked so hard to obtain.

This is not the first time Trump has been accused of flashing the White Power symbol during a speech and it's a very interestering time to be stirring it up again, what with him being impeached on the same day and all but Vladimir Putin says Trump should not worry as he can't see his GOP Senators reversing the votes he worked so hard to obtain.

In the end, no Republican House Members voted to impeach the President and only 2 Democrats voted not to but, on Article 2 of the Impeachment (Obstruction), 35 Republican's did not vote rather than pretend the President did not obstruct Congress any of the 10 times he was cited for doing so in the Mueller Report. Unfortunately for Trump, the leaves the House Vote 221 to 165 against him and that's 57% – more than enough to convict in the Senate.

I say we give Trump a pass on using the OK sign because maybe the President is just oblivious to current events or, if not, lacks the self-control to avoid making controversial gestures that are likely to be misinterpreted as support for the worst possible people or, even better – perhaps he was just "owning the Libs" by making racist gestures at his rally – like the true chessmaster he is. You know, the usual GOP talking points that makes everything the President does seem – OK!

I say we give Trump a pass on using the OK sign because maybe the President is just oblivious to current events or, if not, lacks the self-control to avoid making controversial gestures that are likely to be misinterpreted as support for the worst possible people or, even better – perhaps he was just "owning the Libs" by making racist gestures at his rally – like the true chessmaster he is. You know, the usual GOP talking points that makes everything the President does seem – OK!

The markets are still OK even though there is no actual China Deal signed and, of course, the President is being Impeached but "Moscow" Mitch McConnell has already made it clear that his Constitutional role as an impartial juror in Trump's Senate Trial takes a back of the bus seat to his role as Trump's Advocate. "I'm not an impartial juror. This is a political process. There's not anything judicial about it," McConnell told reporters on Tuesday. McConnell's comments to reporters came after the majority leader rejected Democrats' request to call witnesses for Trump's Senate trial.

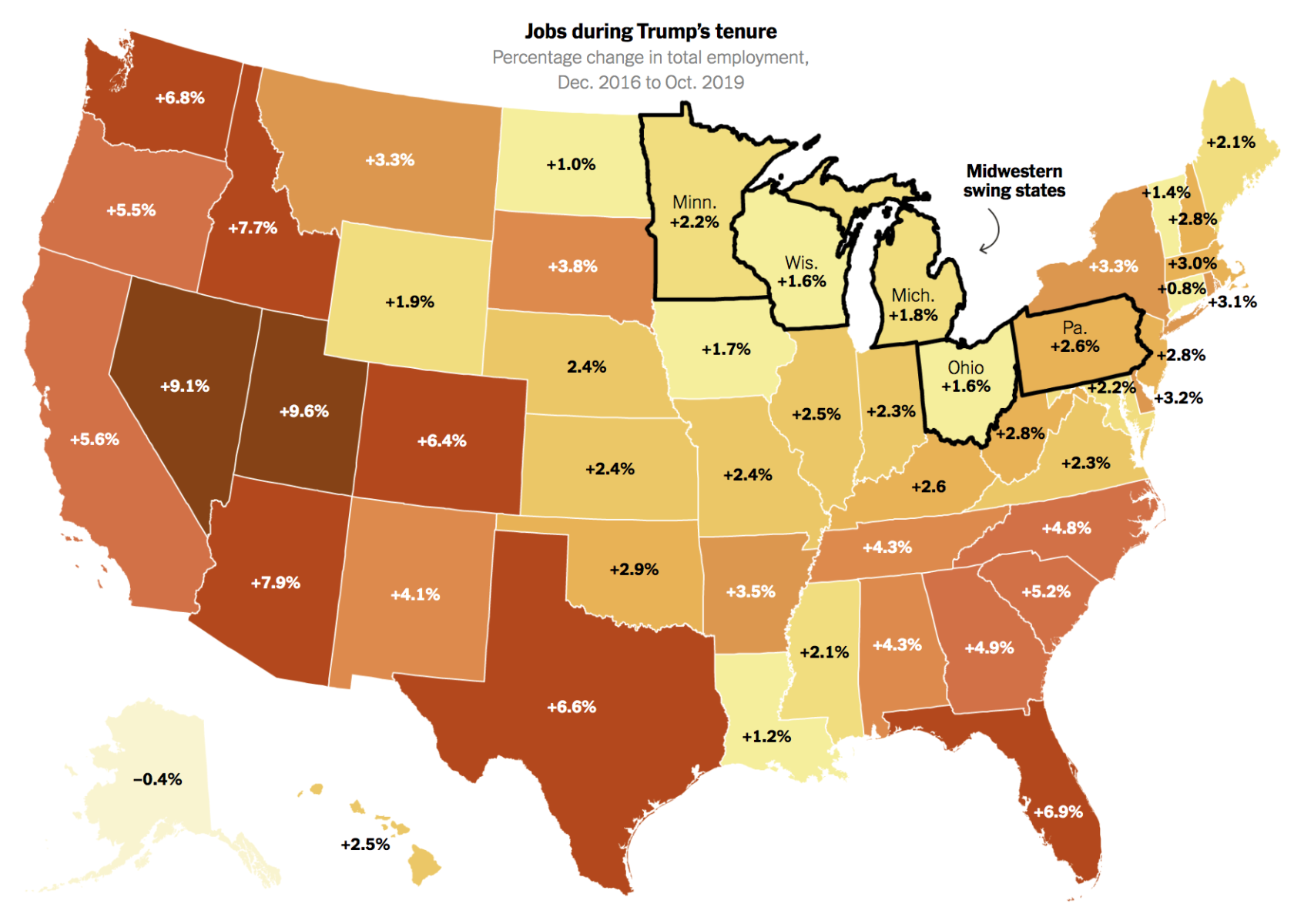

Trump should be more worried about weak job growth in swing states like Michigan, Ohio and Wisconsin so, while Trump is holding a rally in Michigan talking about his National Job Creation in a state that simply isn't seeing the effect at all.

Trump should be more worried about weak job growth in swing states like Michigan, Ohio and Wisconsin so, while Trump is holding a rally in Michigan talking about his National Job Creation in a state that simply isn't seeing the effect at all.

Bloomberg has a disturbing article this morning about "Financial Fakery" – something we tried to eliminate after the last financial crisis but seems to be making a comeback as Trump defunds and defangs Elizabeth Warren's CFTC. Of course, with insiders making $1.8Bn off a single Trump tweet – they don't want the CFTC looking into anything and the lack of bank oversight is just collateral damage in dismantling the agency and setting us up for the next crisis. As noted by Bloomberg:

Everybody risk-adjusts. JPMorgan Chase & Co., the biggest U.S. bank, says its capital backs up 12% of its assets when they’re risk-adjusted. The ratio drops to 6% without the adjustments. That’s because the adjustments shrink the bank’s $2.8 trillion balance sheet to $1.5 trillion. The shrinking balance sheet is more striking at European banks, which have broader leeway to use internal formulas for credit risk. Deutsche Bank AG’s €1.5 trillion ($1.67 trillion) balance sheet becomes €344 billion after risk-weighting. That helps its capital ratio jump from 4% to a risk-adjusted 13%.

Yikes! That's a $700Bn difference for JP Morgan (JPM) alone. Lehman collapsed in 2008 over a $50Bn difference in collateral.

Be careful out there!