Merry Christmas!

Merry Christmas!

I hope you get everything you want this holiday season and, most importantly, I hope you have time to spend with your family. I love waiting for my kids to wake up on Christmas morning to come out of their rooms so I can videotape (gosh I’m old, there’s no tape anymore) them in those first moments of Christmas morning – how can I not be of good cheer anticipating that?

I have something I can give you for the holidays as well. Not peace on Earth but perhaps peace of mind heading into the New Year – a way to help insure some future prosperity with a few inflation-fighting stock picks that can brighten up your portfolio, which also can be used to help balance your home's budget against unexpected cost increases.

We haven't had much inflation recently but the Fed is probably done easing and, if the economy is doing anything to justify the stock market's enthusiasm, then pricing pressure may be right around the corner as well. If not, we can still pick solid stocks with sensible option spreads that will give us both leverage and protection that can perform well – even if the underlying position isn't boosted by inflation.

This isn’t an options seminar or one about risk or leverage – these are just a few practical ideas you can use to hedge against inflation as it may affect your everyday life using basic industry ETFs and some simple hedging strategies to give you an opportunity to stay ahead of the markets if they keep going higher.

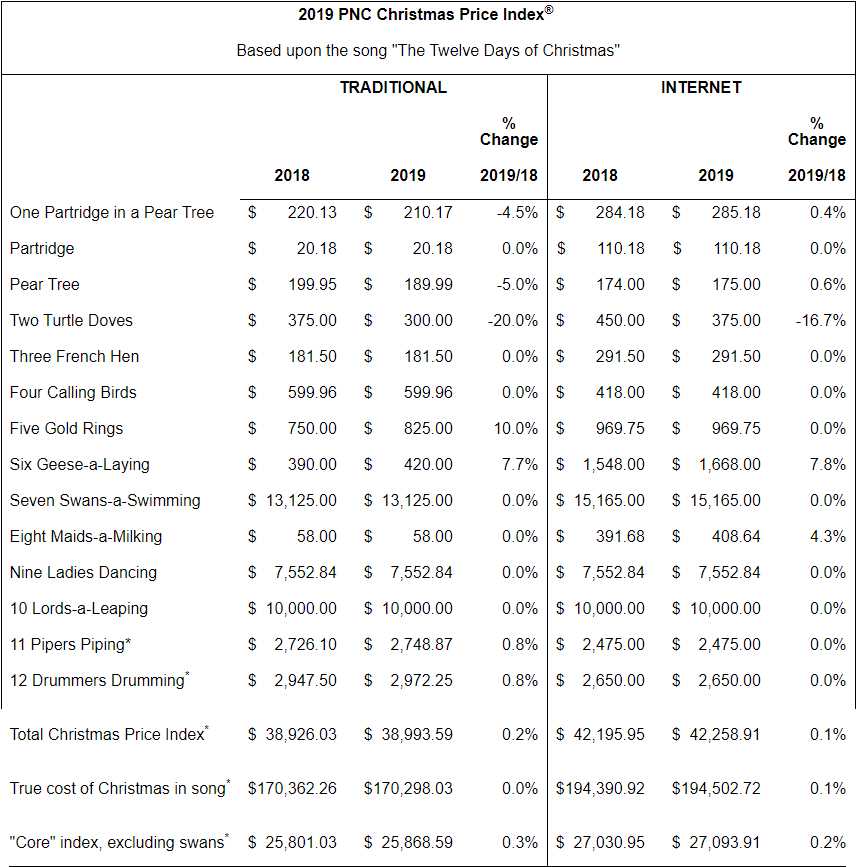

As you can see from the chart above, we haven't actually had much inflation in the last few years, which is why we haven't felt the need for Secret Santa Hedges since 2017 but, because we practice our strategy of "Being the House – NOT the Gambler", we don't ASSUME that next year will be like the last so, going forward, I like the following hedges:

Idea #1 – General Inflation Hedging with Gold

Idea #1 – General Inflation Hedging with Gold

The Dollar at 97 is 5% lower than it was in 2017 (102) and gold is 25% higher but I still like a best-of-breed miner like Barrick Gold (GOLD) at $17.76. That's a $32Bn market cap for ABX, who has 70M ounces of proven gold reserves in the ground, worth $104.5Bn at $1,493 per ounce. Now, the real value of the gold is the marginal cost of removing it from the ground and ABX has their costs pegged around $950, so $550 profit x 100M is still $55Bn, which makes ABX reasonable – even at these prices. I want to go conservative in case the Dollar rises with the following play:

- Sell 10 GOLD 2022 $15 puts for $1.90 ($1,900)

- Buy 20 GOLD 2022 $13 calls for $6 ($12,000)

- Sell 20 GOLD 2022 $17 calls for $4 ($8,000)

That's a net cost of $2,100 on the $8,000 spread. So we are putting up $2,100 in cash and the margin requirement on the sale will be roughly $1,350 in an ordinary margin account. What have we accomplished? Well, if ABX just stays flat, your $2,100 becomes $8,000, gaining $5,900 (280% gain on cash) as a very nice general inflation hedge. So nice, in fact, that GOLD is already our Trade of the Year!

On the risk side. We certainly don’t expect GOLD to go to zero but let’s say it falls to $12 (1/3). Well, you are obligated to own 1,000 shares at $15 ($15,000) and you would have lost $2 per share, so $2,000 is your risk there plus $2,100 (the cost of the spread if that's wiped out) but I would put it to you that, if gold goes so far down that ABX loses 1/3 of it's value – then your bullish stock picks should be doing exceptionally well – as clearly no one is worried enough to have a bit of gold on the side.

That’s what hedging is, it gives you a cushion that can prevent things from getting away from you. You can actually work price swings to your advantage by adjusting the trade as the stock moves through a channel but, for the sake of simplicity – we’re just discussing passive risk management examples. The idea is to reduce your risk of waiting – that lets you sit back and make an intelligent, well-timed decision without worrying that the market is getting away from you. Unlike CDs or Bonds, there is no penalty for an early withdrawal from a hedge, other than the bid/ask spread you may pay if you do it very quickly.

Idea #2 – Hedging for Fuel Inflation

Idea #2 – Hedging for Fuel Inflation

Gasoline prices have moved up 20% at the pump and we're 30% over where we were last Christmas. If you are the average family, you buy about 1,500 gallons of gas per year ($3,500) and spend another $1,500 heating your home. That’s $5,000 a year spent on energy.

The Energy Sector Spider (XLE) is up just 5% for the year and many names in that sector are trading lower than they should be. Exxon (XOM) has been out exploring while others have tightened their belts and it's a tough call to play the index or to play Big Daddy but I think we're going to go with XOM, who also pay a 5% dividend ($3.48) that can cover your gas expenses each year – but you have to put down $70,000 for 1,000 shares so let's see if we can do better with a spread:

- Sell 10 XOM 2022 55 puts for $4 ($4,000)

- Buy 10 XOM 2021 $65 calls for $7.75 ($7,750)

- Sell 10 XOM 2021 $75 calls for $2.75 ($2,750)

That's a net outlay of $1,000 and, if XOM is over $75 in Jan, 2021, we collect $10,000 and our energy bills are paid for and then we can sell a 2022 spread to pay for another year. That's how you get Exxon to pay all your energy bills – you'll be cheering for higher gas prices! The worst case is you get assigned XOM stock at net $56 (a 20% discount to the current price) but be careful with that as it's $56,000 so use stops on 1/2 the puts at $4 ($2,000) and 1/2 the puts at $6 ($3,000) to limit your total loss on the spread to $6,000 if it's wiped out. Ideally, that would only happen if your energy costs get much cheaper.

Now our Members at Phil’s Stock World know they can roll those puts or convert those put assignments into buy/writes or do a dozen other things to mitigate the losses – as I said, these are really basic examples of how anyone can hedge their real-life budgets to help them make long-range plans to fight inflation.

Idea #3 – Hedging for Industrial Inflation

Idea #3 – Hedging for Industrial Inflation

While the average consumer doesn't worry about the cost of iron ore and steel, it's still a nice general measure of inflation. Usually we hedge for food costs but food costs have not gone up significantly in many years and Coffee (KO) already had a huge run as that and Soybeans (SOYB) were our favorite food bets this year.

So, as a general inflation hedge, I still like CLF, who are merging with AKS and got beaten up for it but I think they are very undervalued at $8.21 – though they are bound to have some rough times ahead as they consolidate the two companies. Nonetheless, it's too tempting (and too cheap) not to play so let's:

- Sell 20 CLF 2022 $7 puts for $1.75 ($3,500)

- Buy 30 CLF 2022 $4 calls for $4.35 ($13,050)

- Sell 30 CLF 2022 $7 calls for $2.50 ($7,500)

That's net $2,050 on the $9,000 spread and all CLF has to do to pay in full is not drop $1.20 (15%) over the next 2 years. Worst case is you get assigned 2,000 shares of CLF at $7 + the $1.05 loss/share is the same price it is now and CLF pays an 0.24 (3%) dividend if that happens.

Remember, these are not magic beans that pay off no matter what the market does – these are hedges against inflation and, if there is no inflation, then you will save LESS than you otherwise would have but, again – there are dozens of ways to make owning CLF long-term a successful part of your portfolio. Instead of randomly investing your retirement savings – trade ideas like these are ways to put some of the money to work for you – in ways that can help you manage your bills NOW – as part of your daily life.

Inflation Hedge #4 – Hedging Against Rises in PSW Member Fees

Inflation Hedge #4 – Hedging Against Rises in PSW Member Fees

We run a unique service. I am on-line most trading days chatting live with members about trades like this but there is a limit to how many people we can effectively get back to in a day so we limit our Membership and, when it gets too crowded, we raise our prices We haven’t raised them in a while but I'll be featured on TheStreet in 2020 and that may fill us up again, forcing us to raise prices at some point.

So, for 2020, let’s make things interesting with a banking hedge. If you sign up for a full-year membership between now (12/24/2019) and Jan 4th, 2020 and the following trade idea does NOT net 100% on the cash outlay by expiration day IN JUST 6 MONTHS, then I will give you a free Membership for 2021! That’s a 50% discount on two years and your hedge can be going for let’s say $2,500 (1/2 the Basic Membership) on the spread and you either make $2,500 which is 1/2 of the 2020 Membership or you get 2021 for free, which, assuming you lose all $2,500, is 50% off anyway. No matter what, you get one year of a PSW Membership for 1/2 price. Not bad right? You do not have to buy the spread to play – just the Membership, which is non-refundable so don’t get cute!

(Probably good time to put in some kind of contest disclaimer that this is just for fun and we guarantee nothing at all and that we can change the rules at any time and that we accept no responsibility for anything under any circumstances whatsoever and that billions may play and nobody might win – how’s that? You just have to trust us, we’re not in the contest/guarantee business – I just want you to know how good I feel about this trade idea. Always consult a professional investment advisor (I’m not one) before doing anything!)

Anyway, what’s the trade? VERY simple on TD Bank (TD), who are beaten down with the Canadian Dollar but that has stabilized and the bank, at $56, is at $100Bn in market cap while dropping $12Bn a year to the bottom line – a great value!

- Sell 15 TD July $55 puts for $2.25 ($3,375)

- Buy 15 TD July $50 calls for $5.80 ($8,700)

- Sell 15 TD July $55 calls for $2.35 ($3,525)

That's net $1,800 on the $7,500 spread so the upside potential is a $5,700 (316%) potential gain in 206 days and that means we have to get to net $3,600 or better in just 7 months to make 100% back on the $1,800 cash outlay. If we do, we will have paid for a solid chunk of your 2020 Membership (you're welcome in advance) and, if we hit our goal – it's a free Basic Membership (you're welcome in advance).

The worst case is you end up owning 1,500 shares of TD at $55 plus the $1.20/share loss is right where it is now and this is a very, very good bank to own that pays a 4% dividend ($2.24) while you enjoy your free PSW Membership. A warning though – we have never had to pay off a challenge bet because we have never failed to hit our goal!

I very much hope all these trades work out well, ESPECIALLY the last one! I also hope you go back and read our prior hedging ideas and think about how much money you can make with simple, long-term investments like these – rather than messing around trying to guess the next hot stock. Trades like this are the bread and butter of our portfolios.

Have a very happy holidays and we hope to see you inside in the new year.

All the best,

– Phil