So much for shorting the Nasdaq.

So much for shorting the Nasdaq.

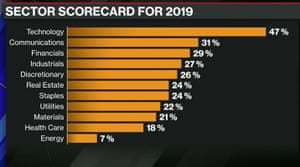

After a very mild rejection, the Nasdaq 100 went a ahead and plowed over the 9,000 line yesterday, joining the broader Composite Index, which is now at the 9,200 line – up about 50% since Dec of 2018 – just 13 months ago at 6,190. To be fair, we had fallen from 8,133 so an optimist could say that that was a fair price and the sell-off was silly – I'm sure that what they'll say about the next sell-off, despite the last one being 22.5%, which would take us back to 7,130 if something "silly" happens again.

If we call 7,500 a good base to climb from, then the 9,000 line is the 20% mark and 9,300 is a 20% overshoot of that mark (20% of the run up, not 20% of 9,000) so that's the next mountain the Nasdaq will have to climb – not even 1% away these days – we should be able to do that standing on our heads if this rally is meant to continue.

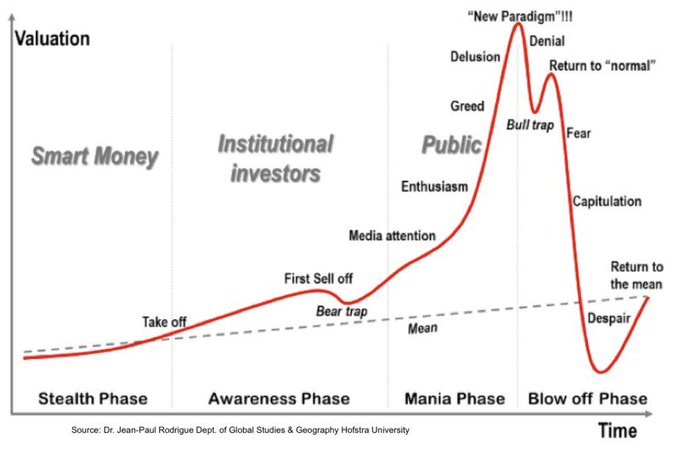

Our index shorts were a fail as Apple (AAPL) climbed up to $310 and the end-stage of bubble rallies can often be market by parabolic moves up and one has to wonder where all this money is coming from with FAANG Stocks gaining almost $2Tn in value in the past year, which is 10% of the US GDP and our GDP only grew 2% ($400Bn) so, even if every last cent of the entire US GDP expansion went into those 5 stocks, where did the other $1.6Tn come from?

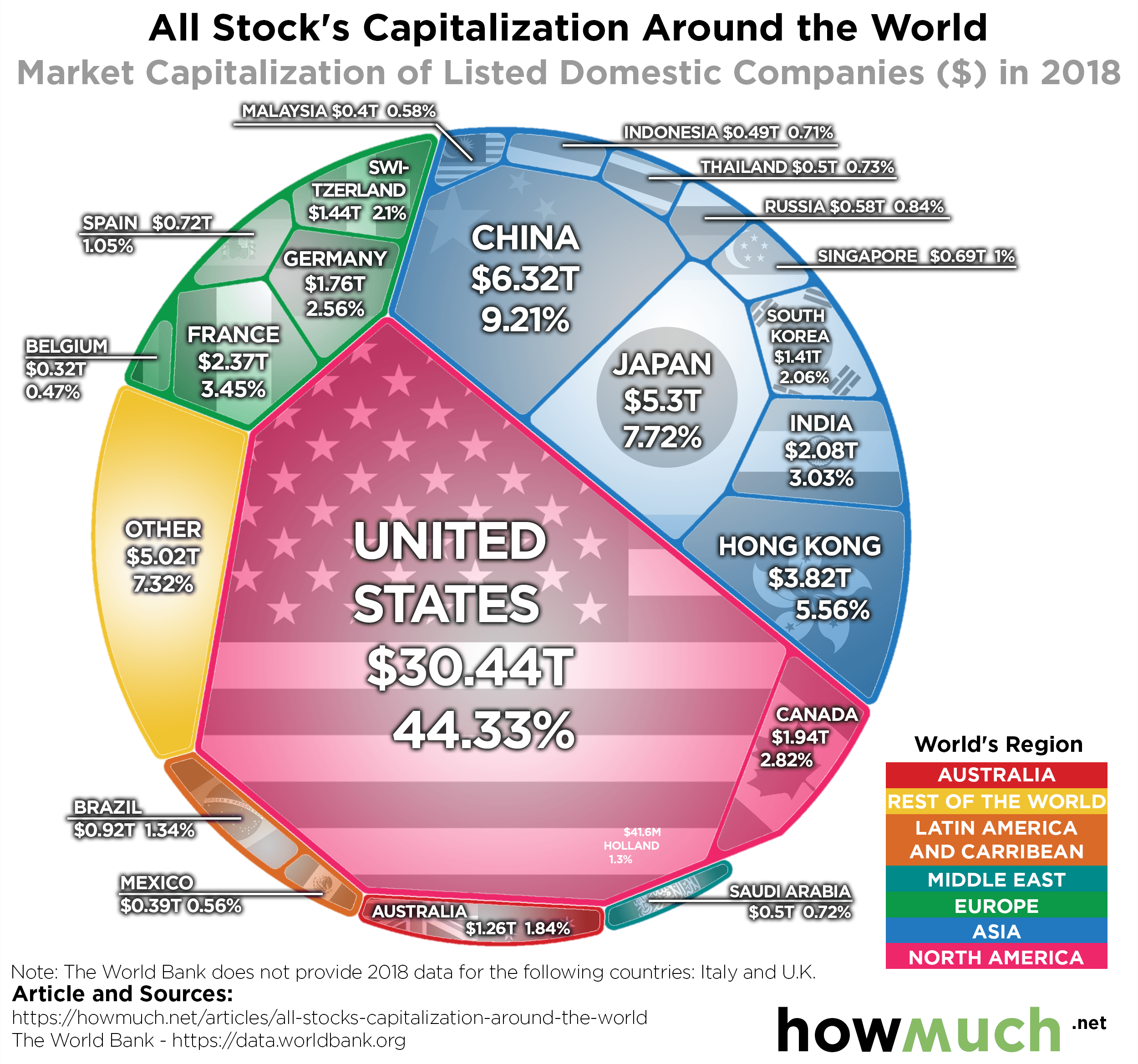

The entire planet's GDP is about $90Tn and it grew at 3.5% so there's $3.15Tn, so I guess maybe the entire World put 2/3 of their 2019 growth into those 5 stocks but the rest of the markets did expand as well – up 24% Globally – and that means we're right about the $100Tn mark in global equities, having started 2018 at $77.5Tn.

The entire planet's GDP is about $90Tn and it grew at 3.5% so there's $3.15Tn, so I guess maybe the entire World put 2/3 of their 2019 growth into those 5 stocks but the rest of the markets did expand as well – up 24% Globally – and that means we're right about the $100Tn mark in global equities, having started 2018 at $77.5Tn.

Again, let's do the math and reflect, the Global GDP was $80.6Tn at the start of 2018 and we had a good year and hit $84.8Tn to start 2019 (up 5%) and 2019 was slower, up 3.5% (thanks Trade War) to $87.8Tn to begin the 2020's and again, that's just $7Tn of growth in two years and the markets are up about $20Tn in the same time-frame. So, very clearly, the markets are not up because money poured in – there simply wasn't enough money in the World to cover that move. What happened is we got a speculative bubble as people kept buying at the margins while very few people actually sold, driving the APPARENT PRICE of equities higher.

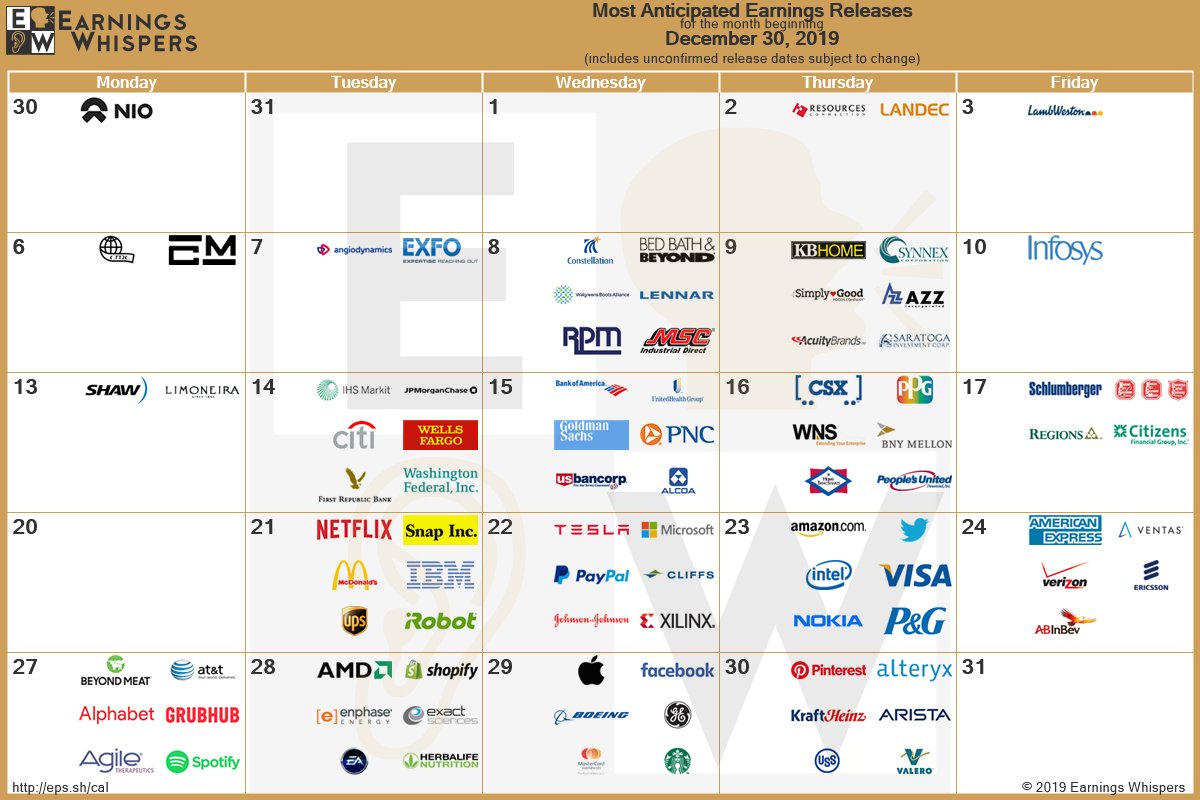

Next week we are supposed to sign the China Trade Deal (Weds) and that's what's keeping the market aflot despite Impeachment and the War but, after that, the focus shifts back to earnings, which have to support these sky-high prices.

Just because things are expensive doesn't mean we can't have any fun. We finally initiated a new Long-Term Portfolio as Bed, Bath and Beyond (BBBY) fell back to a level ($13.50) that we just couldn't resist playing so we sold 10 BBBY 2022 $15 puts for $5.42 to put a quick $5,000 in our pocket and, as discussed, the current Short-Term Portfolio will become the Long-Term Portfolio so we're really making a new $100,000 Short-Term Portfolio and simply adding cash to bring the STP up to a $500,000 base (+$400,000) and renaming that the LTP. Next week, we will, of course, be moving the risky STP positions out of the LTP and deciding whether they are still valid for our new STP.

In Monday morning's PSW Report, we played Natural Gas long at $2.16 and FINALLY we got our pop this morning so the stop is now at $2.20 and that was a conviction play so we ended up doing better than 0.04 (and with more contracts) but even 0.04 is a nice $400 per contract gain on the week.

Overall, the week has played out pretty much as we expected because, as I said on Monday:

The VIX Futures are back to 16 on all the uncertainty and we haven't been over 16 for long since October – so a move over that line should be taken very seriously if it lasts a day. When we spiked higher in August it signaled a 200-point drop in the S&P so 40 points is nothing if this is going to be a real correction. Of course, so far, this is nothing more than a very small blip in a very huge rally and China will be signing Phase 1 of the Trade Deal on the 15th – so it's going to be hard for the bears to sustain a down move when more "good news" is on the way.

See – the markets aren't that hard to predict, are they?

In Wednesday's Live Trading Webinar (replay available here) we picked up long contracts on Gasoline (/RB) and they were still playable yesterday morning and I said hold on despite the drop to $1.635 (-$420/contract) but now we are at $1.67 and our 2 longs are up $1,890 and that's silly to risk so I'd cash one out (or half if you have more) and put a stop on the remaining contract(s) at $750 to lock in a very nice 2-day gain (you're welcome!).

In Wednesday's Live Trading Webinar (replay available here) we picked up long contracts on Gasoline (/RB) and they were still playable yesterday morning and I said hold on despite the drop to $1.635 (-$420/contract) but now we are at $1.67 and our 2 longs are up $1,890 and that's silly to risk so I'd cash one out (or half if you have more) and put a stop on the remaining contract(s) at $750 to lock in a very nice 2-day gain (you're welcome!).

Unless you are very, very rich, gaining $1,695 (our stop) in 2 days or, even for the week is nothing to sneeze at and it's part of your discipline as a trader to learn to take quick gains like these off the table because the weekends are uncertain and, though the potential for war with Iran makes it fun to speculate /RB will be back in the $1.70s next week – the bird in the hand isn't worth risking. Of course, we're not limiting our gains on the other half – just setting a stop in case it pulls back.

"Well, the runway lies ahead like a great false dawn

With a cannon blast, lightnin' flash, movin' fast through the tent, Mars-bent

And the Ferris wheel turns and turns like it ain't ever gonna stop

And the circus boss leans over and whispers into the little boy's ear

"Hey, son, you want to try the big top? "- Springsteen

Have a great weekend,

– Phil